Since the clean break of a long term trendline on USD/JPY and the NFP inspired boost close to 126, Japanese policymakers have stepped up verbal intervention.

But none have had such a significant impact as those from BoJ Governor Kuroda, who likely has more sway over JPY policy given his stint at the International Division at the MoF (Sakakibara being his predecessor).

While the MoF traditionally has responsibility over the JPY, the market reaction seems to suggest that this may no longer hold given that FinMin Aso is no economic heavyweight.

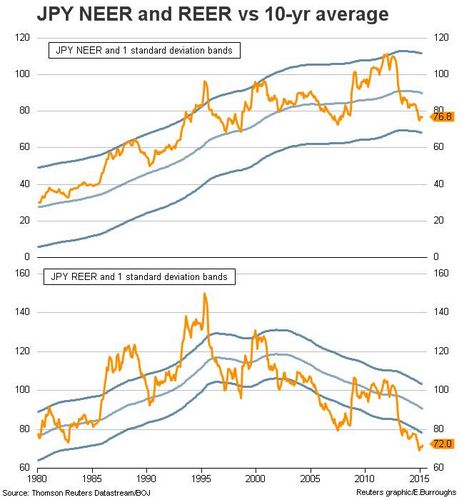

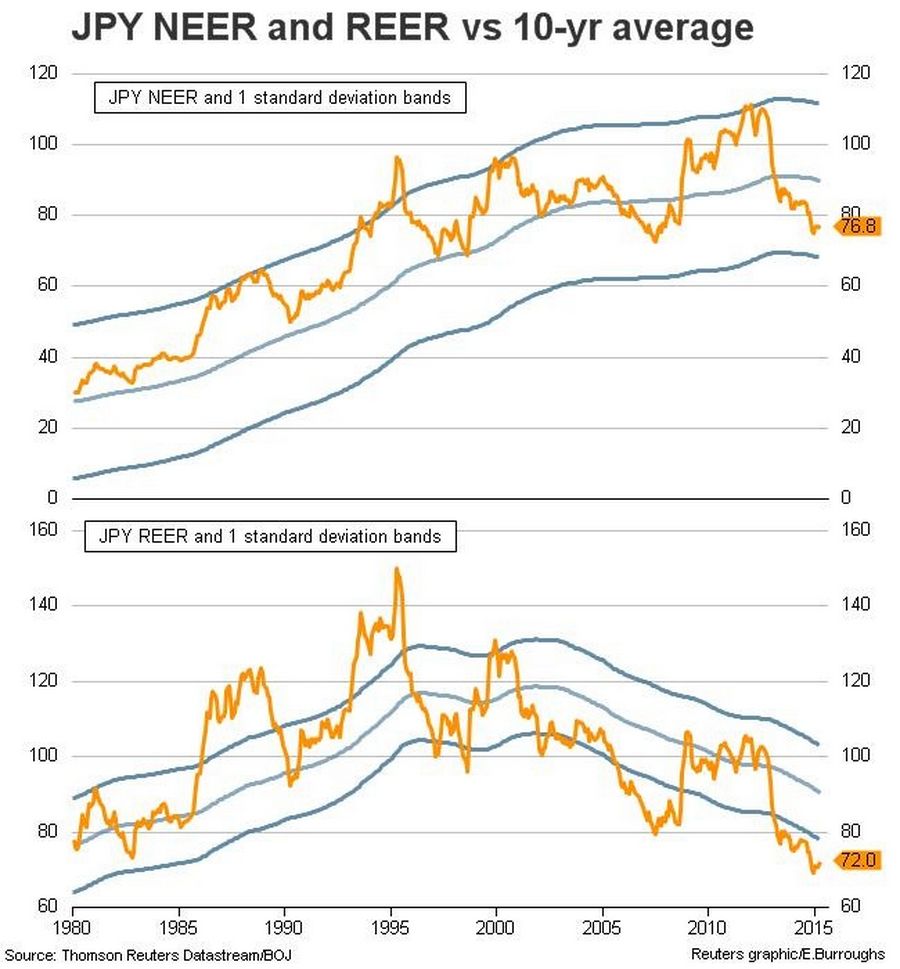

Kuroda focused on the Real Effective Exchange Rate (REER) of the JPY and how, on this basis, it was hard to see it falling further. Other BoJ members have been making similar noises suggesting that they are comfortable with where it currently sits.

At a time when the Japanese government is trying to complete a trade deal via the Trans Pacific Partnership with the US, Tokyo does not want the JPY to become an issue.

Allowing the JPY to weaken excessively could play into the hands of those that feel such a trade deal would hurt US jobs and growth. For Japan, improving its growth outlook with such a trade deal is seen as important to help boost exports and corporate profits.

Given the dismal history of actual and verbal intervention from the MoF/BoJ, the JPY is still biased toward weakness. The sharp drop ahead of quarter-end could help to limit USD/JPY in a 120-125 trading range. But ultimately we think that a USD/JPY visit back above the 125 highs will happen before long.

BoJ