Hammered home

Stanley Black & Decker showed off its financial sophistication with an innovative US$750m mandatory convertible bond issue designed to maximise accounting benefits in a rating-friendly wrapper.

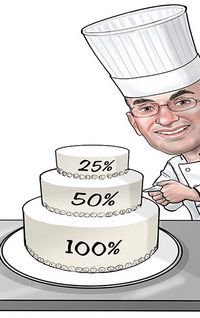

High equity treatment by ratings agencies was a key consideration for SBD. Mandatories are structured as three-year forward purchase contracts with underlying debt. Typically the underlying is straight debt, with Moody’s and S&P giving 25% and 100% equity credit. In this case, SBD opted for convertible preferred stock, increasing the Moody’s equity credit to 50%.

The mandatory issue had the added benefit of Treasury stock accounting, which made the units accretive to earnings per share.

The underlying dynamics were irrelevant to equity-linked investors – in three years they are getting stock and being paid for the upside sacrificed.

“We were threading the needle from a cost perspective, from a ratings perspective, and from a dilution perspective,” said SBD assistant treasurer Robert Paternostro, who had spent months discussing the security with ratings agencies.

“We always seek to preserve our credit rating and financial flexibility that comes along with it. Then we want to lower our weighted-average cost of capital within that [ratings] parameter.”

The securities were printed in May at a 5.375% dividend yield and 17.5% conversion premium, versus talk of 5.5%–6% and 15%–20%. In addition to pricing through the dividend talk, strong investor interest allowed SBD to bump sizing to US$675m from US$650m at launch, rising to US$750m with the greenshoe. The more than 120 institutions that participated helped push gross demand over US$3.3bn.

Citigroup, Credit Suisse, Wells Fargo and Goldman Sachs were joint bookrunners.

SBD had closed the acquisitions of Newell Rubbermaid’s tools business and Sears’ Craftsman brand in March, draining some US$2.5bn of liquidity. Bridging that capital call from cashflows was contemplated, but threatened to stretch the company when other opportunities could arise, Paternostro said.

SBD spent US$26m on a capped call to offset dilution to US$179.35, a 30% premium. That looks to be money well spent because SBD issued the mandatory when its shares were trading at an all-time high yet they have continued to rise. At the time of writing the shares were trading around US$169, just above the US$167.27 conversion price.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.