Here’s a stock answer to the headline question: quite a bit more liquid than real assets such as residential property; quite a bit less liquid than equities.

But let’s pose the same question in a slightly different way. How much should banks intermediate in secondary credit markets?

That’s a trickier question. But that’s exactly what regulations currently taking hold – from Basel III to the Volcker Rule – in effect determine, as well as, by extension, the liquidity of corporate bonds.

The case for the defence proffered by bankers runs as follows: liquidity is a good thing. It allows asset managers and pension funds to buy and sell bonds and rejig their investment portfolios. Having a liquid pool of bonds also allows companies to issue debt more cheaply, bringing tangible benefits to the real economy.

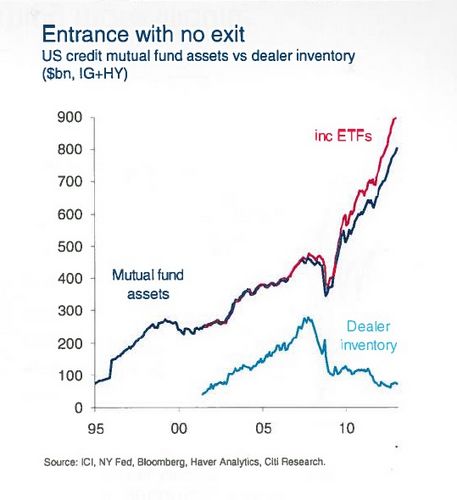

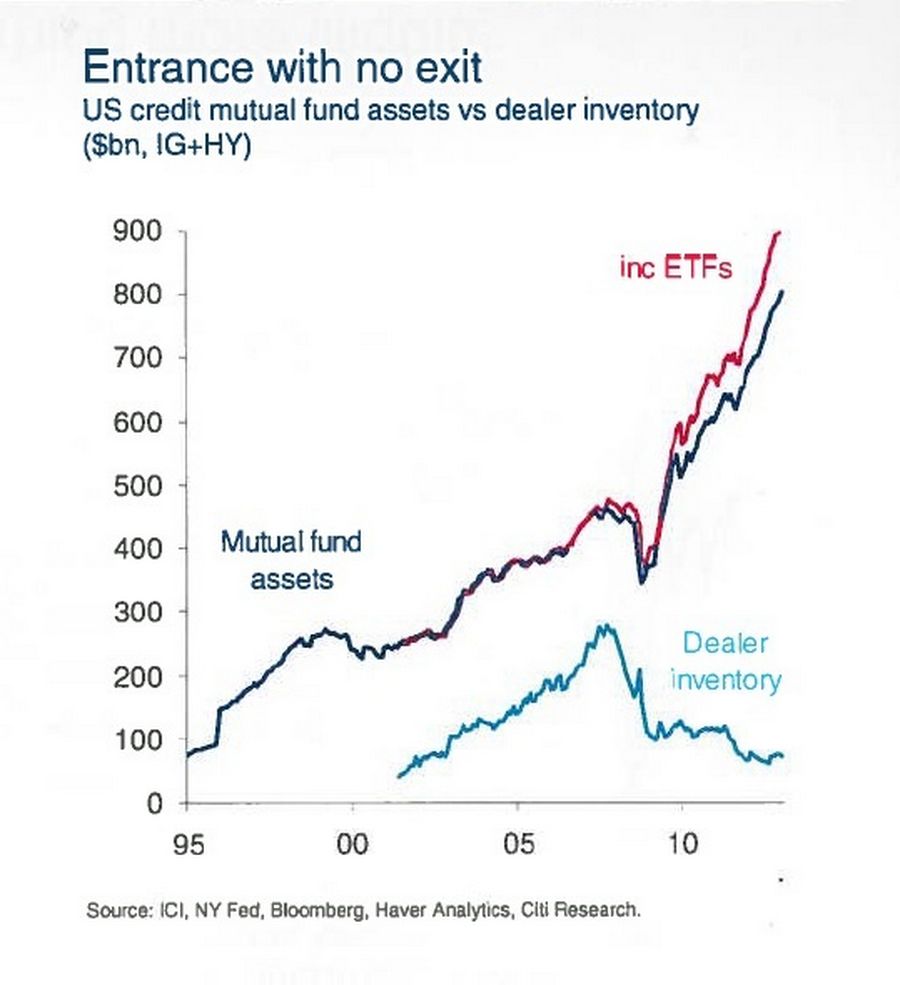

This will then be followed by the terrifying (and valid) question: what happens when we see a Great Rotation out of bonds and investment managers all rush for the exits at the same time? Banks will no longer be around to soak up the flows, and chaos will ensue (at this point your average bond banker can be relied on to point to a chart like this one that shows US dealer bond inventories cratering from US$235bn in 2007 to US$57bn now, while bond funds on the buyside have soared).

