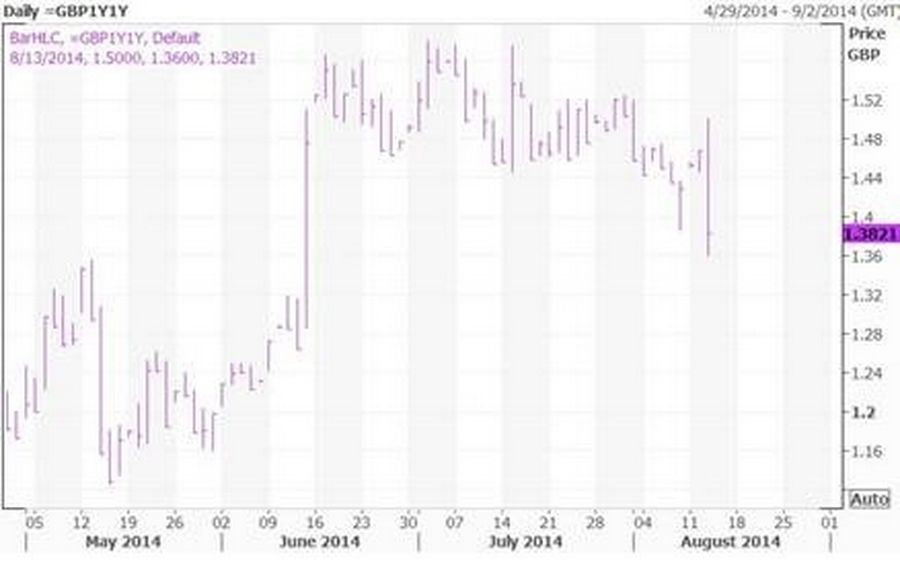

The BoE’s quarterly inflation report has delivered the expected flattening of the money market curve, with 1y1y GBP OIS down 9bps on the day to below 1.40%.

GBP 1y1y spread

What stands out from the QIR is the importance the BoE MPC attaches to wage growth in “assessing inflationary pressures”. While the BoE has fine-tuned its view on slack from a range of between 1% and 1.5% to just 1% it has significantly downgraded its view on wage growth for 2014 and 2015.

The impact on the market of the BoE’s QIR has come via two channels:

1) a lower probability of a rate hike this year and

2) a flattening of the expected tightening cycle.

The latter can be seen in the sharp move lower on 1y1y GBP OIS while the MPC OIS contracts also suggest that the odds of a rate hike in Nov 2014 are below 50% while Feb 2015 is now priced with a 100% probability.

The shift in rate expectations has been helped by the BoE focusing on wage growth to judge inflationary pressures. Wage growth forecast for 2014 has been halved from 2.5% to 1.25% with the estimate for 2015 cut from 3.5% to 3.25%.

The estimate of slack has not so much been lowered but fine-tuned from the uncertainty of a range (1-1.5%) to a point forecast of 1%. The fact that the BoE has underestimated the degree of slack over the past two years and has reduced forecasts on wages suggests that there is likely to be great uncertainly over the 1% forecast.

The fact that the BoE’s own forecasts are made based on market expectations that the first rate hike will happen in Feb 2015 is interesting given that the market had previously been forecasting a strong possibility of a rate hike this year. This seems to be a strong signal that the first rate hike will happen next year and not this year.

We are comfortable maintaining our view that the 1y1y spread between GBP (receive) and USD (pay) will narrow.