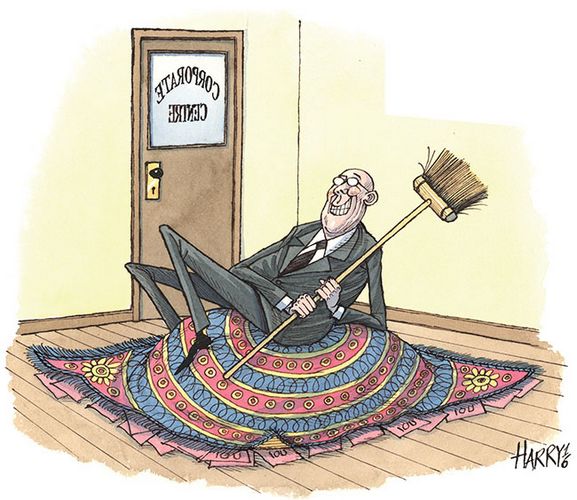

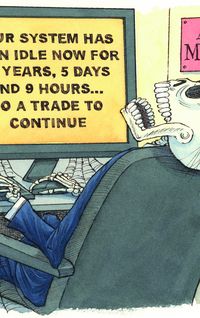

Big banks have lost more than US$60bn in their corporate centres in the last four years. Some critics say the units can mask the true performance of business divisions.

Banks are under pressure to improve the consistency and transparency around their so-called corporate centres due to concerns that the units have become “black boxes” that are used to make other divisions appear better than they are.

Eleven major banks lost more than US$60bn in aggregate in their corporate centres over the past four years, according to IFR calculations.

Such losses are not a surprise given that many of the units carry big central costs and bring in little revenue, but investors and analysts said there is concern about the wide variance in what corporate centres include and the opaqueness of some.

The biggest worry is that corporate centres can mask the true performances of business divisions when bank bosses are supposed to be making hard-nosed strategic decisions on which businesses to keep and which to get rid of.

“It can create a smokescreen around the reality, deliberately or not,” said Jeremy Sigee, an analyst at Barclays in London. “That can create a confused discussion and weakened scrutiny and accountability of divisional management.

“The biggest danger is the wrong business decisions get taken, because companies delude themselves about the real profitability of some of their businesses.”

“They [management] allow businesses to remain and grow, when the economic reality is some areas are not clearing their cost of capital and they should be shrinking and restructuring, not growing or ‘business as usual’.”

Big losses

The use of corporate centres is common among big, complex banks.

They handle functions used across a bank, such as treasury, capital management, foreign exchange and other hedging functions. They are also used for shared resources such as real estate, human resources, technology, legal, compliance, finance and risk management.

JP Morgan employed 31,572 people in its corporate centre at the end of September, which is 13% of its headcount and 11,000 more than at the start of 2013. UBS has 24,059 corporate centre staff, or 40% of its employees.

Others use them sparingly, or not at all. Goldman Sachs and Morgan Stanley do not operate with them and allocate all costs and equity to their business divisions.

The 11 banks with a corporate centre assessed by IFR lost US$52bn from 2013 to 2015 and another US$9bn in the first nine months of 2016, according to their published results. (see chart)

Those losses included some lumpy costs. JP Morgan’s corporate centre booked US$10bn in legal costs in 2013 and BNP Paribas took a €6bn charge in 2014 related to its settlement with US authorities. Citigroup had US$4.4bn of corporate centre legal charges in the same year.

Swings in the carrying value of banks’ own debt can be significant items in the central centre, as can complex accounting issues, often related to tax.

Of course, there can be big one-off revenues too. This year European banks booked substantial income in corporate centres from the sale of their stakes in credit card company Visa Europe, for example.

Banks’ results show costs are far more common than income, however, and often include goodwill charges on past bad acquisitions, or restructuring expenses.

