In good health

A swathe of super-sized US M&A deals came to fruition in 2015, creating a fee bonanza for top advisers. As the pre-eminent house across sectors, Goldman Sachs was in a prime position to benefit from the surge, making it IFR’s Advisory House of the Year.

M&A hit a new high in 2015. In only the first 10 months of the year, the total value of announced deals had already topped the previous full-year peak set in 2007 and by the end of November over US$4.2trn of deals had been unveiled.

The US was at the heart of the action during the bumper year, especially when it came to the mega-deals. No less than eight individual offers for US targets of over US$20bn were successfully completed during this time, as acquirers made the most of strong conditions for financing.

“It was a year for big public company deals with significant financing,” said Gregg Lemkau, co-head of global M&A at Goldman Sachs. “Marquee transactions that had been thought about for 20 years eventually happened.”

One of the drivers was a huge upswing in confidence in the C-suite.

“What really changed is the level of CEO confidence,” said Gilberto Pozzi, co-head of M&A at the bank. “There is an interest in looking at dream deals. These big cross-border transactions are solid deals which make strategic sense.”

Michael Carr is also co-head of M&A with Lemkau and Pozzi.

Increased US M&A played to Goldman’s strength as the pre-eminent adviser to corporate America. When those huge transactions were finally launched, Goldman was the house that sellers wanted to have in their boardroom. The bank often took the prime role, acting for the target in half of the completed US$20bn-plus deals, and leaving rivals scrambling to pick the winning buyside mandate.

Fees

Goldman’s dominance in the last year can be seen from the fees that the leading banks reported for advisory work in the first nine months of the year. During that period Goldman reported a record US$2.59bn in advisory revenues, an increase of 45% year-on-year.

“If you get paid, it means the client values your contribution,” said Pozzi.

That is telling in an era when many mega-deals now have multiple advisers on both sides, who get equal credit – but very different fees. Goldman’s fees put it significantly ahead of its nearest rival in the table of completed deals by value: JP Morgan, in second spot, reported advisory fees of US$1.51bn, up 27% compared with the same period in 2014.

Morgan Stanley, third in the deals table, saw its pot go up by the same amount, 27%, to US$1.45bn. Goldman’s prime position in terms of fees – a whopping US$1bn ahead of each of its top two competitors – is impressive.

Lemkau believes Goldman is reaping the rewards of marrying its advisory prowess with canny market-based advice about how modern mega-deals can be financed.

“Our decision to bring experienced capital markets advisers into the M&A team in 2013 to show what’s possible regarding leverage, what investors will accept in relation to deals and how it might affect a company’s rating, has really paid off,” he said.

Many of the major transactions, which in the previous boom may have been financed primarily by banks in the loan market, have this time been swiftly supported by an accompanying jumbo bond issuance. Goldman benefits immensely from its ability to execute such deals as an active market participant (rather than a boutique adviser), because it knows how investor appetite might allow a bidder to pay up for an asset.

Rude health

These skills were in particular demand in the healthcare sector. This was the most active area for completed M&A over the last year, accounting – at US$400bn – for 15% of the market by total value of transactions agreed.

The hectic activity was driven by companies taking advantage of cheap funding before the possibility that the US Federal Reserve might start to raise interest rates from their record lows. The other driver was US entities seeking to effectively relocate, through takeovers dubbed “tax inversions”, to jurisdictions with lower corporate tax rates.

The companies targeted in the top three completed healthcare deals by value, all of which were over US$20bn in enterprise value, all appointed Goldman as adviser. In descending size order these were Allergan, Covidien and Baxalta.

The US$42.7bn takeover of Covidien by Medtronic was a marquee tax inversion deal that allowed the purchaser to make use of Covidien’s Irish domicile. Goldman advised on the creation of Baxalta, which was spun out of Baxter Healthcare to its shareholders and continues to advise the company as it fends off a putative US$30.6bn takeover from Shire, another Irish-domiciled company.

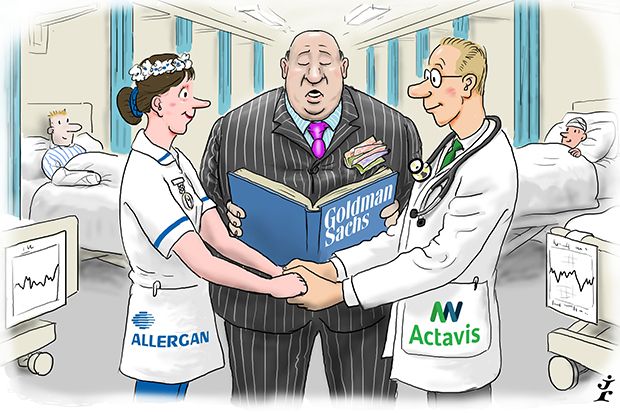

Allergan

Allergan’s board hired Goldman shortly before the pharmaceutical company, best known for making Botox, was approached by Valeant Pharmaceuticals. Valeant’s move was hostile and it appeared to be working in conjunction with activist investor Bill Ackman’s hedge fund Pershing Square, which quickly built up a near-10% stake in Allergan in February 2014 just ahead of Valeant’s US$160-a-share approach.

The presence of such a disruptive influence on the target’s shareholder register made it particularly tricky to defend Allergan from the unwanted offer from Valeant. Goldman, together with Bank of America Merrill Lynch, had a difficult mandate in the face of this assault.

The advisers attended over 30 Allergan board meetings, sketching out various scenarios as the circumstances changed and the company fought to fend off the unwanted approach, initially by contemplating its own purchase of Salix Pharmaceuticals. That would have made the larger entity harder for Valeant to swallow.

Allergan may always have found it impossible to remain independent under these trying circumstances. It was a major achievement to find a preferable third-party bidder to intervene, in the shape of Actavis, which eventually offered the equivalent of US$219-a-share for Allergan, nearly double Valeant’s undisturbed share price before Ackman’s stake-building was unveiled.

The winning bid from the white knight valued the company at US$68bn, one of the biggest deals to close in 2015. Goldman drew strongly in this instance on its heritage as a top defence adviser, first developed 20 years ago when corporate – rather than activist-led – raids were in vogue.

“There is more activism than there was two years ago. This trend is here to stay. But this is essentially ‘Raid Defence 2.0’. And we have built our own franchise in this area over the last 20 years,” said Lemkau.

“Our main goal is to advise corporates, their CEOs and boards. We don’t want to be on the side of the raiders. Corporates are our clients but we are prepared to engage with all shareholders and talk to them.”

Defence

Other highlights beyond the healthcare sector were in insurance. Goldman advised no less than three of Japan’s largest insurance companies – Dai-Ichi Life, Sumitomo Life and Mitsui Sumitomo Insurance – on overseas acquisitions. Again, this highlighted how the bank was the adviser of choice to such companies on their rare forays outside Japan. Goldman was also adviser to two insurers targeted by other Japanese companies.

M&A is a key business for Goldman, accounting for roughly half of the bank’s overall revenues from investment banking. With such an active year for US transactions, the high regard the franchise is held in by corporates was evident in the results the bank delivered.

“We have lots of people with over 20 years of experience,” said Lemkau. “We have very deep experience and are able to work across different sectors with several people deployed on each deal.”

Some 120 executives work in M&A but, also considering financing coverage bankers, the whole capacity dedicated to originating deals is nearer 160. Using the larger number, each managed to bring in an average of US$16m in fees during the first nine months of the year. No wonder the franchise remains the envy of many.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .

<object id="__symantecPKIClientMessenger" style="display: none;" data-extension-version="0.4.0.129" data-install-updates-user-configuration="true"></object>