North stars: In an unusually consolidated market, one bank has managed to separate itself from the competition – not because of the size of its balance sheet, but thanks to its overall investment banking platform. For consistent success in leading large transactions for key clients, BMO Capital Markets is IFR’s Canada Equity House of the Year.

To see the full digital edition of the IFR Americas Review of the Year, please click here.

Canadian banks have their own way of doing business and little regard for hyper-competitiveness that can be typical in other jurisdictions. The strength of their balance sheets allowed the industry to emerge relatively unscathed from the credit crisis and take advantage of disruptions among foreign rivals.

BMO Capital Markets, the investment banking arm of Bank of Montreal, is the latest to stake a claim to the US, hiring originators across select industry verticals and enhancing its sales and trading and research capabilities. Reflective of its Canadian heritage, the bank has a focused strategy around its US build-out that is measured and rooted in profitability.

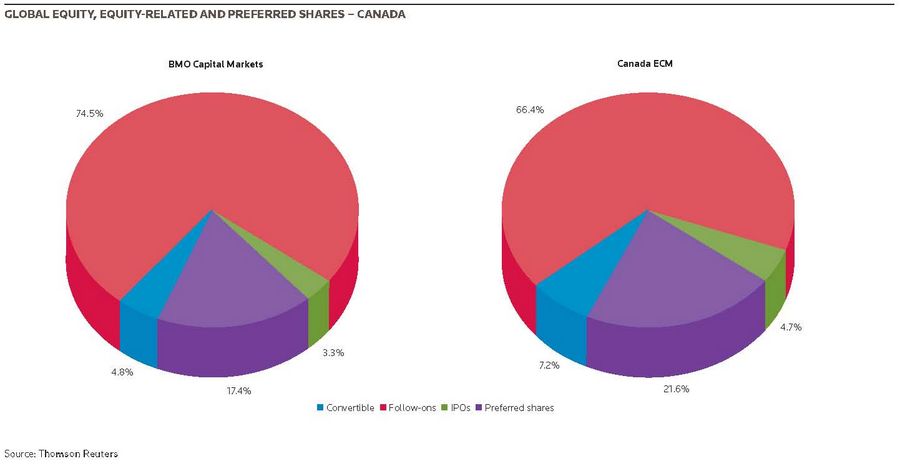

Still, the prowess of BMO’s investment banking operations is Canada, where it made impressive gains in ECM underwriting volumes both on an absolute and relative basis. The bank led 36 stock offerings that raised C$4.6bn (US$4.6bn) in the awards year, up from C$2.9bn in the previous year, increasing its market share from 8.7% to 15.8% and trailing only Scotiabank and RBC Capital Markets.

Instrumental to that success was repeat business from key investment banking clientele.

Gibson Energy, a midstream energy company, Cominar Real Estate Investment Trust and Crescent Point Energy, an E&P, all turned to BMO to lead multiple important equity financings throughout 2012.

That repeat business was a key differentiating factor in a year of relatively light equity volumes that saw issuance (excluding preferred share offerings) fall to C$29.2bn from C$32.8bn in 2011. The decline is traceable to the impact commodity price drops have on activity in the mining sector and is also the result of a lack of large IPOs.

Gibson Energy went public in mid-2011 and has since undertaken four bought deal equity financings with BMO hired as lead or co-lead on all of its offerings. The offerings, which occurred at successively higher stock prices, helped fund acquisitions and allowed Gibson’s energy-focused private equity sponsor Riverstone to fully exit its position within nine months of the IPO.

BMO also led, alongside National Bank Financial, a succession of bought deals for Cominar Real Estate Investment Trust, the third-largest diversified real estate investment trust in Canada and the largest commercial property owner in the province of Quebec. It was a fine example of integrated investment banking.

The firm had already been advising Cominar on its acquisition of Canmarc REIT when it joint bookran a C$144m bought deal in December 2011 and then followed it up by working on another C$202m offering in February – both while the takeover was still in process. BMO was bookrunner on two more offerings for Cominar, in May and August, taking aggregate proceeds from the offerings to C$807m.

