When AT&T visited some of its biggest bondholders late last year, it had an unusual request.

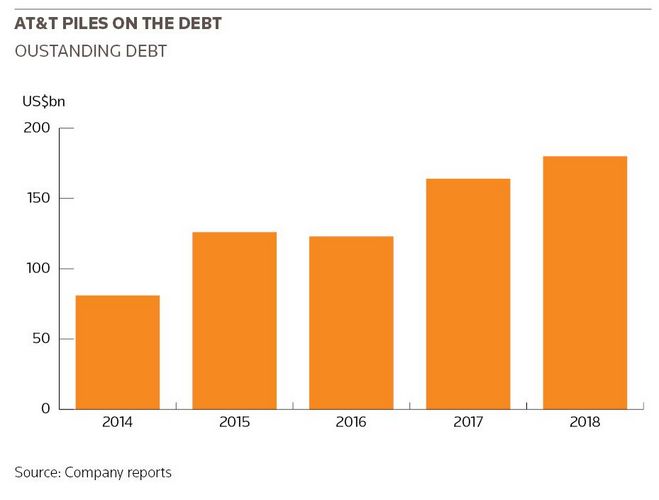

US bond funds had over the previous three years financed the biggest expansion in the company’s 137-year history, buying up one bond deal after another as it built up a war chest to first buy satellite TV provider DirecTV and then the Time Warner media empire. In those three years, AT&T’s debt had doubled – to more than US$160bn.

But concerns were mounting that the US bond market, the deepest of them all, might be too small for what had become the world’s most indebted company.

AT&T’s mounting debt, larger than that of most countries, had already begun to test the limits of the market. Some funds had loaded up so much on AT&T debt that they were starting to hit concentration limits that restrict how much of a company’s debt they can take on.

The concentration limits problem would only grow worse once the Time Warner deal, which was approved on Tuesday, went through. AT&T will inherit the debt of the media empire, taking its debt to US$180bn. And with a US$16bn bank loan that had been lined up to part-finance the purchase needing to be paid off, further bond sales are expected.

AT&T had a suggestion for the funds it was meeting with: they could simply ditch their safety limits, freeing them up to buy even more debt. It’s unclear how many agreed. But the fact that such a request was deemed necessary is an illustration that AT&T’s debt is starting to become an issue for the market.

“The only way to describe the size of the debt is ‘terrifying’,” said Craig Moffett, a partner at research advisory firm MoffettNathanson. “We have never seen anything of this scale before. If AT&T were a rapidly growing company, the debt would raise some eyebrows; but it isn’t growing – profit and revenues are shrinking. I don’t know why the market isn’t more concerned.”

Moody’s, which put AT&T on review for downgrade after the Time Warner deal was announced, warned late last year that its debt levels “could test the depth of the credit market”. So far, however, the market seems to have hardly blinked as the company piled on debt: its last foray into the US dollar market last July, for a US$22.5bn deal – the third-biggest US dollar corporate bond deal ever – drew US$60bn of orders.

CASH FLOODING OUT

But AT&T’s debt binge took place against a backdrop of cash flooding into US corporate bond funds, and there are now signs that trend is starting to reverse, as interest rate rises take effect.

The iShares iBoxx Dollar Investment Grade Corporate Bond ETF, the largest corporate bond ETF with more than US$800m of AT&T bonds, has seen net assets fall by almost a fifth since the end of last year.

And with less cash sloshing around, the issue of concentration limits is likely to become more acute.

“There are some technical issues around companies with this much debt – it pushes the buyside to the limit in terms of how much they can own,” said Neil Begley, who rates AT&T for Moody’s. “A lot of these investors are capped out in terms of where they stand in the index. After speaking with many bond investors over the past year, many appear to be full up on capacity.”

AT&T doesn’t immediately need to come to bond markets: it has over US$50bn of cash on its balance sheet – mostly raised in the bond market – plus the untapped US$16bn bank loan, which should be enough to cover the cash portion of the US$85bn acquisition of Time Warner. But lenders say that AT&T is expected to sell more bonds over coming months to pay off the bridge loan.

Many believe that the acquisition of Time Warner, and its stable of content that includes HBO, Warner Brothers Pictures and CNN, will be transformative for AT&T. Time Warner is a cash-generating beast, and in some ways the US$85bn deal will pay for itself. While AT&T will be on the hook for US$6.7bn of interest payments a year after the deal, those costs are multiple times covered by the combined company’s free cashflow.

“They aren’t just piling on debt, they are also bringing in a large amount of cashflow – Time Warner generates about US$4bn of free cashflow every year,” said Lindsay Gibbons, an analyst at CreditSights. “I think the strategic rationale for the acquisition is sound, and I like to see AT&T diversify away from wireless, where penetration is very high and competition is fierce.”

A MILLION LOST CUSTOMERS

Others are less sure, pointing out that the company’s previous big acquisition, its purchase of DirecTV for US$48bn in 2015, hasn’t been the game-changer that was promised. Recent figures have been disappointing: AT&T has lost over a million US cable and satellite customers since the deal. Even when its new internet TV service is factored in, AT&T now has fewer video customers in the US than it had just after it bought DirecTV.

“They thought that getting into the pay TV business was going to be a good differentiator for them, but I think if anything it has made the business inherently more risky given the structural challenges in that market,” said one analyst who asked not to be named because AT&T is such a big client for his bank. “They are basically doubling down with Time Warner. They are getting out of their core competency.”

