The BoJ meeting this week is not expected to see added stimulus via an expansion of its QQE programme.

Let’s put to one side the debate as to how much further the BoJ can continue to impact the price/yield on both government and private sector assets. The ECB meeting last week suggests a growing acceptance from major central banks that the limit for interest rates is lower than thought.

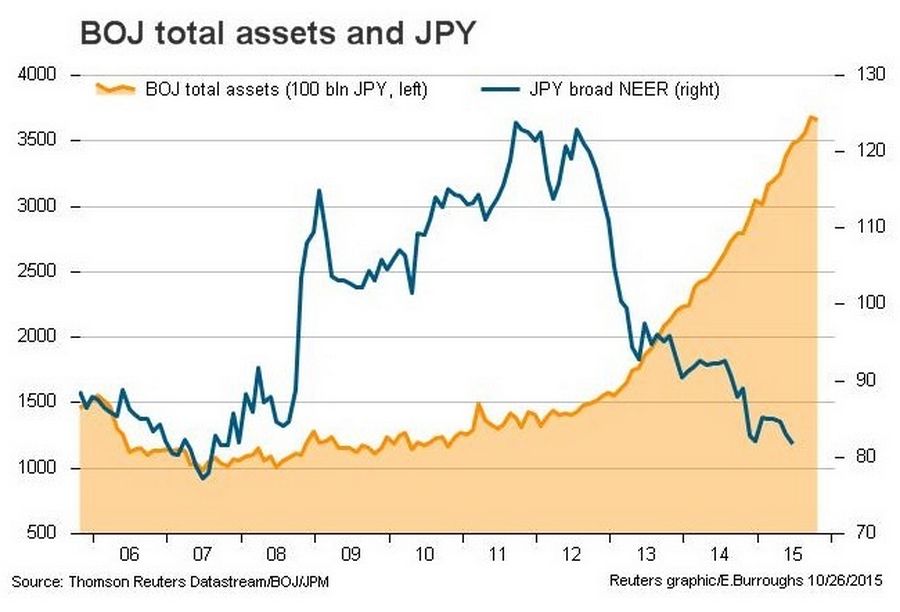

Before the SNB and Riksbank’s more aggressive stance on negative rates, the limit was seen closer to zero. While QE has been an important avenue in impacting the price/yield of domestic assets (via forced asset reallocation and pushing discount rates to zero), the currency impacts are indirect at best.

Negative interest rates could be a much more important vehicle for forcing a weaker exchange rate. We are not there yet in finding the right conditions under which the BoJ would consider negative rates.

For negative interest rates to become a real policy option:

1) the JPY would have to strengthen considerably and/or

2) the BoJ would need to feel that further QQE costs outweigh the benefits.

Currently the BoJ seems to be relying on expected policy divergence between itself and the Fed to keep the JPY NEER biased to the upside: look at comments from PM Abe advisor Hamada saying there was no need to ease policy while market expectations for US rate hike keep the JPY weak.