Germany went from being a core ECM market pre-crisis to smaller than some emerging markets as the crisis unfolded. Yet the country has been the source of the most significant deal structuring when firms have needed to replace debt funding. It is also at the forefront of the IPO revival, though with four months of the year done the market may have run out of steam. Owen Wild reports.

In equity capital markets, Germany often disappoints. Volumes frequently track behind the UK and France. And in the past two years there has been another reason for frustration on the part of German bankers: the inherent caution of most companies and banks meant there was far less distressed in the Teutonic nations than seen across Europe. When recapitalisations dominated, there was little for German bankers to do.

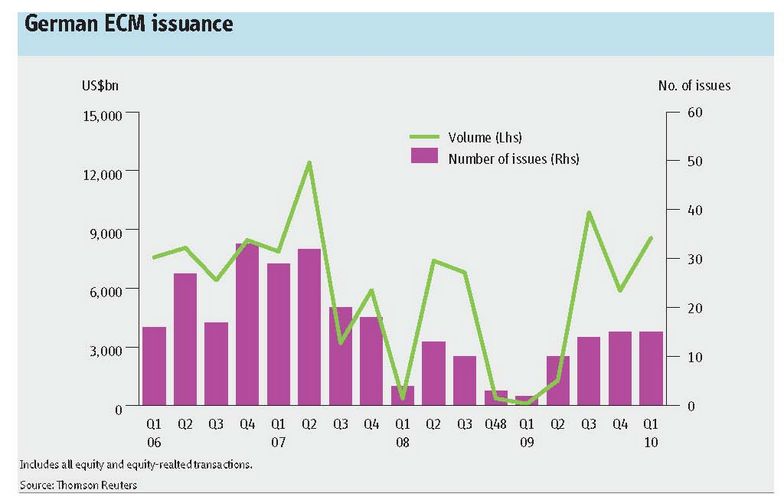

Yet the latter stages of 2009 and the start of 2010 have seen volumes rocket from multi-year lows back to the high times of 2006/2007. This turnaround has been driven by two key factors.

The vast majority of German companies had debt levels that were manageable even during the crisis. As a result, there was not a rush to issue equity. Compared with other European markets, banks also fared well in the crisis. Government support was useful for some, while equity raises totalling €3bn in Q3 2008 from Deutsche Bank and Commerzbank, related to M&A, paled in comparison to just one of the fundraisings by the UK’s Royal Bank of Scotland. Again, there was then little for bankers to deal with.

Where banks have benefited is the large family shareholdings that exist in many major companies in Germany. Similarly, an opportunity arose from stake building that had taken place through equity financing, where loans were secured against the equity bought with the borrowed funds. When equity values collapsed and companies needed an injection of funds, both situations required complicated resolution.

The process that was pioneered with HeidelbergCement by Deutsche Bank and Morgan Stanley saw two companies restructured with a group of more than fifty banks. It was an elegant solution, with all major parties giving up their rights for free and a pre-placing of those rights in an accelerated bookbuild flat to market. The deal raised necessary funds for the company and dealt with the problem of a major shareholder that couldn’t afford to participate while rescuing a company from debt it couldn’t finance.

While the structuring complexity was huge, the deal presented to the market was simple. It was born out of a unique set of circumstances, making the structuring efforts of the lead banks all the more praiseworthy. Yet, twice in 2010 the structure has been adopted by other German companies.

Tyre maker Continental had €13.5bn of loan debt outstanding and moved to refinance €3.5bn of this in late 2009. A forward-start of €2.5bn was secured, but only on the basis that the remaining €1bn was taken out with equity. The challenge was that Schaeffler was not in a position to participate, but did not want to be heavily diluted. Indeed the constraint was put on the banks that the deal could only proceed on the basis that Schaeffler’s 88.9% stake did not fall below 75% - the level that ensures near total control in Germany.

The HeidelbergCement structure was a good fit, even if the circumstances were different. However the certainty required by Schaeffler demanded a tweak in the structure, which led to lost value. Most of the pre-placement of rights was completed as a private placement to ensure the pricing necessary could be achieved. However the reaction of the stock once the private placement was announced proved value had been left on the table. In an effort to regain some ground the remaining rights, that had been due to be offered at the same price, were priced much higher – leading to anger at the discount given to favoured accounts. The change also failed to recompense Schaeffler: German law meant the extra funds raised went to Continental, meaning that company raised more than it needed while Schaeffler was diluted more than necessary.

