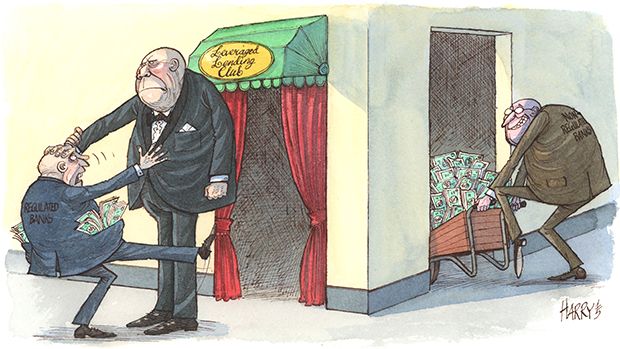

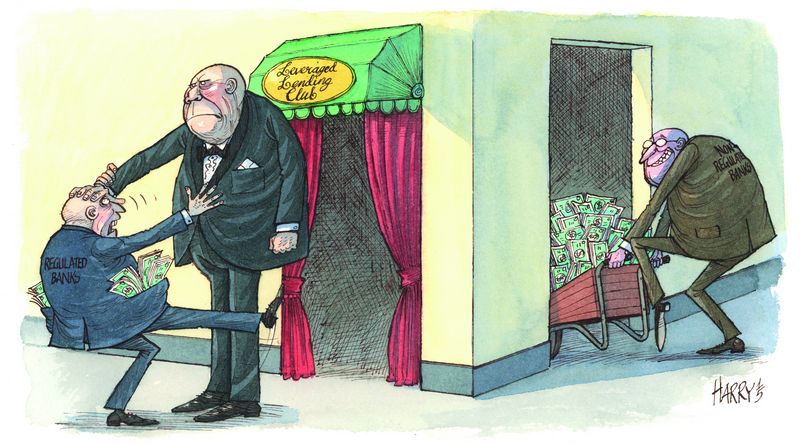

Guidelines issued by the Fed, designed to limit leverage and reduce systemic risk, have made it harder for banks to compete in the leveraged lending business in the US. But while the leaders in the business have lost market share this year, lending remains healthy, with those borrowers looking for leverage able to find other options.

It is common practice, investment manager Neuberger Berman wrote in a client note, to use protective wrap when shipping fragile items. “Regulators have similarly tried to employ regulations to shield investors from a bubble in the US credit market,” it said.

In 2013, regulators provided guidance that said leveraged loans should use pro-forma leverage of no more than six times, as measured by total debt/Ebitda; and have the ability to fully amortise secured debt or repay 50% of the total debt over a five to seven-year horizon.

It was not until September 2014, when the Fed asked one bank to immediately address problems relating to its underwriting and sale of leveraged loans, that its guidance had the desired impact on the market. According to Barclays, the share of the market made up by loans with leverage exceeding seven times fell from 20.7% to 15.4% over the last three quarters of 2014. There has been a concomitant drop in bank participation in the leveraged loan market.

The guidelines, which are in effect regulations, are intended to reverse a perceived deterioration in underwriting standards. They apply to US depository institutions and federal branches of foreign banks in the US.

David Sharp, head of loan capital markets and syndicate in the US at Societe Generale, said: “The guidelines are similar to what we have always done when assessing a borrower’s ability to repay and delever over the course of a loan. Before then there was a bit more scope for nuance; some sectors might have a higher capacity for leverage, for example, where now we cannot always make that judgement.”

This is, he admitted, a subtle difference. Usually it isn’t even a factor. He added: “On the vast majority of credit profiles we already viewed leverage in a similar way to how the Fed looks at it.”

A weakening grip

What is certainly clear, though, is that total issuance of leveraged loans in the US in 2015 has fallen significantly. In the period to mid-October 2015 total volume was US$652bn, according to Thomson Reuters, markedly down on the US$922m recorded at the same point the previous year.

And while the biggest banks still dominate the league tables for leveraged loans, their grip on the business has been weakened considerably. Bank of America Merrill Lynch remained in top spot in 2015 as at mid-October, as it was at the same point of 2014, according to Thomson Reuters data.

But whereas a year ago it had arranged deals worth US$101.4bn, this year that has fallen to just under US$56.5bn, with its market share dropping from 11% to 8.7%. JP Morgan and Wells Fargo, in second and third places respectively both this year and last, saw similar declines, from US$79.3bn to US$40.7bn, and US$67.8bn to US$39.8bn, respectively.

The new guidelines are not the only explanation for this trend. The increased cost of capital has forced many banks to step back from a lot of businesses. Many banks may therefore have scaled back their activity in this area even without the guidelines.

Economic conditions have also played an important part. Sharp said: “In 2014, we saw a lot of refinancing, repricings, dividend recapitalisations and other opportunistic deals. These deals inflated the new-issue numbers. This year, spreads have been flat or a little up, so the rationale for those opportunistic deals has not been there, leading to a large drop in that category of new issuance.”

