Intellectual muscle: In a tricky year for Asia-Pacific’s equity markets, one bank mastered the block business and succeeded with primary offerings while its rivals stayed on the sidelines. For its impressive range of innovative solutions and an enviable appetite for risk, UBS is IFR’s Asia-Pacific Equity House of the Year.

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

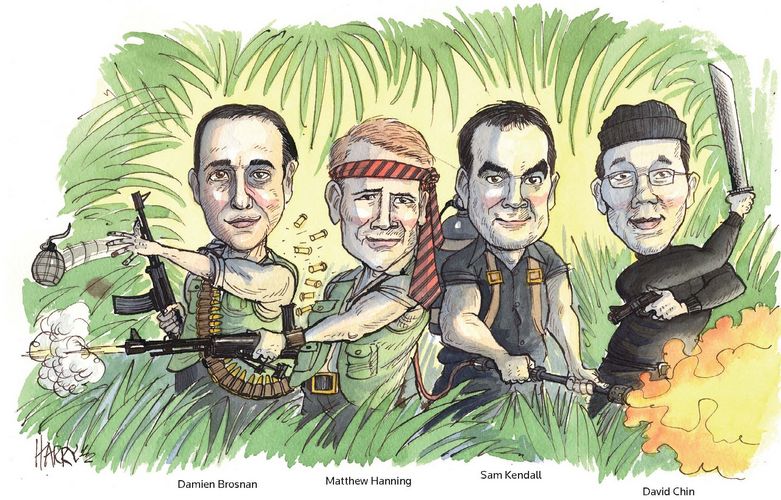

Negotiating Asia-Pacific’s equity capital markets in a volatile year required all the adaptability and strength of a champion fighter. UBS showed it had both the muscle and agility to counter any challenge, building on its heavyweight reputation in Asian equities with a flurry of smart and innovative transactions.

With market conditions changing at a moment’s notice, bookrunners were constantly at risk of being caught off-guard by tanking share prices, or of missing opportunities by being too cautious.

UBS showed an impressive sense of determination that kept it busy – and revenues flowing – throughout a year when new listings remained exceptionally challenging and many of its competitors stayed away from primary offerings.

It also played a leading role in the explosion of block trades during the year, coming up with innovative solutions to mobilise international capital for its Asian clients.

“Markets have been difficult, but we have continued to provide solutions for clients,” said Sam Kendall, UBS’s head of equity capital markets for Asia. “Our overwhelming focus has been on putting the client first but we have also sought to be proactive and entrepreneurial. In addition, having benefited from an uninterrupted deal flow has allowed us to assess investor appetite and needs accurately.”

In China, UBS extended its dominance in the domestic markets to offer a full range of services to Chinese issuers. The Swiss bank was the only foreign arranger to work on both the A and H-share tranches of the US$1.89bn Hong Kong and Shanghai dual listing of New China Life Insurance, the third-largest insurer in China, in December 2011. The deal was done at a time when many other companies were delaying their jumbo listing plans.

Fundraising for China Minsheng Banking Corp also demonstrated UBS’s ability to capitalise on its presence in both markets.

In March, the bank, alongside Haitong International, completed a H-share placement of HK$11.2bn (US$1.44bn) for China Minsheng at a tight discount of 5% to the last traded price. The two bookrunners are now looking to raise as much as Rmb20bn (US$3.2bn) in the domestic Chinese market through a jumbo sale of convertible bonds.

UBS was also joint global co-ordinator on the HK$13bn Hong Kong IPO of Haitong Securities in March. The deal, postponed from November 2011 due to difficult market conditions, priced at a higher valuation on its second attempt.

Other jumbo transactions on the bank’s playbook during IFR’s review period included the Rmb8.8bn A-share private placement of Chinese train manufacturer CSR Corp and the HK$7.01bn Hong Kong IPO of Inner Mongolia Yitai Coal, the first Chinese company with only a B-share listing to sell shares in the city.

A new playbook

The block business also yielded some signature deals that differentiated UBS from its competitors, including the HK$5.85bn selldown in Macau gaming company Galaxy Entertainment on August 28.

