Brazil’s share of equity capital markets activity in the Latin American region has slumped dramatically this year and this trend is likely to continue, as investors turn to markets with lower company valuations than Brazil, say experts.

To view the digital version of this report, please click here.

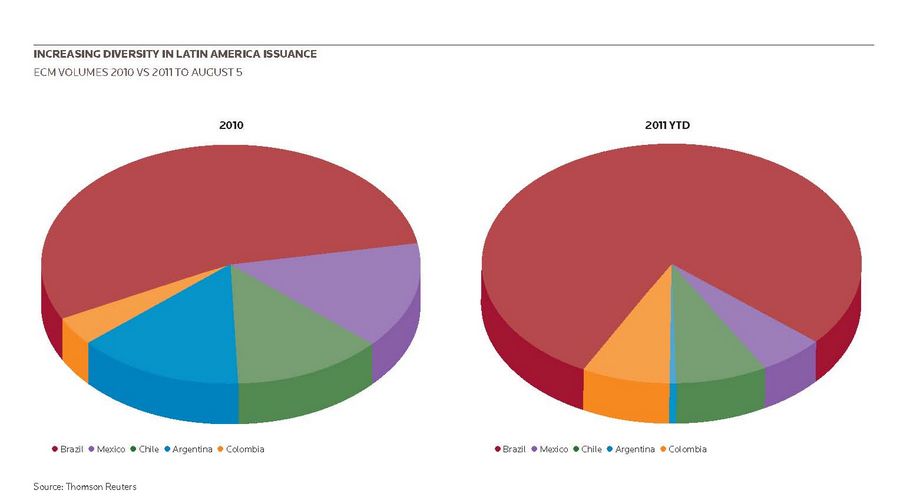

Total ECM volume in Latin America amounted to US$29.9bn for the year to August 5 with a total of 91 deals, according to Thomson Reuters. Brazil made up 54.3% of the total with 44 transactions. It was followed by Mexico, which accounted for 14.6% of the volume with 10 deals, by Argentina with 14.2% (with eight deals) and Chile with 12.6% (16 deals).

However, previously Brazil has accounted for about 80% of the ECM activity in the region. Last year, there were a total of 173 transactions in Latin America adding up to US$71.79bn and Brazil made up 78.6% of the volume (or US$56.4bn) with 94 issues. Chile accounted for 7.8% of the volume last year with 28 deals and Colombia 7.2% with four deals. Brazil peaked in 2008 when it made up 86.7% of all issuance from Latin America.

“The Andean region – especially Chile and Colombia – is becoming much more active,” says Juan Carlos George, managing director and head of equities market for Latin America at Citi. “Brazil remains the number one market but other countries are now becoming more important than before.“

He adds that the Andean region’s allure is highlighted by the fact that it has seen a number of transactions around the US$1bn level this year. “Brazil will pick up again significantly and Chile and Colombia are expected to continue to raise capital to fuel attractive equity stories,“ he adds.

“Chile has been considered a safe haven for a long time and its companies have had the highest valuations on a multiple basis in the region for many years. However, it has strong domestic pension funds and these are able to absorb most of the local issuance.“

Scaling the heights of the Andes

George thinks that the creation of the new Latin American Integrated Market (Mercado Integrado Latinoamericano/Mila) – which is composed of the main stocks from Chile, Colombia and Peru – should help to make the Andean region’s markets – especially the secondary ones – even more dynamic.

Alex Lehmann, head of equity capital markets for Brazil at Deutsche Bank, says: “We are starting to see a significant rise in transactions coming out of other parts of Latin America – especially Colombia, Peru and Argentina. We are also witnessing more internationally distributed deals from Chile. Global market conditions mean that this is a tough time to undertake an equity capital raising, but looking over a three to five-year period, the total size of the Latin American pie is clearly going to expand.

“The region is attracting substantial interest from sovereign wealth funds, private equity groups, hedge funds and family offices from around the world. Traditionally, Brazil has made up about 70%–80% of ECM activity in Latin America; that could slip to about 50%–60% in coming years, as other countries become more significant.¨

Analysts say that overall IPO activity has been disappointing this year and a large number of deals have been shelved or postponed, mostly because of volatility in the international market. At the start of the year, bankers were expecting about 60 IPOs from the region including 40 from Brazil, according to Deutsche Bank. For the year to August 5, only 19 IPOs have taken place, including 11 from Brazil, according to Thomson Reuters. Lehmann estimates that for the remainder of the year the region is likely to see around an additional seven IPOs including five from Brazil but only if market conditions normalise.

“The Andean region – especially Chile and Colombia – is becoming much more active”

Last year’s ECM market in the region was skewed heavily by just one transaction: the follow-on by Petrobras, the semi-public Brazilian oil major, in September which raised a total US$67bn, the biggest share issue in corporate history (this deal is not included in the Thomson Reuters totals). In comparison, the biggest deals out of Brazil this year are the March follow-on by Eletrobras, the power utility company, and the April follow-on by Gerdau, the steel producer, both for US$2.4bn. The Gerdau transaction’s bookrunners were BTG Pactual, Itau USA Securities and Banco do Brasil BBI.

