Steeling a march

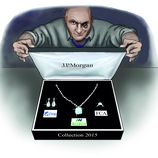

It was six years between regulators allowing exchangeable bonds in China and the country’s biggest steelmaker Baosteel printing the first deal in December 2014. Yet the bond is certain to open the floodgates as the only tool that allows major shareholders to monetise their stakes in China.

The Rmb4bn (US$650m) exchangeable into shares of China’s third-largest insurance company New China Life has also set a template for other state-owned enterprises to capitalise on their non-core assets, part of SOE reform in China.

Pioneering transactions in China require clearing multiple regulatory hurdles before even considering marketing and distribution. Baosteel needed blessings from five regulators – the State-owned Assets Supervision and Administration Commission, China Securities Regulatory Commission, Shanghai Stock Exchange, China Securities Depositary and Clearing, and China Insurance Regulatory Commission.

Convincing investors to accept the new product was another challenge. Instead of a step-up structure that is typically used in China’s convertible bonds, Baosteel’s exchangeable offered a fixed-rate coupon.

“As an innovative product [in China], the terms should be as simple as possible to allow investors to understand it better,” said Huang Zhaohui, managing director in investment banking at CICC, at the time. “[The] fixed-rate coupon allows investors to enjoy higher returns in the early years.”

Even a market correction could not throw the deal off track. Marketing of the exchangeable began on December 9, capitalising on a 25% gain in the Shanghai Composite Index the previous month. The same day, the index dropped 5.43% and shares of NCL fell by the maximum 10% allowed on the exchange before being suspended.

Demand was apparently immune to the drop – correctly, considering the upward path immediately resumed and continued until mid-June. The institutional tranche of the deal was 27 times covered, allowing the issuer to price the coupon at the bottom of the 1.5%–3.5% range. The conversion premium, set before bookbuilding began, was 9.35%.

Riding on the overwhelming response to Baosteel’s offering and the CSRC viewing exchangeables as outside the ban on shareholders of 5% or more selling shares, other issuers have been encouraged to take the exchangeable bond route.

Three other companies have raised a combined Rmb7.2bn from public exchangeables in 2015, while Shanghai State-owned Assets Operation is mulling a Rmb3.5bn EB into shares of China Pacific Insurance.

Both Baosteel and the EBs scored AAA ratings from Chengxin. Credit Suisse Founder Securities and UBS Securities were joint bookrunners alongside CICC.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .

<object id="__symantecPKIClientMessenger" style="display: none;" data-install-updates-user-configuration="true" data-extension-version="0.4.0.129"></object>