The Citi that never sleeps

Banking and capital markets certainly didn’t lack drama in 2016 as the industry battled a complex and volatile operating environment, while individual firms pushed forward with strategic recalibrations and strove to improve returns. There may not have been any dazzling epiphanies, but one firm resolutely continued its steady progress and made impressive strides. Citigroup is IFR’s Bank of the Year.

“I don’t think there’s a question that we’ve re-established ourselves as one of the leading global banks in wholesale. No one is questioning our viability, survivability or presence. When people think about the banks that will be dominant in the future, Citi will have a seat at that table.”

That comment by James Forese, president of Citigroup and CEO of the Institutional Client Group, speaks volumes about how far the bank has come on its journey. Citigroup made US$17bn in net income in 2015, its highest level since 2006; and 3Q 2016 results showed continued momentum across the business lines in a tough year for the industry.

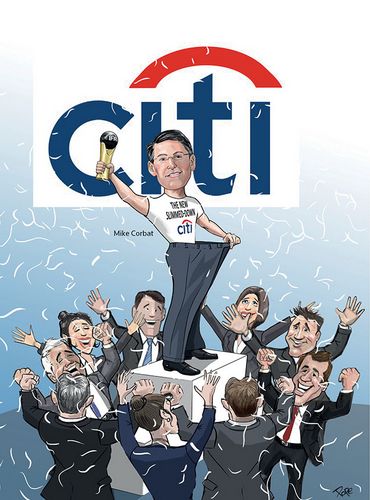

Citigroup’s progress marks a confident contrast to the rebuild of recent years. After Chuck Prince, who haplessly led the bank from 2003 into the crisis, and Vikram Pandit, who led a tough five years from 2007 through daunting capital and liquidity adversities, Michael Corbat has spent much of his four years or so at the helm re-shaping the group.

Corbat’s tenure has meant methodical, systematic and orderly restructuring; trimming costs; right-sizing; optimising the geographical and client footprint; and rebuilding relationships with regulators, politicians and policymakers. The process continues, but Citigroup is now equipped with the strengths, attributes and characteristics it needs to drive revenue growth.

In terms of 2016 milestones, the fact that the group will no longer break out Citi Holdings numbers was a remarkable achievement. At the time of its formation at the start of 2009, the non-core unit housed a staggering US$850bn of the group’s US$1.95trn in assets. By the end of the third quarter of 2016, that had been managed down to US$61bn. As of mid-October, Citigroup said it had signed agreements to reduce assets by a further US$10bn.

Corbat announced in April that the Federal Reserve and FDIC had found no deficiencies in the group’s resolution plans. Mid-year, the group sailed through its CCAR, and the Fed approved the group’s planned capital actions.

These included an increase in the quarterly common stock dividend to 16 cents per share, and a stock repurchase programme of up to US$8.6bn over four quarters starting in Q3 2016. In November, the buyback programme was increased by US$1.75bn, making for total planned capital actions of US$12.2bn.

“2016 was a big year for the firm as we pivot to growth,” Corbat said.

“The fact that we stopped reporting Citi Holdings as a stand-alone entity is a sign that our realignment is largely complete. We were the only big US bank to clear resolution where CCAR used to be an issue, and we’ve shed non-core businesses and now focus on core clients,” he said.

“We had to undertake this restructuring in an extremely difficult environment politically and economically, and in an industry incorporating an entirely new regulatory regime. But we had a good sense of where the world might be headed, and we believed our scale and geographic reach would continue to be valuable to a core set of clients and that we could distinguish ourselves with those attributes.”

Smaller footprint

Corbat has radically cut the number of markets the consumer bank operates in from 50 to 19. ICG has maintained its presence in 100 countries and remains a full-service bank. But in line with Corbat’s point about focus, Citigroup slashed its ICG client list from 32,000 to 14,000.

In doing so, the bank didn’t exit any product areas, even though the product-led approach was curtailed. “What’s different today is we do client-related plans rather than product-related plans,” Forese said.

