Bankers are starting to move from London to the eurozone to prepare for Brexit, although the shift is gradual and 62% of European jobs advertised by the big US investment banks are still in the UK.

Data compiled by IFR show the five Wall Street giants had 2,447 jobs advertised in the European Union at the start of October, and 1,524 of those were in Britain.

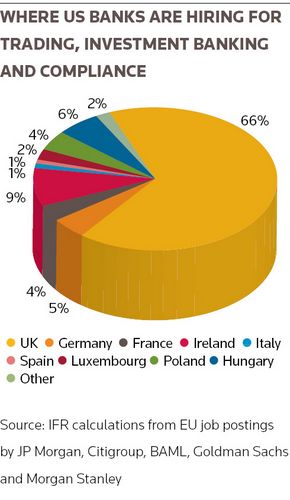

The UK remains even more dominant when it comes to hiring for investment banking and trading: the five banks had 227 jobs on offer, including 163 in London, or 72%.

Bankers said this reflected London’s stronghold as Europe’s financial centre and the slow approach that firms are taking towards Brexit. They said that although some jobs are shifting, banks are reluctant to move to rival cities or hire there until they really need to.

“There’s no benefit to moving now and having duplicate functions,” said one senior executive at one of the US banks.

The data show the five US banks had 94 jobs on offer across all businesses in Germany, and only 24 in France - combined, that’s fewer than 8% of the open jobs in Britain. There are far more jobs open in Poland and Hungary, with 274 and 248 open positions, respectively. That reflects the technology and back office hubs there - and also shows Frankfurt and Paris may not be the main beneficiaries of Brexit.

The banks had 10 investment banking and trading jobs open in Germany, nine in Ireland and eight in France. There were 17 in Hungary, mostly at Citigroup and Morgan Stanley.

The data were based on job openings posted on the websites of JP Morgan, Citigroup, Bank of America Merrill Lynch, Goldman Sachs and Morgan Stanley at the start of October.

The banks had 163 jobs available in compliance (including risk and legal at some firms) across the EU, and 91 of those were in Britain. There were 24 compliance jobs open in Dublin, far more than the 14 combined in Germany and France.

How US banks react to Brexit is being closely watched: they have thousands of high earning (and high tax paying) staff, and they dominate capital markets, so wherever they put resources and provide liquidity, rivals may follow.

NOT LONG TO GO

Britain is due to leave the EU on March 29, although details of how financial services will be affected are still unclear.

Bankers said handfuls of staff have moved in recent months - or have been told they may have to in the future.

Consultancy EY last week estimated that over 2,500 new Brexit-related financial services jobs have been created or are in the process of being created across Europe, including 500 in London, based on a survey of 222 firms. It said 10,500 UK staff could be relocated.

“A number of firms have identified Europeans in their UK employment who want to move back home, and many of the more senior roles are being filled with relative ease,” said Omar Ali, UK financial services leader at EY. But Ali said there remained cost and other challenges to relocating staff, and EU regulators view short-term relocation or commuting as “undesirable”.

Bankers said firms are under pressure to mitigate increases in costs and capital and potential fragmentation of risk functions in their Brexit planning.

Staff already moving include client coverage and finance bankers and sales staff, where bankers said it makes sense to be closer to big clients in Paris, Frankfurt, Milan or Madrid.

Goldman said it made sense to move them regardless of Brexit and was similar to moving staff to Seattle or Dallas in the US, which it has also done. It has moved its fixed income and currency sales team for France and the Benelux region to Paris from London, for example.

But it’s a different matter for traders and syndication teams. Bankers said firms want to make decisions on these teams later, partly because strict labour laws can make hiring difficult to unwind and because when senior traders move they are joined by risk, compliance, operations and back office roles - so moving one team could involve more than 100 people.

Banks are also reluctant to break up trading floors, in the belief that the more communication across asset classes the better. Keeping teams - and capital pools - together is also more capital-efficient and better for risk management.

BAML said it was moving three of its senior sales and trading staff to a new Paris office some time in 2019. They include Sanaz Zaimi, head of global fixed income, currencies and commodities sales, who will assume the additional role of country executive for France.

The pace of moves will be influenced by how demanding the European Central Bank is. One banker said the ECB does not currently have enough staff to closely supervise dozens of new entities, but it could “turn the screw” and require more senior bankers to sit in the eurozone over the next five years.

FRANKFURT - OR BUDAPEST?

JP Morgan, Citigroup, Goldman and Morgan Stanley have all set up broker-dealer operations in Frankfurt for their EU trading hubs while BAML has chosen Dublin. But all say they plan to spread jobs more widely.

Goldman has taken new buildings in Dublin, Frankfurt, Milan and Stockholm, and added space to offices in Paris and Madrid.

Morgan Stanley is expected to shift about 300 jobs due to Brexit, including about 200 to Frankfurt to double its headcount there, with others in Paris and elsewhere.

Citigroup already had a big Dublin operation and plans to add 150 to 250 staff across Frankfurt, Milan, Amsterdam, Dublin, Luxembourg, Madrid and Paris either by relocation or new hiring. Luigi de Vecchi, its chairman for continental Europe, relocated to Paris from Milan to supervise expansion there.

Of the 56 investment banking and trading positions open on Citigroup’s website, 33 are in London. There are only two each in Paris and Frankfurt, while there are nine in Budapest. None are in Dublin - but it is seeking 14 compliance staff in the Irish capital.

JP Morgan is more centralised in London and is expected to move about 400 staff in the first couple of years, but warned there could be many more in the long term. It has 16,000 staff in London, Bournemouth and Scotland, compared with 2,200 in the rest of the EU. And for now, that’s still where it’s hiring - 77% of its open EU jobs are in Britain, including 81% of investment banking and trading roles.