Divyang Shah

IFR Senior Strategist

The strength of the UK economy has surprised the BoE to such an extent that they now expect the unemployment threshold of 7% to be hit much earlier than its August forecast of Q3-2016.

How much earlier depends upon the assumption made on interest rates. Attempts at defending forward guidance in the face of strong growth and faster take up of economic slack continue to fall on deaf ears with markets finding it difficult to believe that rates will stay lower for longer.

In the space of three months the BoE has been forced into shifting its stance closer to that of financial markets on the speed at which unemployment will hit 7%. The BoE now sees unemployment hitting 7%:

1) 12-months earlier if based on market interest rates, and

2) some 18-months earlier if based on constant interest rates.

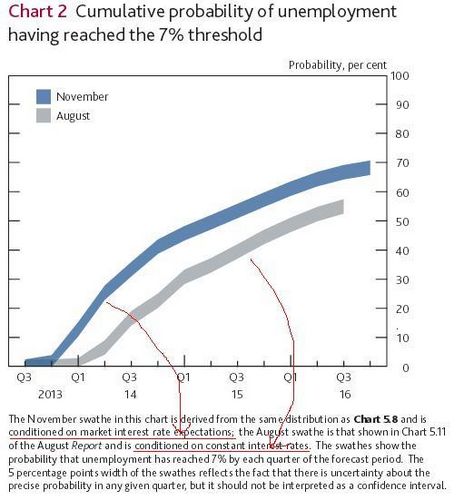

In its ribbon chart on the cumulative probability of unemployment hitting 7% the BoE attempts to deliver a softer message by not making an apples-to-apples comparison.

Take a look at the footnote to see how comparing the two forecasts is deceptive. Essentially, the unemployment threshold would have been forecast to have been breached much sooner had the updated chart used the same assumption of constant interest rates as had been done in August.

Clutching at straws

Market pricing continues to point toward a hike in early 2015 while the BoE still wants us to believe that it will leave rates on hold if unemployment hits 7%. The BoE is clutching at straws to convince us that the better unemployment outlook does not equate to an earlier tightening of policy. Just as the BoE underestimated the extent of slowdown during the financial crisis it is now at risk of underestimating the recovery which is being aided by a strong upturn in the housing market.

More forceful measures such as lowering the threshold for unemployment to 6.5% or 6.0% seem unlikely at this stage but could become more viable options as unemployment gets closer to 7%. The BoE is likely to keep an eye on what the Fed does with its unemployment threshold before taking any bold steps of its own in reducing the unemployment threshold.

Unlike the US labour market the UK labour market is seeing a falling unemployment rate accompanied by an increase in the participation rate.