Bond inventories

What a fantastically dire scenario, we credulous hacks say to ourselves, gleefully scribbling our doomsday articles. But there is an old adage in journalism that bond traders will doubtless appreciate too: everyone has an axe to grind.

Fixed-income units account for 55% of investment banks’ revenues, according to UBS analysts. Goldman Sachs – traditionally strong in equities and M&A – saw FICC more than double from 17% of its overall revenues in 1998 to become its largest and most profitable business a decade later. Or put another way: banks defend activity that makes them flipping great wodges of cash.

So don’t take their word for it. BlackRock, the world’s most prominent buyside investor, has also raised concerns about the lack of bond liquidity and has embarked on a campaign to make the product more fungible.

But that is easier said than done. The fragmentation of liquidity across multiple debt issues means that efforts to shift bonds on to exchanges, like equities, face significant challenges. Citigroup has almost 2,000 bonds outstanding. It only has one share price.

The problem is, I suspect, no one really knows how liquid corporate bonds should be. It’s about time we had a proper debate about it

Put simply, credit is an illiquid asset class – banks merely artificially injected it with liquidity over the past decade by loading up their balance sheets with billions of dollars worth of bonds.

The question is whether that is appropriate or necessary. One head of fixed income likes to relay a particularly instructive encounter with a US regulator over the pressures on fixed-income trading.

“You’re not hearing me,” the regulator says, waving away his protestations. “We don’t want you to buffer client flows like you did in the past. Instead of selling US$50m of bonds at a time, the investor can sell five lots of US$10m over the space of a week. That way it’s their capital put at risk, not yours.”

It is very hard to say whether this represents a serious and imminent threat to market stability. Dealer inventories were at similarly depressed levels at the turn of the millennium (the 2007 yardstick oft-quoted by dealers was at the height of the largest credit boom in history), but then again global corporate credit markets have since doubled from US$64trn to US$128trn in mid-2012, according to BNP Paribas analysts.

Others reckon the idea of the Great Rotation is flawed and suggest a widescale pullback from bonds will never materialise.

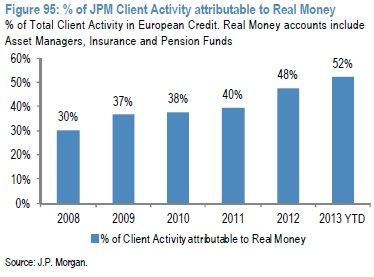

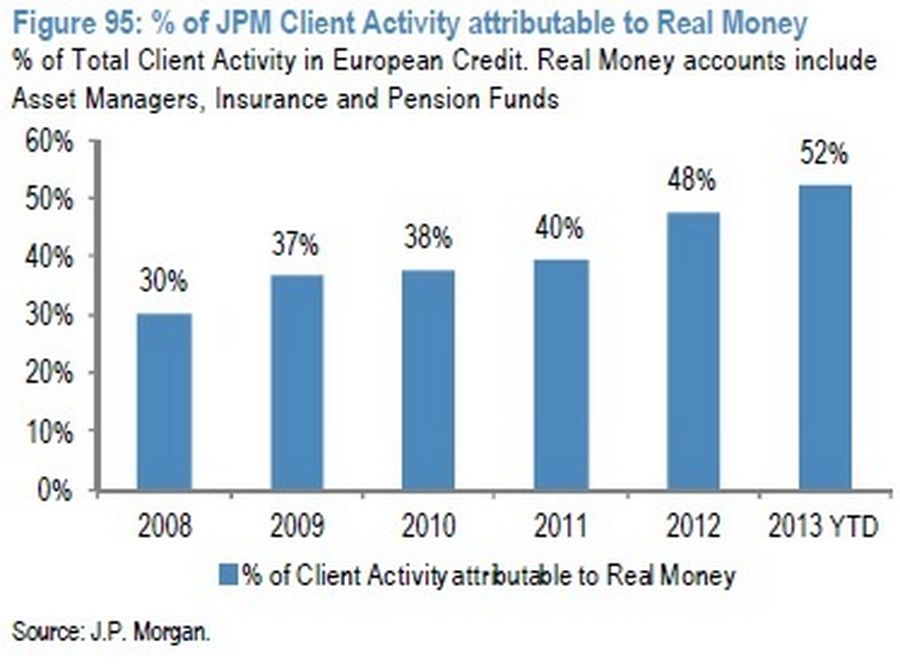

What is sure is that the buyside is already adapting to the new environment, potentially negating the need for banks to be so involved in secondary trading. A recent JP Morgan report focusing on how the buyside’s behaviour affects liquidity finds that real-money investors now account for 52% of the bank’s client activity in European credit compared with 30% in 2008.

JPM client activity

This shift in the investor base has increased the importance of primary issuance and diminished that of secondary trading, the authors note, with JP Morgan’s client activity attributable to primary tripling from 5% to 15% over the same period.

