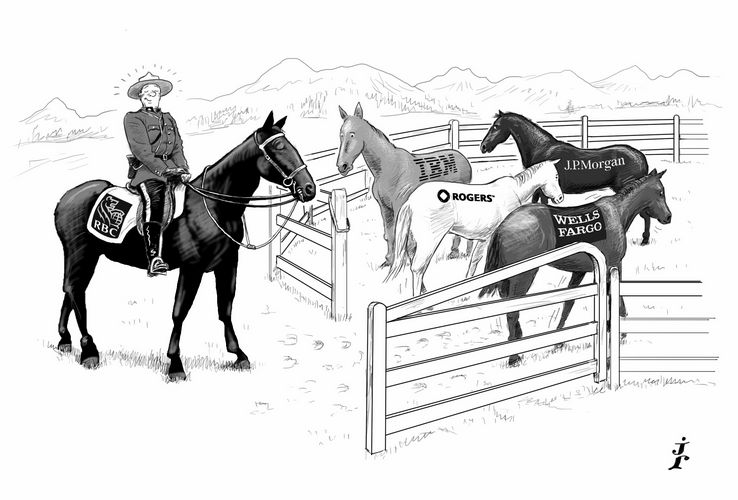

High and mighty: Only a few banks in the world can boast the kind of single-market domination that RBC Capital Markets has demonstrated in Canada. For its unmatched ability to open and reopen funding avenues and for further developing the country’s debt markets, RBC Capital Markets is IFR’s Canada Bond House of the Year.

To see the full digital edition of the IFR Americas Review of the Year, please click here.

As the European crisis and the slowing US economy have created some market volatility in 2012, banks with strong distribution capabilities and an ability to provide cost-effective solutions were preferred by clients.

With a well developed cross-border debt platform comprising research, origination and execution capabilities across both investment-grade and high-yield debt, RBC Capital Markets was able to meet those demands, continuing to excel even in the face of growing competition from an array of banks looking to grab a share of the Canadian bond market.

“Against the backdrop of an intensifying competitive environment and limited corporate supply, in 2012 RBC was able to expand our leadership margin over our competitors through sound client advice and execution prowess,” said Chris Seip, RBC’s head of DCM, Canada.

“We continued to innovate and were product-agnostic [and] that enabled our dominance in the Canadian bond markets across a number of products.”

The bank topped the Thomson Reuters league tables for the awards period, leading 115 deals for C$35.7bn (US$36bn) for a market share of 23.1%. Second-placed National Bank of Canada led deals for C$27.03bn for a market share of 17.5%, reflecting RBC’s reign over the market.

In the previous year, RBC had a market share of 23.3%, leading 127 deals for C$39.08bn, with TD Securities placed second with 98 deals and 18.7% market share for C$31.3bn.

But it was not just the numbers that reflected another dominant year for the bank; it was also the ability to identify and capitalise on key themes and evolving market dynamics.

Big in FIG

RBC was the leading dealer in the FIG sector and had a role on the largest financings of the year.

The bank was joint bookrunner on the Wells Fargo Canada Corp C$1.5bn 2.774% medium-term notes due February 9 2017 – the second-largest single tranche deal ever in the Canadian market, and the 11th-largest offering ever, including multi-tranche deals.

Books were significantly oversubscribed – up to C$2.8bn – and there was broad distribution, with allocation across 71 accounts, including 11 new buyers.

Wells followed that with another C$1.5bn seven-year deal in July that attracted 83 unique buyers, including 48 who participated in the February offering as well as 12 new buyers. The allocation represented the second-largest seven-year buyer count and the fourth largest ever in Canada.

The 2.994% coupon paid on the transaction represented the lowest coupon ever in the seven-year tenor in the Canadian market.

Similarly, in May, the bank was joint bookrunner for a C$1.1bn dual-tranche offering from Rogers Communications that achieved coupons of 3% and 4% for the five and 10-year tranches – the lowest ever paid in the Canadian market by a Communications, Media and Technology sector issuer for those tenors. They were the second-lowest coupons ever paid in the Triple B rating space in Canada in the five and 10-year part of the curve.

Indeed, low cost borrowing was one of the themes of the year for RBC. Its clients featured in more than half of the transactions among the top 20 record-low coupons in 2012.

With such transactions, the bank helped open significant funding avenues for other issuers. RBC’s lead role in the Wells transactions ensured other prominent FIG issuers were interested in getting into the Canadian bond market. One example was JP Morgan, which hired RBC as a joint bookrunner for a foray into the Canadian dollar market that raised C$1.25bn from a five-year senior note in September.

It was the first Canadian dollar senior offering from JP Morgan, which had last printed a sub debt deal in February 2006. It was also the first Maple bank offering of 2012 and the largest Maple offering since February 2007.

The order book on the transaction was the largest for any single tranche Maple and had the largest number of buyers for any single tranche Maple offering.

RBC again demonstrated strong distribution skills in this transaction, which was distributed across 76 investors.

“The Maple market made a strong comeback in 2012 helped by limited domestic supply, demand for diversification and yield appetite in the context of the low rate environment,” Seip said.

“We dominated that space, with almost two-thirds of all Maple offerings in 2012 featuring RBC as a bookrunner.”

The bank was on other key deals in the Maple market, including a C$500m five-year offering from IBM in February and deals for National Grid Electricity Transmission and Australian toll road operator Transurban.

National Grid’s C$750m five-year in September was the largest corporate Maple ever, as well as the second-largest Maple of all time.

The debut deal was a huge success, in part thanks to a cross country three-day roadshow that comprised group lunches in Toronto, Winnipeg and Montreal, a national investor conference call and one-on-one meetings.

The National Grid deal was almost twice covered, allowing the issuer to increase the deal size from a minimum C$400m at launch. The offering was placed with 47 investors, and about C$8m was sold to buyers outside Canada.

Not just high-grade

RBC also dominated the small but increasingly significant Canadian high-yield market. It was a joint bookrunner on the Russel Metals (Ba1) debut Canadian high-yield offering of C$300m 6% 2022s. The deal was increased in size from C$250m at launch, helped by demand from over 60 institutional investors, while order books were 2.5 times covered. The order book comprised over 15 US accounts, which can be viewed as reflective of RBC’s growing cross-border distribution capabilities.

Over and above the ability to execute deals, the bank’s ability to spot and seize trends during the year also won it a few interesting mandates.

“Strong demand for long and ultra-long product from insurance companies on the back of liability-driven investing requirements, and the historically low rate environment, drove an influx of ultra-long [40-and 50-year] supply,” said Seip. “And we were a pre-eminent dealer in that space.”

He said the bank was able to capitalise on significant insights into niche appetite as well as unique pricing dynamics for ultra-long products to provide attractive funding opportunities.

RBC was sole bookrunner on Hydro One’s C$235m reopening of its 50-year issue in August. The reopening was in response to several reverse enquiries on the back of an original C$75m offering completed in late July. The total size of C$310m represented the largest ultra-long amount outstanding in the Canadian corporate market.

Another reflection of the bank’s wide reach across products was that the bank acted as joint lead on five out of six Canada mortgage bond transactions in 2012, including a C$5.5bn CMB from Canada Housing Trust – the largest by the trust this year and yet another sign of RBC’s comprehensive performance in the Canadian bond markets in 2012.