Perhaps the crowning achievement in terms of repeat bookrun activity for BMO was its intimate involvement with Crescent Point Energy, for which it led three follow-ons over the course of 2012, raising a total of nearly C$2bn. The deals highlighted BMO’s cross-border capabilities, particularly in the most recent transaction that saw Crescent Point raise C$750m to fund the acquisition of Utah-focused oil and gas producer Ute Energy Upstream Holdings.

Separating from the pack

One of the most distinctive features of Canadian capital markets is the overwhelming dominance of its local banks. Bulge-bracket banks in the US and elsewhere have made limited inroads into the country and, realistically, are likely to find it difficult to ever do so.

Partly that reflects the nature of the Canadian market, with its heavy focus on capital-intensive sectors like energy, mining, and real estate. The heavy borrowing needs of such clients place significant emphasis on lending relationships and the relative stability of Canada’s “big five” banks: Royal Bank of Canada (RBC Capital Markets), Toronto-Dominion Bank (TD Securities), Bank of Nova Scotia (Scotiabank), Bank of Montreal (BMO Capital Markets) and Canadian Imperial Bank of Commerce (CIBC World Markets).

Combined, the five banks had a hand in roughly 70% of the equity volumes in 2012 – the biggest contribution from a foreign bank came from Morgan Stanley and its participation on four deals totalling C$475.3m, a 1.6% share. The top five banks of US issuance, by comparison, account for 55.4% of equity underwriting volumes.

“We are actually handicapped [when it comes to] winning deals [by] our credit,” said the firm’s Canadian head of ECM, Peter Miller. “RBC is the big dog along with TD and Scotiabank. We have to win business on just pure investment banking. Our sales and trading and research are what really differentiate us … not writing a cheque for loans.”

Contributing to the league table consolidation is the standard practice of capital-committed transactions placed on an overnight basis. Some 90% of follow-on issuance comes in the form of bought deals via one or two institutions with the risk subsequently sub-syndicated to a much broader underwriting group. In addition to an agreed upon offer price to the public, the purchase price is standardised at a further 4% discount.

Rarely, if ever, is a single institution forced to absorb a meaningful loss.

One differentiating factor is IPOs. Although Canadian IPO volumes were scant in 2012, totalling just C$1.9bn, BMO managed to distinguish itself by participating in three of the 13 IPOs last year. The effort was highlighted by a lead-left position in October on the C$300m IPO of IvanPlats, the African metals and mining play of magnate Robert Friedland.

And while outside the consideration period, the bank also played a key role in underwriting the C$365m IPO of Hudson’s Bay Company on November 19. Considered a Canadian icon, the retailer’s IPO proved a difficult exercise that tested the combined distribution channels of the entire underwriting syndicate.

Looking to the future, BMO’s Miller sees a role for a new and somewhat controversial breed of foreign asset income trusts, a yield-oriented product carved out of provisions of 2006 legislation that effectively abolished the popular Canadian royalty income trust. While FAIT underwriting largely has been limited to US-domiciled E&Ps with small reserve bases, the structure may have applicability to foreign infrastructure projects (solar, wind farms) that offer a more stable long-term cashflow profile.

“There’s nothing wrong with the structure and the concept [but] the challenge is finding the quality and thus far in my opinion that hasn’t been there,” he said. “Canadian investors are not suckers. So when you come with something from the US they are going to ask: why are you coming to Canada?”

South of the border

One of the more notable developments for BMO was its continued expansion into the US. Although it has long had a presence south of the border, the bank made a concerted effort to take advantage of the job-shedding by bulge-bracket banks to expand its investment banking practice.

In January 2012, the bank nabbed former Morgan Stanley banker Michael Cippoletti to head US ECM, oversee the build-out and focus on natural resources and business services. Among his more recent hires are Michael Anderson, from Jefferies, to head FIG and industrials origination and Deutsche Bank veteran Steven Tuch to focus on healthcare, technology and private placements. Along with BMO veteran Phil Winiecki (consumer and real estate), the four managing directors provide origination capabilities across eight industry verticals.

“We are not trying to break into IBM,” said US investment banking head Perry Hoffmeister, referring to the firm’s focus on companies with market capitalisation of between US$200m–$5bn. “This mid-cap space is a very vibrant space.”