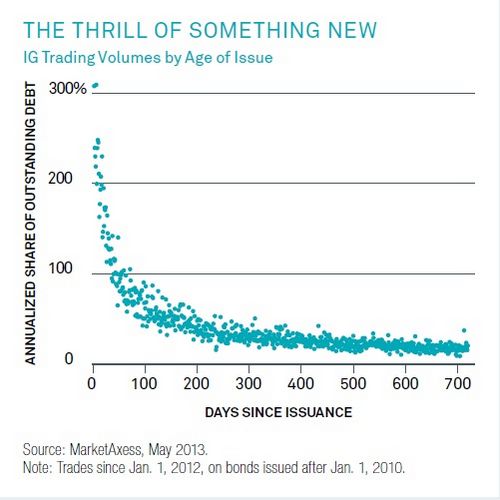

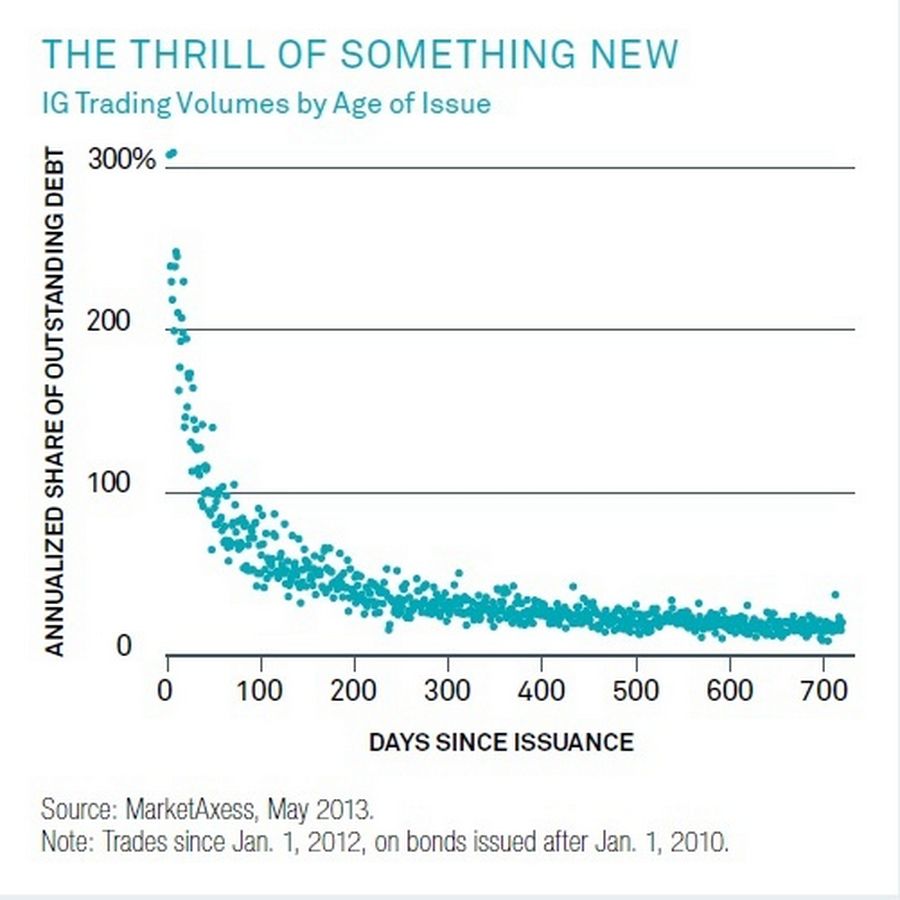

New issues now have a liquidity premium of around 10bp by some estimations. Bonds change hands frequently at first, but within a month trading volume plummets by 50%, according to BlackRock, and falls to a near standstill after two months.

New issue bond liquidity

Controversial as it may sound to those who cut their teeth in the boom years, bonds are becoming a buy-and-hold investment, meaning investors should demand a yield that adequately compensates at the outset for the risk they take. Those running diversified portfolios should be able to absorb the odd blip, or even hedge via the more liquid derivatives market if their mandate allows.

What does this mean for bond issuers, though? Will they have to cough up more money to issue bonds in return for having what policymakers view as a sturdier banking system?

Regulators clearly understand the importance of liquidity when it suits them (see the decision to exclude sovereign debt from the Volcker Rule, while governments continue to resist risk weightings), but regulatory body language hardly provides much comfort for other borrowers.

Companies certainly aren’t having any difficulty issuing debt at attractive levels at present despite the shrinkage in dealer balance sheets. What is harder to predict is whether this will change once ultra-loose monetary policy comes to an end and investors become a little more discerning.

The problem is, I suspect, no one really knows how liquid corporate bonds should be. It’s about time we had a proper debate about it.