Leveraging on the bank’s exclusive working relationship with certain investors, sole bookrunner UBS gauged interest from a small group of institutional investors with strong support from a large US long-only investor. Having secured the support of some distinctive anchors, UBS structured the deal as a club placement, instead of a traditional bookbuild. US investor Waddell & Reed, a repeat client for UBS as both a vendor and investor during the review period, was said to have bought shares worth US$550m in the transaction.

The limited distribution minimised market risk without leaving the vendor, private equity firm Permira, at a disadvantage. The block of 278.8m Galaxy shares was sold at a fixed price of HK$21 per share, or at a modest discount of 4.1% to the pre-deal spot, and the stock rose 3.42% the day after the selldown, closing at HK$22.65 on August 29.

Just over two months later, UBS, once again as sole bookrunner, waived the previous lock-up attached to the above Galaxy block and brought another Permira selldown to the market.

The clean-up trade of 249.6m shares was priced at the bottom of the indicative price range of HK$27.17–$27.46 each, or at a discount of 5% to the pre-deal spot, to raise HK$6.78bn.

Again, the shares traded well in the aftermarket, closing at HK$27.35 the following day – 0.67% above the placement price.

The trades underlined UBS’s ability to find creative solutions to the problems presented by a turbulent equity market.

“Difficult markets present two options – either sit on the sidelines or draw on your intellectual capital and the breadth of our business to address client needs,” said Kendall. “What sets us apart has been a willingness to rip up the playbook and not be hostage to the previously-tested game plans that may have worked in 2007 but no longer apply today.”

In South Korea, that innovative thinking was again in evidence in a triple-decker block trade that raised a total of W577.9bn (US$532.7m) for steelmaker Posco.

In the largest of the three simultaneous trades in April, Posco sold 2.3m shares in SK Telecom at W137,000 each, a 3.9% discount. The company also sold 2.2m shares in Hana Financial at W44,450 per share, a 1% discount, and 3.9m shares in KB Financial at W42,300, flat to the last closing price. UBS was joint bookrunner for the transactions.

It also led the way with a new structure in India, working as joint bookrunner for the country’s first institutional placement programme to raise Rs3.7bn (US$66m) for Godrej Properties. This oversubscribed deal was a notable achievement in a year in which a number of Indian equity deals ended in disaster.

Having maintained its leadership in the Australian equity market for yet another year, UBS again tried something new in an environment where big trades were few and far between. Acting as adviser to coal freight operator QR National and sole placement agent to the Queensland Government, it managed a A$1.5bn (US$1.6bn) equity selldown for the state. Splitting the deal between an A$1bn stock buyback and A$500m placement allowed the shares to be sold at a premium to the market price, ensured a strong aftermarket performance and cleared the overhang on the stock.

Being everywhere

As momentum shifted to South-East Asia this year, UBS was again at the forefront of some unusually busy markets, including the Philippines, Malaysia, Singapore, and Indonesia.

Its continued strong presence in the Philippines paid off as the PSE finally sprang into life, with companies scrambling to boost their free-floats ahead of a regulatory deadline. The year’s standout deal, the US$504m GT Capital IPO, was the 10th consecutive capital market transaction UBS has won on a sole basis with the Metrobank group.

The Swiss bank actually clocked up seven follow-on offerings in the country totalling US$1.14bn. Other notable highlights were the US$323m Ayala Land offering and a US$231m re-IPO for Bloomberry Resorts.

Underlining the sense of a unique spread across the region backed by unmatched prowess in accelerated transactions, UBS was the only foreign bank on the US$1.2bn follow-on offering for Maybank. It priced with a tight 1.2% discount and was the largest ever overnight trade in Malaysia and the largest in South-East Asia during the awards period.

Real estate dominated in Japan and UBS played its part with senior roles on a fifth of the stock offerings for J-REITs, including as joint bookrunner on the overseas portion on the largest J-REIT IPO of the review period, Activia Properties’ ¥94bn (US$1.16bn) offering in June. UBS also played a junior role in the world’s second-biggest IPO of the year, Japan Airlines’ ¥663.3bn global offering.