If that opportunistic element is excluded, he said, the decline has not been as significant as it initially appears.

For those borrowers that have been unable to access bank financing this year, there have been two options. The capital markets are the preferred choice where they are available, offering cheaper financing, for longer durations, with a fixed coupon. There was an uptick in high-yield bond issuance in the first half of 2015, which can at least partly be explained by the diversion of flows from loans into bonds.

Yet this market has also been affected by the new guidelines – even if the impact has been less marked. The guidelines apply to debt in its totality, whereas in the past often banks looked primarily at senior secured debt leverage, said Arnaud Achour, head of high-yield capital markets for the Americas at SG.

“So the high-yield bond market this year might not have seen the kind of supply we could have expected from LBOs or highly levered corporates,” he added.

But it is hard, said Achour, to measure the impact of the guidelines versus general market circumstances.

“Sectors that are traditionally prolific in HY such as energy, metals and mining and even TMT to some extent, have all been under pressure this year,” he said.

This he attributes in large part to macroeconomic considerations such as speculation around the Fed hike, China, oil and gas or commodity record low prices.

March of the leveraged funds

For those without access to the capital markets, non-bank lenders, principally private equity companies and hedge funds, have stepped in to fill the vacuum. Many such cash-rich funds are buying up debt at deep discounts and offering liquidity to businesses they believe can turn things around. Financing is likely to be more expensive and funds will often require an equity stake in the businesses they invest in.

Sandy Brown, a partner at Bracewell & Giuliani in Texas, said: “Hedge and private equity funds are willing to take more risk, offering less stringent covenants and longer-term financing, for example. The pricing on offer is similar to what the banks were offering last year, but cannot offer this year.”

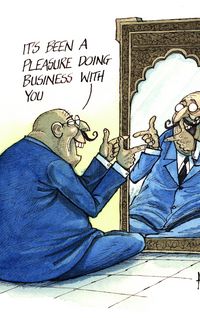

And it is not just deals that the new guidelines are helping fund managers win from banks. Top talent – both experienced executives and youthful graduates – is increasingly gravitating to the buyside, instead of banks. This is thanks, at least in part, to a perception that banks are becoming increasingly constricted by meddlesome rules.

“This is going to increase the draining of talent away from commercial banks towards non-bank institutions,” said Brown. “There are regular reports of top executives leaving the big banks and this is happening with employees at every level. People are concluding that the rewards – and the fun – are just not on offer at the banks anymore.”

Yet there is no indication that leveraged borrowers are finding it significantly harder to secure financing than they were under the old rules, said Magnus Wilson-Webb, a managing director in BNY Mellon’s corporate trust group.

“But we have been experiencing a relatively benign credit environment, so things may look a little different when that changes,” he added.

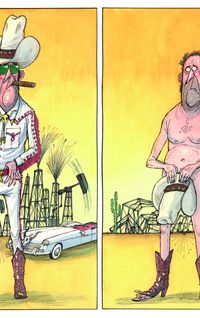

Of course, many leveraged borrowers are under considerable pressure. But this is not being noticeably aggravated by the new rules imposed on the banks. Upstream energy companies, for example, are struggling under high levels of debt as the impact of cheaper oil strangles their finances. Arranging high-yield deals for such companies has become increasingly difficult.

Changing environment

Rising rates in the US in 2016 will also have an impact. Loans usually have floating rates that tend to be more attractive in periods of rising rates and many have Libor floors of 1%, so they will be insulated from the first few rate rises. When rates do start to rise, demand for loans may therefore increase and it will be interesting to see if non-bank players can meet demand.

Yet the prospect of rising rates is unlikely to undermine activity in the high-yield bond market, said Wilson-Webb. “As long as there is no big increase in market volatility I expect to see increasing activity in the high-yield bond market in coming months, with the exception of commodity-sensitive borrowers,” he said.

“As long as there is no big increase in market volatility I expect to see increasing activity in the high-yield bond market in coming months, with the exception of commodity-sensitive borrowers”

As long as borrowers can still access capital and the economy keeps growing, the Fed is unlikely to see any cause for concern.

“Regulators are always weighing up market stability on one hand and access to capital on the other. It can be a delicate balancing act and if in coming months it appears it has stifled access to the market, we could see some changes to the rules,” said Wilson-Webb. For now, the Fed will congratulate itself on reducing leverage in the banking system, without choking off financing for borrowers.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .

<object id="__symantecPKIClientMessenger" style="display: none;" data-extension-version="0.4.0.129" data-install-updates-user-configuration="true"></object>

<object id="__symantecPKIClientMessenger" style="display: none;" data-install-updates-user-configuration="true" data-extension-version="0.4.0.129"></object>