Yet only two weeks into the year and Germany had already seen a €1.1bn issue. In one trade, volume for the first quarter was guaranteed to be higher than the three quarters Q4 2008-Q2 2009.

The structure was employed for the third time in 12 months when Volkswagen needed to raise funds, but major shareholder Porsche was not in a position to participate. This made for the greatest test yet of the structure, with a deal size of €4.2bn to be placed in three days. By abandoning the private placement employed by Continental, the deal was another huge success and provided another boost to volume and bank revenues.

Dominating Europe…

In the first quarter of 2009, Germany lagged behind not only the UK and France, but also minor countries, in an ECM sense, like Sweden, Spain, Denmark and Kazakhstan. The turnaround in 2010 is stark. The first quarter saw Germany move to the top of the league with volume of US$8.5bn, displacing even the UK where volume totalled under US$8bn from nearly five times more deals.

The chart of all German ECM volume, equity and equity-linked, shows how tightly linked activity is to the IPO market, and the dramatic drop in volume from the highs of 2006-2007 to low double digits in the following period.

Germany has unsurprisingly been at the forefront of reopening the IPO market in late 2009 and early 2010, with mixed success. The attempt to float diverse infrastructure firm Hochtief Concessions in a €1bn spin-off in December was an initial blow after the deal flopped and was cancelled at the end of bookbuilding having failed to generate substantial demand.

Yet the pipeline of major deals was robust. In the first quarter, cable company Kabel Deutschland and chemicals firm Brenntag both debuted. Kabel Deutschland completed its €600m IPO in March with pricing coming near the low end of the €21.50-€25.50 range at €22. The book was well allocated, with limited trading when the stock debuted and little price movement. The greenshoe was exercised shortly afterwards and this did cause a dramatic drop in the share price to below €21, but it recovered nearly as quickly to trade back above issue.

The Brenntag IPO was just shy of €750m once the greenshoe was exercised, drawing a strong response from both domestic and international investors. Bankers reported seeing orders from more than 300 of the 400-500 accounts seen during the process.

The response was positive partly because the pricing offered a substantial discount to peers. An initial jump of 10% in trading provided momentum investors with an opportunity to make a quick profit, yet still provide room for further value growth. The worry from bankers is that since then the shares have fallen back to €53-€54 in mid-April against an issue price of €50.

“Investors still need to be convinced to look at a company on its merits. Right now they look for a peer, often the lowest valued, and then apply a big discount to set what they will pay,” said one head of German ECM. “For all its merits Brenntag is still trading at a double digit discount to its peers.”

Part of the problem in the aftermarket is that BC Partners retains a large stake and did not sell as much as hoped in the IPO, so an overhang exists until BC can sell six months after the debut, he explained.

…Albeit briefly

So with the IPO market stabilising Germany should be building momentum. Yet the flow in Q1 has been so significant that the pipeline has been exhausted. Most of the largest deals of recent months have come out of Germany. The work involved in those large transactions means that many banks now have to rebuild their pipelines. Other large transactions like Porsche’s capital increase, a Deutsche Bahn IPO, and the lingering IPO for insurer Talanx are all now seen as 2011 deals at best.

The focus should therefore switch to the Mittelstand and the small and mid-cap floats. But bankers suggest any more than a handful of IPOs is unlikely.

“The Mittelstand has never really happened for ECM,” said the head of German ECM. “There are lots of prospects and some look to an IPO, but frequently they are not comfortable as public companies.”

Access to bank loans is very good for them, and even if liquidity dropped in the German bank market and they looked for a capital markets solution, they are more likely to do a high-yield bond, he said.

Another German ECM head agreed: “I’m not sure there is an incentive to come to market right now. Trading is at healthy levels, but it is still not a market for new issues as you can’t price close to fair value.” Issuance could be strong from financials looking to repay the government for assistance, he said, but the government focus on stable markets means this could be pushed to late 2010 or 2011.

However few are glum at the thought that the bulk of the year’s activity is already done. “2009 was a fabulous ECM year in Germany with all those rights issue fees, and we have all done well already this year,” said one banker.