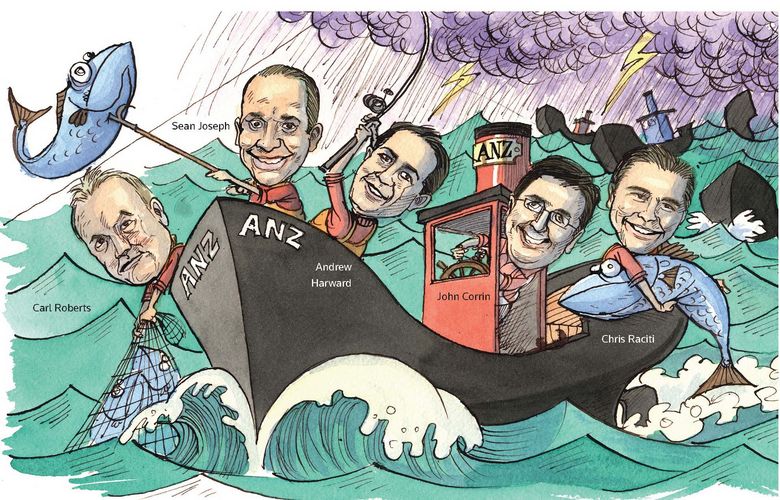

Ahead of the pack: With the eurozone woes casting a long shadow over the global lending markets, one bank stood out for its unflinching support of its clients and impressive track record in distributing risk. For matching a healthy risk appetite with a flawless market read, ANZ is IFR’s Asia-Pacific Loan House of the Year.

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

ANZ has made no secret of its ambitions to expand beyond its home Australian market, and it stuck to that strategy in a year when many global rivals were rethinking their approach to Asia.

The bank supported existing and new clients and underwrote where appropriate. It booked business in the key Asian markets, featured on high-profile acquisition financings, and extended its dominance in Australia. Its determination to do so without compromising standards, and its ability to avoid mispriced transactions was testament to the bank’s read of the marketplace.

In November 2011, there was a cloud of uncertainty hanging over the funding markets. Underwriting was a dirty word, with liquidity and the future of some of Europe’s biggest lenders still very much in question.

Amid such circumstances emerged a challenging US$3bn debut financing for Chinese e-commerce giant Alibaba, featuring six original underwriters, including ANZ.

After several weeks of changing market conditions, Alibaba, which is IFR’s Asia-Pacific Loan of the Year, closed to an overwhelming response. The role ANZ and the other bookrunners played in structuring and distributing the deal helped Alibaba expand its banking relationships, and set in motion another US$1bn loan for the borrower a month later. And while others dropped out, ANZ took another leading role.

New relationships

ANZ performed strongly in countries outside of its home market, in particular in North Asia, where it established new clients, with Alibaba and Legend Holdings among the most high profile.

Event-driven financings in North Asia were a highlight of ANZ’s deal book. Apart from Alibaba, ANZ acted as sole bookrunner on Hong Kong-listed cigarette packaging company Brilliant Circle’s HK$500m (US$64.5m) loan for its merger with CT Holdings in August and a US$500m bridge backing the acquisition of a stake in New Zealand’s Fisher & Paykel by Chinese appliance-maker Haier in November 2012.

The bank was also the sole physical bookrunner on a unique Taiwanese loan for contract IT firm Pegatron. The US$900m facility, signed in November 2012, comprised tranches secured against receivables from Apple and Ireland-incorporated Apple Sales International, and was the first of its kind in Taiwan supported by overseas banks.

ANZ was also one of three underwriters on a HK$1.4bn deal for Fortune REIT in February, which was the first underwritten deal in 2012, and the bank leveraged its relationship with cigarette packaging firm AMVIG’s Australian parent Amcor to win a joint mandate for a HK$2bn deal.

“It’s a misconception that our bank is only strong in Australasia. We have stepped up for our clients no matter where they come from and, in some cases, have established new relationships,” said John Corrin, global head of loan syndications at ANZ. “In several transactions, such as AMVIG, we have managed to displace existing and established relationship banks because of our compelling value proposition.”

