Australia’s capital markets community is reviewing its approach to equity offerings after the competition watchdog filed criminal charges over alleged cartel behaviour following a 2015 share placement.

The Australian Competition and Consumer Commission said last Tuesday that federal prosecutors had charged issuer Australia and New Zealand Banking Group, underwriters Citigroup and Deutsche Bank, as well as six current and former bankers, including the former country heads of Citigroup and Deutsche.

JP Morgan, the third underwriter on the deal, is alleged to have been granted immunity from prosecution after reporting the case to the regulator. The bank declined to comment.

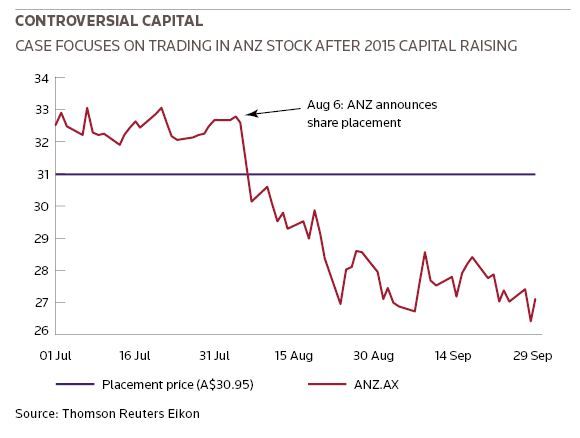

The case centres around 25.5m ANZ shares that were left unsold in the bank’s A$2.5bn (then US$1.84bn) institutional share placement in August 2015.

The Commonwealth Director of Public Prosecutions is expected to allege that the two underwriters and ANZ engaged in cartel arrangements relating to the trading of those shares. Its case is understood to hinge in part on a videoconference call in which bankers discussed how to coordinate the disposal of the outstanding stock. Further details are expected when the case is heard in Sydney’s Downing district court on July 3.

Cartel charges are unprecedented in a capital raising, making the ACCC’s move an important precedent that could have major ramifications for the world’s capital markets.

“If the competition regulator is using this as a test case it could create problems for a lot of other institutions,” said Neil Jeans, a financial crime consultant with Initialism in Melbourne.

“Is it widespread? It wouldn’t surprise me one bit. The question now is: Could this become the next Libor?”

One head of Australian equity capital markets said bankers were “aghast” that the practice has become a competition issue.

“Ultimately, underwriters aim to minimise the market impact and standard practice is, if you’re left with residual shares after a placement, it’s in everyone’s interests – the shareholders, the issuer, everyone – to dispose of this in an orderly way.”

Other bankers warned that the prosecutor’s decision to charge bankers would affect how follow-on offerings are handled in future.

“One possibility is that banks will only be willing to act as sole underwriter,” said one Sydney-based ECM banker.

“Another possible consequence is that all deals will be priced with very little prospect of a shortfall.”

An end to joint underwriting could limit the size of equity raisings that are possible in Australia, and potentially raise the cost of capital for Australian companies. But bankers stressed that they would continue to offer the full range of products.

“Everyone is waiting to see what the basis of the case is, although banks will take a super-conservative approach until then,” said the second ECM banker.

BOMBSHELL

The CDPP is expected to argue that the underwriters breached anti-cartel rules by controlling the output or limiting the amount of goods and services under the Competition and Consumer Act.

Under legislation passed in 2009, criminal sanctions can be levelled in cases of cartel conduct. So far, there have been only three criminal prosecutions under that statute.

The banks are fighting the charges on the basis that it is standard practice for syndicate members to work together on any capital raising.

They are expected to argue in court that Australian law does not make it clear when the syndicate “breaks”, the point at which cooperation between joint underwriters is no longer allowed, and could be defined as cartel behaviour.

“The nature of most underwriting agreements is there is a carve-out that says you’re cooperating, but it’s not clear when you’re freed from those shackles,” said one Sydney-based lawyer.

“From a market practice perspective, nobody ever even considered this. This is a bombshell. I suppose bankers get paid danger money for what they do, but it’s a shame this has blown up in their faces.”

Jeans at Initialism, however, cautioned that the case would define whether standard market practice was in fact acceptable conduct.

“In Libor their defence was that this was ‘normal market practice’. That turned out to be a fairly flimsy defence.”

Professor Justin O’Brien, head of financial regulation at Monash Business School in Melbourne, said the presence of a cooperative whistleblower would have been critical to the CDPP’s decision to prosecute. He said in criminal cartel cases there was a strong incentive to be the first to claim immunity.

“The key issue here is not whether the ACCC or the CDPP thought they had a case. It’s that JPMorgan believed they had a case. It’s a case of the prisoner’s dilemma,” he said.

BANK BACKLASH

The individuals charged are Michael Ormaechea, formerly Australia head and head of global markets for Asia Pacific at Deutsche; Michael Richardson, previously Deutsche’s head of equity capital markets for Australia; Citigroup’s former Australia country head Stephen Roberts; current Citigroup global foreign exchange head Itay Tuchman, who was previously head of global markets for Australia; John McLean, head of capital markets origination for Australia and New Zealand at Citigroup; and Rick Moscati, ANZ’s treasurer.

Meanwhile, ANZ said it was cooperating with an investigation by the Australian Securities and Investments Commission into its non-disclosure that the underwriters had kept a portion of the shares issued.

All three banks came out swinging following the announcement of the charges.

Deutsche said in an statement that its former employees Richardson and Ormaechea “acted responsibly, in the interests of clients and in a manner consistent with the Corporations Act and ASIC market integrity rules”.

It gave both the bank’s “full support” and said it would “vigorously defend” the charges.

Citigroup stood by the statement it issued on June 1, when the ACCC first announced the action.

“Underwriting syndicates exist to provide the capacity to assume risk and to underwrite large capital raisings, and have operated successfully in Australia in this manner for decades,” the New York-headquartered bank said.

“If the ACCC believes there are matters to address, these should be clarified by law or regulation or consultation,” it added.

ANZ said it had acted “in accordance with the law in relation to the placement” and would “defend both the company and our employee”.

Bank of America Merrill Lynch, which hired Richardson last year as head of global capital markets for Australia, has placed him on leave. BAML declined to comment.

Flag Group, the Sydney-based boutique where Ormaechea now works, declined to comment.

WIDER IMPACT?

Joint underwriting agreements are commonplace in bond and loan markets, but debt bankers say the ANZ case has had no impact on their business.

“The only area where there could be some impact is on hard underwritten trades which suffer a shortfall, though there have only been a handful of such deals in the last decade,” said one debt capital markets banker.

Equity placements continued at pace outside Australia with no sign of any dent to risk appetite. In one example in Hong Kong, JP Morgan and Goldman Sachs jointly underwrote a HK$2.39bn (US$304m) follow-on offering in Genscript Biotech – a stock that had gained 740% in the previous 12 months.

Still, there are concerns that competition regulators around the world will take a similar approach or that they will apply this to other offerings, such as retail bond offerings, which are already more liable to regulatory scrutiny.

“If you look at the law, you can make an argument the banks need to act independently, but that’s never been clarified and there have only been three criminal cartel cases brought forward by prosecutors,” said one Australian lawyer.

“The last one was a Zimmer frame manufacturer. It’s a bit of a leap to go from Zimmer frames to investment banks.”