HSBC reports its central costs in “other”, which made a pretax loss of US$3.5bn in the third quarter of 2016 alone. That included movements in the value of its own credit and restructuring costs. In recent years HSBC has reported an annual loss of just over US$2bn in “other”.

Santander’s corporate centre incurs the cost of hedging the capital adequacy of its overseas subsidiaries and with the gap between high interest rates in Brazil and low euro rates that annual cost has been substantial.

Santander was also criticised for booking charges relating to mis-selling payment protection insurance in its British business through its corporate centre, but the bank said legally all the PPI charges were booked through the UK business and were fully in the UK unit’s accounts. It said the losses were included in the corporate centre because they covered historical costs and were not a reflection of the underlying performance of the UK business.

Less accountable?

A worry among investors and analysts is that what goes into the corporate centres can be vaguely defined and it ends up being a dumping ground for costs, losses or capital – which should be allocated to business units.

One senior banker admitted they can be seen as a “black box” and banks need to improve their transparency for the good of investors, staff, media and regulators.

Often there is less accountability for corporate centres and some worry that because remuneration is often tied to divisional profits, losses can be pushed into the central area to protect bankers’ bonuses.

Capital allocation

How banks use corporate centres for the allocation of capital is one of the biggest areas of inconsistency, raising concern that such tactics distort returns, bankers and analysts said.

Banks calculate return on equity for individual business lines based on the equity held in each, so if a division is allocated less capital, its ROE will look higher.

UBS allocated SFr28.9bn of equity to its corporate centre at the end of September, or 54% of the bank’s entire capital. Another SFr5bn was not allocated to any business. That left only 36% of group equity directly allocated to its business areas.

“The capital allocation within the group makes the divisions appear to be more profitable than they really are,” analysts at Bank of America Merrill Lynch said in a report on UBS earlier this year.

UBS reported an ROE of 25.9% for its investment bank in 2015, the highest of all major banks, and even higher ROE for all other units. That was despite group ROE being 11.8%.

For the first nine months of 2016, UBS said its investment bank’s ROE was 12.1%, asset management delivered 29.3% and all other divisions made an ROE of 40% or more. Yet group ROE came in at a sluggish 6.3%.

The BAML analysts said UBS’s investment bank should have almost double the capital allocated to it that it does.

Barclays’ Sigee said if capital were properly allocated, UBS’s investment bank would deliver a return on required tangible equity of 7% in 2018 based on expected earnings, not the 17% it would achieve on the company’s current equity allocation.

As with many issues around the corporate centres, banks calculate equity allocation in different, often complex ways.

UBS says all its units meet regulatory capital requirements and it is transparent on how its equity is allocated.

It holds more assets than rivals in its corporate centre (including its non-core assets) and holds equity for goodwill, deferred tax assets and asset liability management. It also holds excess group capital, which is significant given the group’s common equity Tier 1 ratio is 14%, one of the highest in the industry.

Improving and transparent?

As banks come under sustained pressure to improve returns and efficiency more scrutiny is being put on corporate centres.

Many banks acknowledge it is an area ripe for improvement – in terms of transparency and cost savings.

Some senior bankers admit some corporate centres became inefficient in the years running up to the financial crisis (partly as banks made acquisitions) and may have been slow to improve.

Santander executive chairman Ana Botin, who took over at the end of 2014, has set out to diminish the corporate centre’s influence at the Spanish bank and make it more transparent and efficient.

Botin aims to reduce losses in the corporate centre to below 15% of group attributable profit by 2018, down from 39% in the first half of 2015. Santander estimated the average losses at corporate centres relative to attributable profits across six eurozone peers was 35%. Santander said it cut its level to 23% in the third quarter of 2016 and was on track to hit the 2018 target.

Analysts said investors would welcome greater transparency and could reward those banks who shed light on their corporate centres with higher valuations.

“You can end up spending more time thinking about the corporate centre than the rest of the bank, because it’s where all the awkward stuff has been parked and it can become the biggest swing factor,” said Sigee.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com