One of the biggest deals in Latin America outside Brazil was the April IPO by Arcos Dorados, the Buenos Aires-headquartered company that controls McDonald’s restaurants in most of Latin America, for US$1.4bn. Bookrunners were Bank of America Merrill Lynch, JP Morgan, Morgan Stanley, Itau BBA and Citi.

In March, Grupo Aval, a Colombian conglomerate with interests in financial activities, including banking, telecommunications and real estate issued Ps2.2trn (US$1.17bn) in preferential, non-voting shares in a follow-on in the local market. The group, which owns Banco de Bogota and Banco Popular, two of Colombia’s most important banks, had originally planned to raise about US$500m but decided to increase the issue after receiving offers for around US$1.7bn. Bookrunners were Corporacion Financiera Colombiana and Corredores Asociados.

In March, AviancaTaca, which operates Colombia’s largest airline by market share, launched an IPO for about US$250m, representing 11.1% of the company’s equity. In January, E-CL, the Chilean power utility company, issued US$1.05bn of stock in a follow-on. Its bookrunners were Larrain Vial and JP Morgan.

At the end of July, Ecopetrol, the Colombian state-owned oil company, said it would sell as much as US$1.41bn of stock in the country’s largest deal in about four years. It planned to sell around 676m shares, representing a 1.67% stake, between July 27 and August 17.

Despite the uncertainty in global markets, Ecopetrol reports that its offer has been well received by investors and the company´s president, Javier Gutiérrez Pemberthy, said on August 11 that it had already received offers for the equivalent of US$750m.

For the year to July 25, nine IPOs and follows had been shelved in Brazil. These include a US$1.7bn IPO by Copersucar, the millers co-operative, and US$510m IPO by Perenco Petroleo e Gas do Brasil Participacoes, a Brazilian subsidiary of Perenco, the French oil exploration company, both planned for July. Issuers postponed the deals because of the steep drop in the Bovespa index and expected valuations.

Slipping below value

Furthermore, most Brazilian transactions that have come to market have been below the original valuation range, including the Gerdau deal and the US$905m IPO by QGEP Participacoes in February. Gerdau was expected to be issued at R$21.30 per share but had an offer price of R$19.25. QGEP Participacoes had a range of R$23–R$29 but was priced at R$19.

“Your take on events in Brazil’s ECM market depends on whether you see the glass half full or half empty,” says Jean-Marc Etlin, head of investment banking at Itau BBA, one of Brazil’s leading investment banks.

“Against the backdrop of higher risk aversion globally, investors are also weighing the start of a new government in Brazil. This has led to a reduction of investor flows into Brazil and consequently for issuers to adjust valuation expectations. Despite all of this, we have already seen some 20 transactions this year.

“There is still a gap between companies’ and markets’ expectations but I think we are seeing companies move a lot closer to the markets. After the recent market sell-of, a fair number of Brazilian companies seem to be reasonably valued given the country’s growth potential.”

“There is still a gap between companies’ and markets’ expectations but I think we are seeing companies move a lot closer to the markets”

Gregg Nabhan, head of Latin American equity capital markets at Bank of America Merrill Lynch, says: “There are some interesting deals taking place in Latin America outside Brazil; we have seen a pick-up in entrepreneurial activity in Argentina, Chile and Colombia, for example. There is also the potential for privatisations in a number of countries but I think you have to be careful in over-stating the importance of other Latin American markets: in reality, the action remains Brazil-centric.

“Currently, the Bovespa is experiencing a significant correction and that is altering the behaviour of issuers and investors alike but you have to make a call on Brazil over the longer term. Many international investment banks have invested heavily in Brazil; they may not witness any immediate dividends but if they are considering a three, five or 10-year perspective, the returns should be meaningful.”

ECM activity in Latin America – especially in Brazil – has dropped significantly this year, mostly because of global markets volatility. The giant South American country still dominates the market but a number of other countries – especially from the Andean region – are becoming more and more important players in the market.

| Global equity capital markets Latam 2010 | |||

|---|---|---|---|

| Bookrunner | No of issues | Proceeds (US$m) | |

| Bank of America Merrill Lynch | 7 | 6,308.40 | |

| Santander | 14 | 5,605.60 | |

| Citi | 6 | 5,325.00 | |

| Itau Unibanco | 14 | 5,044.90 | |

| Banco Bradesco | 8 | 4,244.40 | |

| Total | 71 | 54,569.00 | |

| Source: Thomson Reuters | |||

| Global equity capital markets Latam 2011 | |||

|---|---|---|---|

| Bookrunner | No of issues | Proceeds (US$m) | |

| Itau Unibanco | 21 | 3,544.90 | |

| Banco BTG Pactual | 11 | 2,236.60 | |

| Credit Suisse | 14 | 2,009.20 | |

| Bank of America Merrill Lynch | 8 | 1,568.70 | |

| Banco Bradesco | 7 | 1,385.50 | |

| Total | 47 | 21,592.10 | |

| Source: Thomson Reuters | |||