ANZ underwrote several deals in Hong Kong. It was one of eight lenders backing AIA Group’s US$1.73bn acquisition of the Asian insurance assets of ING with a bridge financing, and was one of nine bookrunners on a SKr10.5bn (US$1.51bn) refinancing for Hi3G Enterprise, a Swedish unit of Hutchison Whampoa, in July.

It was also one of a dozen lead banks on a HK$7.1bn deal for steel-to-property conglomerate Citic Pacific in June, while Cheung Kong Infrastructure Finance (Australia) was another blue chip that hired ANZ as a bookrunner for a A$250m loan in September.

Dominant Down Under

Late in 2011, ANZ forecast that liquidity would remain constrained in 2012, pricing would rise, refinancing would drive volumes, and underwriting would be available for the right names.

Those predictions were borne out in the ensuing months, particularly in Australia, where ANZ won a dozen sole mandates, including four that were fully underwritten. They included a A$500m acquisition loan for building-materials firm Boral, a A$390m project financing for miner Sandfire Resources, and a A$140m refinancing for the Dampier-Bunbury gas pipeline.

The bank’s master stroke was its gutsy move to underwrite fully an A$1.2bn capital expenditure loan for Whitehaven Coal, Australia’s largest independent coal producer, to fund a mine expansion. The deal was cut in November 2012 against a backdrop of softening commodity prices due to faltering demand from China.

It was especially eye-catching in light of the troubles facing other resources players, such as Australia’s Fortescue Metals Group, which was forced to tap into the US Term Loan B market for a US$5bn refinancing after coming close to breaching covenants on its existing bank debt.

ANZ was a co-arranger on Fortescue’s loan, which is IFR’s North America Leveraged Loan of the Year.

Fortescue’s TLB also replaced an underwritten US$1.5bn loan that had struggled to attract banks a couple of months earlier. Against that backdrop, ANZ’s underwritten loan for Whitehaven bore testimony to the bank’s distribution capabilities.

Different approach

ANZ has a clear strategy to tap into Asia’s burgeoning economies and growing population. In addition to the financial centres of Hong Kong and Singapore, it has loan syndication desks in Beijing, Taipei, India, London and New York.

“From a distribution angle, we have a better read with people on the ground. Our pitch to clients is that ANZ is the clear distribution leader. You can tap Asian liquidity because of the relationships we have,” said Sean Joseph, head of loan syndications for Australia.

Proof of the bank’s wide suite of debt and loan products, ranging from leasing, leveraged financing, project and export financing to debt and equity advisory, was demonstrated in an unusual A$1.4bn performance-bond facility for Australian contractor Leighton Holdings in November 2012. ANZ devised a structure to deal with the company’s growing work-in-hand requirements in relation to its projects in Australia and Asia.

ANZ acted as fronting bank to optimise liquidity, operating a single performance bond platform and taking the risk off other banks, and the strategy paid off when the deal was increased from A$1.0bn.

Another transaction that was a blowout success was the A$2.4bn refinancing in November 2012 for Australia’s Origin Energy, for which ANZ was one of three bookrunners. It was a lead bank on an A$450m refinancing for earthmoving equipment firm Emeco in September, and was on an A$320m three-bank club for TPG Telecom in December 2011.

Across the Tasman, ANZ is the clear market leader in the institutional loan market, leading deals such as a NZ$1.35bn loan to capitalise Telecom New Zealand spinoff Chorus.

Big features

ANZ did not shy away from big-ticket financings, including the raft of commodity sector deals from Singapore, such as Cargill, Gunvor, Noble, Olam, Trafigura and Vitol, as well as India’s Reliance Industries and Indonesia’s Tower Bersama.

The bank also demonstrated leadership in opening up new pools of liquidity for Australian borrowers seeking to diversify funding sources by arranging 25 non-deal roadshows over the last 18 months to increase their profiles among Asian investors.

ANZ is also keen to develop an alternative investor base for Australian dollar loans as bank capital becomes scarcer with the onslaught of new capital restrictions under Basel III.

To this end, the bank is negotiating with several fund managers to seed their investment portfolios with some of its loan assets. “This is long term, but we are building up this opportunity,” said Joseph.

In September, ANZ jointly led a A$400m leveraged financing to back McAleese’s acquisition of transport firm International Energy Services, which saw the participation of institutional investors.