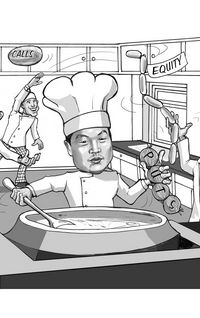

Hitting the sweet spot: The March 2011 earthquake and tsunami left Tepco reeling from a nuclear meltdown and ready to dump liquid assets. Its 8% stake in KDDI meant the telecoms operator’s share price was suffering. For relieving pressure on both companies and opening the market to others, KDDI’s ¥200bn convertible bond is IFR’s Asia-Pacific Structured Equity Issue of the Year.

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

Japanese telecoms operator KDDI’s jumbo ¥200bn (US$2.6bn) four-year zero-coupon convertible bond was a rarity in Asia-Pacific equity-linked. Given the four-month lull in Japanese issuance any deal was remarkable, especially one that (until Sony’s ¥150bn CB in November) was more than twice the size of any other Asia-Pacific trade in the awards period.

Even more amazingly, one rival not involved described the execution as “unbelievably perfect” despite the anguish of missing out on the largest sole bookrun Japanese CB in five years.

“The deal was done in very difficult conditions when very few people expected a convertible bond issuance by KDDI,” said Yoshifumi Otsuka, managing director of ECM at sole bookrunner Daiwa Capital Markets. “Market participants were surprised but the offering was absorbed smoothly and paved the way for other issuers in Asia to come to the CB market afterwards.”

The lack of other new issues and reasonable pricing ensured Daiwa found strong demand and ended with a book close to twice covered, two-thirds of which came from investors in Europe.

“Market conditions in late November 2011, when the deal was launched were far from ideal,” said Takao Asaka, director of ECM at Daiwa. “All stock indices in Japan, the US and Europe had been sluggish because of the US credit downgrade and the flooding in Thailand. In particular, the Nikkei index hit a low for the year just before the KDDI deal was launched and investor sentiment in the credit market was weak because of the European situation.”

Timing was essential, however, as the Euroyen deal was to finance the purchase of Tokyo Electric Power Co’s ¥186bn 8% stake in KDDI. The electricity utility was reeling from the liabilities resulting from the multiple meltdowns at the Fukushima Dai-ichi nuclear power station that followed the March 11 earthquake and tsunami and needed to monetise assets rapidly.

With the threat of a block sale of such a large portion of its shares, “KDDI had to find the best possible way to minimise the impact on its existing shareholders and the markets and that is why KDDI chose to issue a CB to finance the share buyback”, said Asaka.

News of the deal surprised the market. With ¥137bn of cash on its balance sheet at the end of March 2011, KDDI could have financed a share buyback without a major new fundraising.

The funds raised were used to buy Tepco’s 357,541 shares, which at the time were worth about ¥186bn. Additional proceeds took the total buyback to 424,126 shares.

The deal was launched off the ¥521,000 close on November 28 2011, with guidance of 5%–15% for the premium. Bonds were offered at 103 against a 100.5 issue price. The modest premium range reflected the high proceeds target, where the base deal was ¥190bn. Pricing came at 10% to give an initial conversion price of ¥573,100.

At final pricing Daiwa gave an implied volatility of 19.27 and bond floor of 95.89.

Outrights saw a low premium in a large company – a rare investment-grade issuer in Japan – with a growth story. Hedge funds saw a sensible price and the ready availability of cheap asset swap to hedge the credit. Around 20% of the deal was allocated to Asian accounts, 61% to Europe and 20% to US offshore accounts.

Competitors had only compliments for the trade as it was not pre-sounded and traded flat at 103 in the aftermarket – all the more impressive as the lack of issuance meant earlier deals had struggled to find the sweet spot on pricing. The ¥10bn greenshoe was exercised before the end of the week.

Mizuho, Morgan Stanley and Nomura were co-managers.