That means assessing what its wallet share is with leading clients versus other banks. Mature client planning means taking a pass on moves that could garner more share but would not be economic. That’s grown-up banking, focused not on volumes but return: a simple mantra that is now embedded in the way senior Citigroup executives view business opportunities.

In slashing its client platform, Citigroup’s thinking was simple: it would focus on clients that the bank serves well with differentiated coverage, products and services vis-a-vis other banks. That meant sophisticated multinational clients requiring multiple products in multiple jurisdictions.

The 18,000 relationships the bank exited may not have eaten up too much in the way of resources, but they weren’t generating a lot of revenue either. Through full-on KYC and A&L monitoring, management reached its target list, with the real focus on the top 1,000 clients that generate about 60% of revenues.

With its core client footprint right-sized, the focus moved to making targeted investments in markets and businesses that were well positioned to drive revenue growth and support the customer franchise – growth backed by a strong balance sheet of high-quality assets and a substantial liquidity pool.

At the nine-month stage, Citigroup had one of the strongest capital and leverage ratios in the industry: its CET1 ratio stood at 12.6%. Citigroup executives are particularly proud of the fact that JP Morgan Chase’s 2015 annual report acknowledged Citigroup’s ICG as the Corporate & Investment Banking category leader with the best-in-class peer overhead ratio.

Citigroup may not consistently be top three in the league tables in all the areas ICG operates in, but senior managers are not fazed by this; indeed that is not even a key objective. The bank is open about the areas it needs to improve in, such as equities, and is diligently working to address the problem areas quarter by quarter.

“I’m appointed by the board and the CEO to work on behalf of our owners,” said Forese.

“Our owners want a return on capital and only care if we’re number one, number five or number 10 if being higher offers a clear returns advantage. If I focus on industry rankings but don’t generate a return on equity, I haven’t done my job for the owners and am probably going to get fired,” he said.

“We can’t insist on a given share of wallet. What we hope is that we have a core relationship that enables us to pitch for part of a client’s wallet, be that FX or interest-rate hedging, capital markets or M&A, payments or treasury services business.”

In areas where Citigroup wants to compete but lags, the bank’s approach is not to throw massive resources at the issue but to consistently improve year-over-year and incrementally generate more attractive returns. With the exception of equities, which is a work in progress but where Citigroup is making gains, senior executives feel the bank is there or thereabouts in the other areas of core focus.

What Citigroup has built in ICG is a best-in-class global corporate and investment bank that is as integrated as it needs to be to provide optimal service while generating what management considers to be a realistic share of available fees. Management is agnostic about where the revenues come from.

“Transaction and treasury services are way more attractive fields of banking than M&A,” Forese said.

“When we think about resource allocation, we focus on things we know are going to generate more attractive returns for our owners. We’re also specialists in M&A and ECM and want to compete there. But if I’m going to get a better return on transaction services, every one of our shareholders would tell me to put more resources there.”

In terms of how it all fits together, the highly successful corporate bank maintains consistent annuity relationships, while the investment bank works shrewdly and intelligently at or near the apex of the industry. And in 2016 Citigroup continued to win an impressive array of benchmark M&A, capital markets and key episodic mandates.

Citigroup’s CIB client teams are matrixed across industry and country. Each team comprises strategic coverage officers who focus on M&A and equity and related financing solutions, as well as corporate bankers working in partnership with capital markets specialists and supported by the global subsidiaries group (the full-service platform that delivers working capital and risk management solutions for multinationals).

Speaking to the power of the corporate banking footprint, treasury and trade solutions earnings have risen for 11 consecutive quarters and in the third quarter of 2016 accounted for around half the US$4.1bn in net revenues of the banking segment of ICG, against US$1.1bn for investment banking. Only Citigroup’s world-class fixed-income sales and trading division (US$3.5bn in net revenues) was bigger than TTS in overall ICG segment net revenues.

Forese has a clear view of how internal alignments should work, including the notion of cross-sell, which for other banks has become the much-vaunted endgame. “If anyone tells you that we do a lot of cross-selling, they’re mis-stating what we actually do,” Forese said.

“It’s impossible to do, and our customers are too sophisticated to be sold products by people who don’t understand them,” he said.

