The latest record low Bund yield has been accompanied by post-EMU or record yields for the semi-core (France, Netherlands, Austria, Finland and Belgium) as well as peripheral countries (Italy, Spain and Ireland).

While some might fret that the Draghi inspired “whatever it takes” eurozone bond market rally has extended too far and is entering bubble territory, note that the market has not lost all linkages with risk.

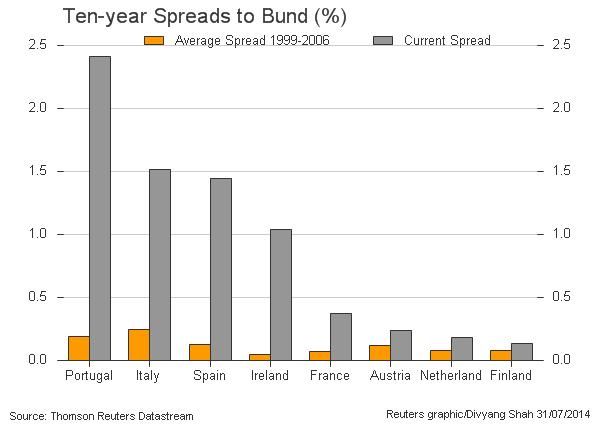

The 10-year spread to Bunds shows that there is still a relative pricing of risk between eurozone countries.

While 10-year peripheral spreads trades wider than the semi-core both of these groupings are trading sharply wider than the post-EMU spread average between 1999–2006 (see chart). With the yield on 10-year Bunds at a historic lows yield hungry investors are forced to move further down the risk spectrum but it’s hard to describe current valuations as excessive.

The fact that peripheral spreads to Bunds have not yet returned to their pre-crisis lows highlights that valuations are not yet at an extreme. The uncertainty is over where exactly the new equilibrium on peripheral yields sits in order for the market to more appropriately price the fiscal debt/deficit risks.

The risk is that overly generous ECB liquidity operations starting with the first TLTRO in September will further stretch valuations.