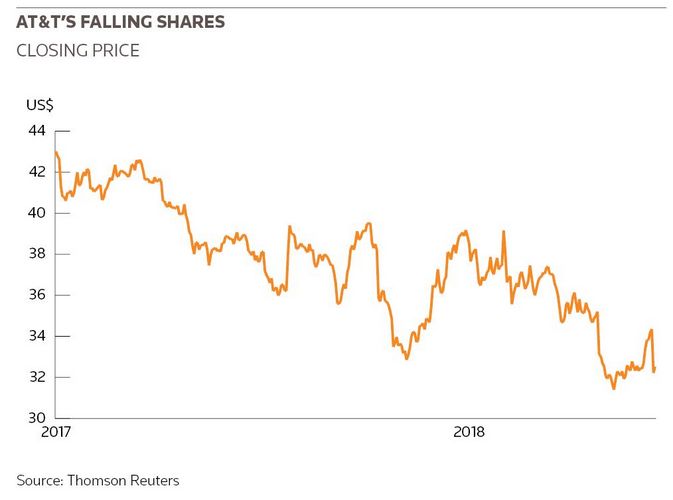

While AT&T’s mobile phone businesses are doing better, margins are thin, and haven’t been enough to prevent a slide in overall profitability since the DirecTV acquisition. Some are starting to worry that the large amounts paid for DirecTV and Time Warner – and acquisitions made many years prior – may leave the company vulnerable to huge writedowns that could undermine the sustainability of its debt.

A DirecTV dish is seen outside a home in the Queens borough of New York, July 29 2013. REUTERS/Shannon Stapleton

“If you look at the balance sheet, there is a large amount allocated to non-tangible assets such as goodwill, often linked to past acquisitions,” said Scott Kimball, portfolio manager at BMO Global Asset Management. “If you go into a scenario where things don’t go too smoothly, they may have to start writing down these intangibles on the balance sheet – that could cause a pretty quick descent into junk territory.”

CAUSING A CALAMITY

Indeed, a ratings downgrade is something many fund managers fret about. In 2013, chief executive Randall Stephenson said maintaining the company’s Single A rating was a “priority”. But AT&T’s debt binge since then has led to downgrades from Moody’s, S&P and Fitch. On Friday, Moody’s downgraded the company another notch to Baa2, citing its “elevated leverage”, leaving AT&T just two notches above junk.

A downgrade to junk could potentially have catastrophic consequences on the bond market.

“There is simply no conceivable way that AT&T could be a junk bond issuer – the market simply isn’t large enough,” said Moffett. “And it would cause a calamity because insurance companies and others that have rating obligations wouldn’t be able to hold it, so you would have massive redemptions. It simply wouldn’t be an option to allow them to be downgraded.”

The man who will help make that decision at Moody’s agreed – although he said that AT&T has options.

“If they were downgraded again … that is when it would get dicey for AT&T,” said Begley at Moody’s. “There is no company in the high-yield space with that much debt, and probably not even with half that amount of debt. They would get to the point where their backs would be against the wall, and they would have to do something such as take a closer look at the appropriateness of its dividend policy.”

SACROSANCT DIVIDEND

Dividends are an interesting topic when it comes to AT&T. The company never ceases to remind investors that it has increased its dividend every year since its IPO in 1984 – and is committed to continue doing so. Analysts say that policy is a massive constraint on its ability to pay down debt. It already eats up US$12bn of free cashflow, and that will rise once new shares are issued as part of the Time Warner deal.

“The company has opined about deleveraging, but frankly it is hard to immediately take them seriously,” said Kimball. “With so much of free cashflow going towards paying the dividend and the cost of integrating Time Warner, the company doesn’t really have much room for manoeuvre in terms of paying down debt. Redemptions are also going to take up a lot more cashflow than they did in the past.”

Begley said it is unlikely that AT&T’s Stephenson and his team will cut the dividend – unless forced to. “It’s fair to say that cutting that dividend might be a career-ending move, and so it is unlikely to happen,” he said.

AT&T CEO Randall Stephenson (L) and Time Warner Inc CEO Jeff Bewkes discuss their companies’ proposed merger at the WSJD Live conference in Laguna Beach, California, October 25 2016. REUTERS/Mike Blake

AT&T declined to make anyone available to talk in detail about how it planned to reduce debt, but it did say in a statement that it is “comfortable with the current financial profile of the business”. It said that growing profits, less capital spending, low interest rates and lower tax rates will help it to bring down leverage levels. “We will also be opportunistic in monetising assets,” it said.

Its first attempt at monetising assets didn’t quite go according to plan, however. When it tried to float its Latin American television assets in April, a deal it hoped would raise as much as US$650m, investors weren’t so keen. AT&T started out seeking US$19–$22 per share, but then dropped the price to US$16–$17. When it was unable to sell even at that level, it decided to ditch the deal.

RISING RATES

Another risk is rising rates, which will make refinancing debt that rolls off more expensive. The company has regular bond maturities coming up – to the tune of about US$8bn a year over the next decade – although most of its debt is only due after 2027. But, with a commitment to increase the dividend, how much leeway will it have to support rising interest costs? What if revenues falter further?

“We’ll be focused on paying down our total level of debt to reduce the impact of potential rate increases,” said AT&T. “We have had a tremendous capability to borrow and have borrowed at attractive rates and spread out the maturities over decades. Our debt portfolio has a weighted average maturity of approximately 14 years … a high percentage of our debt has interest rates that are locked in.”

To be fair, AT&T has time on its hands.

“The issue here isn’t whether or not AT&T is going to go bankrupt; there is no realistic scenario where AT&T is going to go bankrupt,” said Moffett. The real question is simply can they deleverage fast enough to satisfy the ratings agencies – because, if they can’t, then there will be an inevitable call for the company to cut its dividend and to use cash to pay down debt.”

“It isn’t a question of solvency, it’s a question of priorities,” he said.