Syndicated lending in Asia-Pacific, excluding Japan, grew for the first time in four years in 2018, despite a slowdown in event-driven financings and rising volatility in equity and bond markets.

Lending volumes in Asia-Pacific rose by 8.9% from US$445.31bn in 2017 to US$484.82bn, the second-biggest annual tally behind US$523bn in 2014. Australia, China and Singapore posted significant growth after a surge in deal flow late in the year, according to LPC data, which tracks loans in international currencies comprising Australian, Hong Kong, Singapore and Taiwan dollars, renminbi and the G3 currencies.

The number of deals fell slightly to 1,203 in 2018 from 1,245 a year earlier.

“Asian loan markets remained stable in 2018 despite volatility in global capital markets and a slowdown in overall M&A financing activity amidst a reduction in China cross-border M&A activity,” said Benjamin Ng, Citigroup’s head of debt syndicate, loans and acquisition finance in Asia.

Strong volume from China came as a surprise after the government introduced moves to curb overseas acquisitions in late 2016 and trade tensions with the US added to concerns over an economic slowdown in the second half of the year.

Excluding Japan, China dominated Asia-Pacific lending with US$111.26bn of loans in 2018, a 9.9% increase on US$101.28bn of deals in 2017. This was largely due to a jumbo Rmb160bn (US$23bn) 11-year project financing for Chinese state-owned semiconductor maker Fujian Jinhua Integrated Circuit, which was the biggest loan in Asia-Pacific (ex-Japan) in 2018.

The deal, signed in late October, also highlighted the challenges facing lenders in China. Days after the signing, the US government withdrew the borrower’s access to US suppliers amid allegations that the firm stole intellectual property from American semiconductor giant Micron Technology.

Political developments made lenders jittery about Chinese borrowers in the manufacturing and technology, media and telecoms sectors, which are seen as most vulnerable to trade tensions.

M&A lending from Asia-Pacific fell to US$35.25bn in 2018, a 36.8% decline from US$55.74bn in 2017. The fall in Chinese M&A was far steeper, down 75% to US$4.63bn in 2018 from US$18.37bn a year earlier after Beijing introduced measures to control capital outflows.

REFINANCING RUSH

Asian borrowers took advantage of lending appetite among liquid banks and pushed hard to complete refinancings and negotiate more favourable terms on existing deals.

This was particularly true in Australia and Singapore. In Australia, volume climbed 16.8% to US$95.53bn, from US$81.77bn in 2017, and Singapore saw US$51.66bn in 2018, up 27.8% on US$40.42bn in 2017, thanks largely to refinancings and amend-and-extend exercises.

Hong Kong was also busy refinancing, amending and extending existing loans, but overall loan volume slid by 7.3% to US$107.87bn, as fewer Chinese companies tapped the market.

The largest refinancing from Asia (ex-Japan) was a US$5.5bn loan for state-owned China National Chemical Corp (ChemChina) in March, which refinanced part of a US$12.7bn acquisition loan that helped fund its purchase of Swiss seeds and pesticides maker Syngenta in 2017.

Casino and resort operators in Macau and Singapore, including MGM Grand Paradise, Venetian Macau, Wynn Resorts (Macau) and Marina Bay Sands, amended and extended around US$12bn of loans in 2018.

LOOKING AHEAD

Market participants remain optimistic about the outlook for 2019 despite geopolitical concerns, including the trade war, increasing protectionism and Brexit.

“Even with heightened global market volatility, the APAC syndicated loan market remained resilient into the tail end of 2018, with banks demonstrating solid appetite for reasonably priced and well-structured deals,” said Adnan Meraj, co-head Asia-Pacific syndicated and leveraged finance at Bank of America Merrill Lynch.

“We see this trend continuing into the beginning of 2019 and are already seeing strong reverse enquiry on some of the more immediate deals we will be launching in early 2019.”

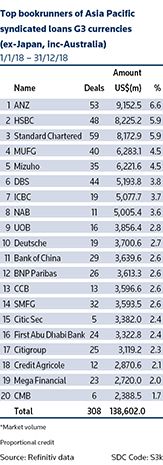

| Top bookrunners of Asia Pacific syndicated loans G3 currencies (ex-Japan, inc-Australia) | ||||

|---|---|---|---|---|

| 1/1/18 – 31/12/18 | ||||

| Amount | ||||

| Name | Deals | US$(m) | % | |

| 1 | ANZ | 53.0 | 9152.5 | 6.6 |

| 2 | HSBC | 48.0 | 8225.2 | 5.9 |

| 3 | Standard Chartered | 59.0 | 8172.9 | 5.9 |

| 4 | MUFG | 40.0 | 6283.1 | 4.5 |

| 5 | Mizuho | 35.0 | 6221.6 | 4.5 |

| 6 | DBS | 44.0 | 5193.8 | 3.8 |

| 7 | ICBC | 19.0 | 5077.7 | 3.7 |

| 8 | NAB | 11.0 | 5005.4 | 3.6 |

| 9 | UOB | 16.0 | 3856.4 | 2.8 |

| 10 | Deutsche | 19.0 | 3700.6 | 2.7 |

| 11 | Bank of China | 29.0 | 3639.6 | 2.6 |

| 12 | BNP Paribas | 26.0 | 3613.3 | 2.6 |

| 13 | CCB | 13.0 | 3596.6 | 2.6 |

| 14 | SMFG | 32.0 | 3593.5 | 2.6 |

| 15.0 | Citic Sec | 5.0 | 3382.0 | 2.4 |

| 16 | First Abu Dhabi Bank | 24 | 3,322.80 | 2.4 |

| 17 | Citigroup | 25 | 3,119.20 | 2.3 |

| 18 | Credit Agricole | 12 | 2,870.60 | 2.1 |

| 19 | Mega Financial | 23 | 2,720.00 | 2 |

| 20 | CMB | 6 | 2,388.50 | 1.7 |

| Total | 308 | 138,602.00 | ||

| *Market volume | ||||

| Proportional credit | ||||

| Source: Refinitiv data | SDC Code: S3k | |||