“What we aim to do is be effective in figuring out which products clients need, and sell as many products and services to the clients that need them. But we deal with that by getting the experts in each product to service the client – not by getting an FX salesperson to sell an equity mandate. It never works and that’s not the desire. What we want are relationship managers who can identify the opportunities and bring in the experts to sell.”

Where payments and FX used to operate in a siloed fashion, the bank now treats a cross-currency payment, for example, as one item derived from a single client instruction. It has integrated systems and technologies to deal with that effectively and efficiently, and has engendered a partnership culture among internal teams to create fluidity across the board.

“There are no prizes for individual achievement,” Forese said. “The prize is achieving the most business we can with core clients.”

Leading player

Given the diversified nature of its wholesale business, Citigroup executives offer a variety of examples to showcase their progress and achievement in 2016. One they’re particularly proud of is the innovative end-to-end supply chain finance programme for Etihad Airways, which built on an existing relationship that included cash management and banking services. At the time, it was the first SCF programme for an airline outside of the United States.

In capital markets origination, Citigroup continues to be a leading global player. It is a top two global debt underwriter, a top three global syndicated lender and a top three to top six ECM underwriter, depending on the segment.

“The quality and global breadth of our business is stronger than ever,” said Tyler Dickson, global head of capital markets origination.

“Our rise has been remarkable. Citi has consistently gained market share,” he said, pointing to the bank’s 100bp market share gain in global bond issuance as a major leap forward propelled by the bank’s global reach.

“We played strongly into all the key themes that impacted global markets in 2016.”

Those included large-scale US dollar issuance (Dell/EMC’s US$20bn offering, the largest-ever tech deal); the reopening of the market after the Brexit vote (Molson-Coors in dollars, Brown-Forman in euros and sterling, and Lloyds’ US dollar holdco print as the first bank issuer after the vote); Yankee and reverse Yankees (US$4bn for BMW’s debut and €4bn for Johnson & Johnson); and large-scale acquisition financing take-outs (Danone and Air Liquide, where Citigroup was the only bank outside the advisers selected to act as an active bookrunner on euro and US dollar offerings).

Further examples include Citigroup’s role in hybrids (Total on the corporate side and the landmark US$2.65bn AT1 for RBS, the largest ever); high-yield (Ardagh/Schaeffler); and the revival in global EM. Notable EM trades included Argentina’s US$16.5bn four-tranche offering – the sovereign’s first foray into the international capital markets for more than 15 years, which drew demand of almost US$70bn – and the Kingdom of Saudi Arabia’s US$17.5bn issue, the largest-ever syndicated sovereign bond.

In ECM, US highlights were the US$660m Valvoline IPO (the third largest US consumer IPO since 2014); the US$2.6bn Molson-Coors follow-on supporting the brewer’s US$12bn purchase of Miller beer assets (the largest-ever consumer/retail acquisition financing follow-on in the US); the Silver Run/Centennial acquisition and IPO; and the BATS trade that reopened the fragile US IPO market.

In EMEA, Citigroup did the margin loan that financed Christo Wiese’s investment in Steinhoff and the largest IPO on the Prague exchange for eight years for Moneta. The bank was also on the US$2.5bn Naspers follow-on (the largest-ever EMEA Internet equity offering) and Credit Suisse’s US$4.4bn rights issue.

Citigroup was also on a host of notable advisory assignments, including Time Warner Cable/Charter Communications; Dell/EMC; Baxalta/Shire; Starwood/Marriott; Nokia/Alcatel-Lucent; Protection 1/ADT; Southern/AGL; Exor/Partner Re; Leidos/Lockheed Martin; Anacor/Pfizer; NOL/CMA; FamilyMart/Uny; and Nippon Life/Mitsui Life.

As to where Citigroup goes from here, the challenge the bank now faces is of a different dimension. Can it build on its progress and become the pre-eminent universal wholesale bank?

“That is the charge for this group of managers that led us out of the wilderness from near-extinction and which brought us from the depths of the crisis to this position of leadership,” said Forese.

“Now we need to change the dynamic, to shift our sights and aim higher. It’s going to be a fun few years.”

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com