The organisation is even considering hiking current leverage ratio proposals if no progress can be made, in a move that would dramatically ratchet up the pressure on an industry already facing demands to cut hundreds of billions dollars of assets.

Banks – particularly European ones – have increasingly turned to RWA optimisation in recent years as a way of boosting capital ratios without raising fresh capital or reducing the size of balance sheets. The practice involves banks changing the way they calculate the default probability of assets, allowing them to reduce risk-weightings, and are signed off by regulators at national level.

“If eventually we still don’t believe the results of their models, let’s just move to a stronger leverage ratio,” said one Basel Committee member. “The Bank of England and some in the US are strong advocates of that. That is why it is in the banks’ best interest to get to the bottom of the problem.”

The Institute of International Finance has already launched a working group to look into the issue, with the industry lobby group keen to uncover any abuse. “They know that if their capital levels can’t be believed, the next best solution is a higher leverage ratio,” said the Basel Committee member.

“If their capital levels can’t be believed, the next best solution is a higher leverage ratio”

It is unclear how much banks have used optimisation in recent years, but analysts broadly agree that the figure is in the hundreds of billions of dollars. Many European banks have openly stated their intention to optimise their RWA models in past quarterly reports, though such strategies in themselves don’t necessarily constitute what the Basel Committee would see as abuse.

In Commerzbank’s third-quarter results in 2011, it explicitly said it would begin using new risk models that would benefit its RWA figures. In the same year, Santander also optimised its RWAs, mainly in how it valued some loans and credit obligations.

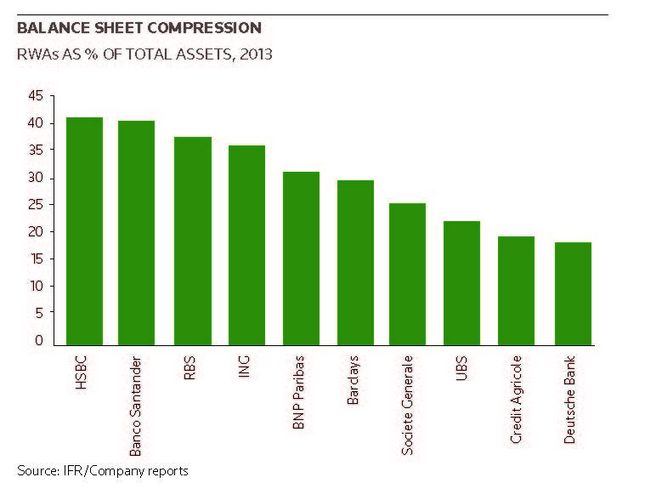

Figures compiled by IFR show wide variation in balance-sheet compression – in effect comparing the amount of RWAs at each bank as a proportion of their total assets – particularly in Europe. Of Europe’s 10 largest banks, Deutsche Bank had the lowest rate at 18.6%, while HSBC had the highest at 40.9% as of the end of 2013.

A lower ratio could suggest more RWA optimisation, though it could also be because a bank holds higher-quality assets that genuinely have lower risk.

Time to act

Basel officials told IFR that after years of recognising that there was a problem, it was time to act. They said there was solid support from national regulators and even the banks to get something done. As Basel has no official jurisdiction, it is dependent upon national regulators to enforce its recommendations.

Officials say that the threat of a higher ratio has resonated as its current figure of 3% is already widely unpopular among banks. As part of the RWA reforms the officials are pushing for model constraints, data requirement improvements, the use of shorter time horizons and even a capital penalty where certain risk management policies are not in use.

Furthermore, they want tougher limits or “floors” of how low a bank can value an asset’s risk.

As Basel has no official jurisdiction, it is dependent upon national regulators to enforce its recommendations

European bankers are predictably unhappy about constraints being put on to RWA models. They say it is almost impossible to find a system that would work. Regulators have acknowledged how difficult their task is, but at the same time, bankers say they would prefer to find a workable solution than have a higher leverage ratio.

“The leverage ratio can be a backstop and as a sanity check is useful,” said one European investment bank chief. “Some national regulators have clearly become too lenient with regard to their own banks, and Basel is concerned.”

Basel officials say they will continue to aggressively push the RWA reform agenda, and they expect to have a plan in place in time for the G20 summit in Brisbane, Australia, which takes place on November 15.