Saudi Arabia’s attempt to kill off the US shale oil industry looks to have badly backfired. More than two years after Riyadh and its OPEC allies ramped up production to push down the price of oil and drive shale producers out of business, it’s actually the cartel that is licking its wounds – and not the US upstarts.

The fight has destroyed OPEC members’ finances, forcing many to dip into reserves and sell bonds to finance spiralling fiscal deficits – Saudi’s alone is US$100bn a year. Other cartel members such as Nigeria have turned to the World Bank for emergency loans, while Venezuela has seen its economy paralysed by falling oil revenues.

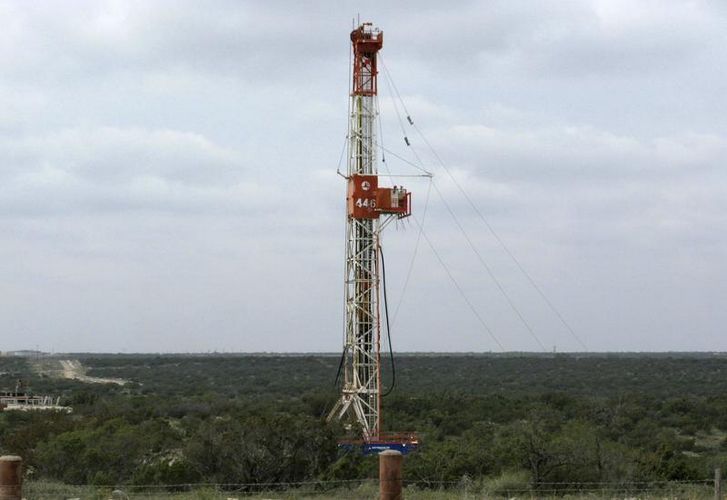

By contrast, the US shale industry is enjoying its second wave. After a painful couple of years when dozens of shale producers filed for bankruptcy and four out of every five rigs were mothballed, cost savings and big improvements in technology have reinvigorated the sector. Activity has rebounded, with 602 rigs now active, double the level last May.

Rather than kill the sector off, the near-death experience has pushed US shale producers into becoming more efficient than ever. Five years ago, producers in the Permian basin were pumping 100 barrels per rig per day. Now it is over 600. Profits have leapt, cashflow is rising, and market share is growing – all at the expense of OPEC.

“It’s worked out terribly for the Saudis and OPEC,” said Brian Gibbons, global head of oil and gas credit research at CreditSights “Their attempt at market share gains did of course result in a record number of shale producers defaulting, but what transpired at the same time was the remaining companies becoming that much more efficient.”

“The US has got much stronger and more resilient … it’s the OPEC members that are haemorrhaging cash,” he added. “Saudi Arabia’s foreign currency reserves are down by about US$220bn over two years, the fiscal budget has gone from a US$100bn surplus to a US$100bn deficit, and they are looking to sell part of the crown jewels in Aramco.”

DEBT PILE-UP

Key to the turnaround has been the reduction in US producer’s debts. The capital-intensive shale boom – and subsequent rush for investors to be part of it – led to an explosion in debt, particularly among smaller, high-yield players that sold about US$130bn of bonds during the first shale wave between 2009 and 2014.

“It’s worked out terribly for the Saudis and OPEC”

Many were left unable to service their debts when oil prices collapsed – 119 producers with US$74bn in debt filed for bankruptcy in the US and Canada during the crisis. But many are now emerging from the process with much smaller debt loads. SandRidge Energy, one of the biggest bankruptcies, shed US$3.7bn of its US$5.8bn debt pile.

According to lawyers who have worked on energy filings, the still subdued price of oil – it is still half what it was three years ago – has made creditors willing to bargain.

“Debtors have been very aggressive … creditors know that they have to be reasonable because this is not a market you want to liquidate in,” said John Grieve, chair of the restructuring group at law firm Fasken Martineau. “Creditors are rolling over because they know they have no alternative.”

Others, such as Chesapeake Energy, have deleveraged without resorting to the courts. The Oklahoma-based company engaged in a number of below-par debt repurchases and exchanges in its bid to stave off bankruptcy. Such has been the turnaround that its 2019 bonds bid at 10 cents on the dollar a year ago are now trading at around par.

Larger players such as Anadarko, Pioneer Natural Resources and Devon Energy have also made deep cuts so that they are profitable even at US$55 a barrel oil. Gibbons estimates that many US players have a breakeven of US$50 or below, a third lower than a couple of years ago. “There is no killing them off, they have proven their ability to adapt,” he said.

RESPITE FROM LENDERS

While many lost access to bond markets – especially high-yield players – access to loans and equity finance has helped many. Chesapeake’s turnaround was aided by respite from its lenders as well as a US$1.1bn convertible bond issue in October. Last year, US oil and gas producers raised US$32bn in equity finance, almost double the previous annual record.

“Energy companies have access to the capital markets. They have done a lot of equity deals and repaired balance sheets,” said one high-yield portfolio manager. “On the shale side companies are going to increase spending. They have done a lot of restructurings like swapping junior debt and a lot of cost improvements.”

Bond markets have begun to reopen as investors take consolation in the debt reductions and in the stability of the oil price since OPEC decided to cut production in November, in part to stem their losses in the battle with US shale. The market is even open for high-yield issuers: after months of no deals, there have been over a dozen since October.

But shale producers are unlikely to go back to their old ways. While many are upping capital expenditure, the funding for projects is now coming from increased free cashflow rather than issuing new debt. There is also a wariness that wasn’t there before: having been through an oil price collapse, producers know how quickly things can turn.

“I still don’t think anyone sees this market screaming back up,” said Grieve. “We are about where we thought we would be in terms of oil prices and OPEC is making sounds it might do things that increase the price a bit.”

“We have plateaued,” he said. “People are cautiously optimistic.”