While 2009 was the year of jumbo record-breaking bond deals, this year’s total issuance is less likely to match last year’s figures. Bakyt Azimkanov reports.

Although, bond issuance has been more evenly spread among the Gulf jurisdictions in 2010 so far, origination desks are confident that the primary market will pick up. Qatar undoubtedly emerged as last year’s darling as the deals from a small nation of less than two million people broke records, notched a few firsts and re-priced the whole existing credit curve for its credits.

The sovereign alone sold US$10bn of Eurobonds and US$5.3bn was issued by Qatari entities, including the Ras Laffan 30-year deal, the largest emerging markets FIG offering from the Commercial Bank of Qatar and the Middle East’s first ever telecoms bond from Qatar Telecom.

However, the picture is different in 2010. At the onset of this year, origination desks expected Middle Eastern issuance to total between US$30bn and US$35bn for 2010. With the current issuance rate, the final figure is expected to barely reach US$25bn compared with 2009’s US$40bn. Despite that, Qatari credits continue to bring well-executed top-notch deals.

For a comparison, Middle Eastern credits had printed 27 deals for US$26.31bn by mid-October 2009 compared with this year’s 26 bonds worth US$23.64bn in the same time-frame. Last year at this time, Citigroup, Goldman Sachs and BNP Paribas maintained the top three spots, and in 2010 HSBC, Barclays Capital and Deutsche Bank have emerged as the top three bookrunners.

This year was largely expected to be dominated by Saudi Arabian issuers. However, the Dar al-Arkan debut US dollar Eurobond, which was also the first Rule 144a transaction from the Kingdom, remains in isolation. It was the first deal from the Middle East in 2009 but failed to become a trail-blazer as many had hoped.

Despite the initial hiccup at the beginning of the year, Middle Eastern issuers are on course to diversify their funding pools. This year alone the region’s credits have tapped the US dollar, Saudi riyal, Australian dollar, Malaysian ringgit, Emirati dirham, Qatari riyal, Singaporean dollar and Kuwaiti dinar markets, with a euro-denominated deal in the works from the Emirates.

“There is a healthy pipeline of deals coming through for the fourth quarter,” said Robert Whichello, co-head of global debt syndicate at BNP Paribas. “Issuance has been fairly light this year compared with 2009 but then we have seen swap rates drop by 100bp in just six months as well as massive spread compression,” he added, noting that “most of our clients have been right to wait until now”.

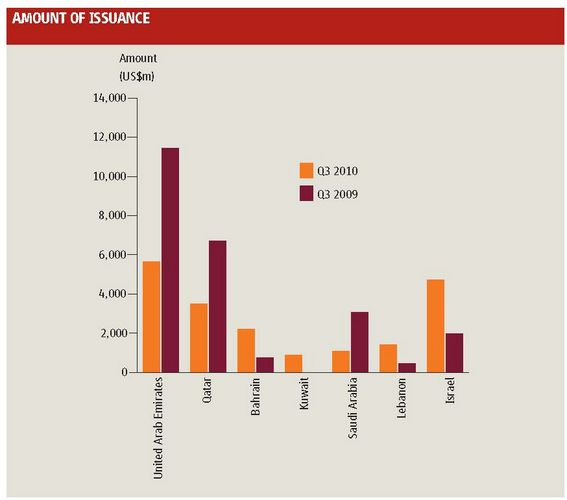

By jurisdiction, in the first three-quarters of 2010, UAE, Israel and Qatar have each issued nine, four and one international bond for US$5.65bn, US$4.74bn and US$3.50bn, respectively, followed by Bahrain, Lebanon and Saudi Arabia, which have printed three and two deals, respectively, for US$2.23bn, US$1.40bn and US$1.10bn. Jordan is expected to join the ranks of the region’s Eurobond issuers as it prepares a long awaited international debut.

There was only one international sukuk issuance from the Middle East to date: Dar al-Akran’s US$450m 11% five-year Rule144a deal. However, the void was filled by issuers in Asia-Pacific region. On the domestic front, Saudi Arabian activity picked up remarkably in 2010 compared with 2009, with a new regulation on housing set to open the doors for new financial products in future.

“The proposed Mortgage Law has the potential to unlock significant real estate development activity in the Kingdom. The capital requirements of such activity will make products, such as RMBS, very attractive to developers,” said Mohammed al-Sheikh, a managing partner at Latham & Watkins in Riyadh.

In the international arena, a few credits have emerged at the forefront of issuance.

“Issuance from the GCC so far this year, with the exception of Bahrain, is significantly down from the levels of the past few years. The recent rally in spreads demonstrates the continued appetite for paper from the region and we anticipate that investors will look for new issuance from a range of borrowers to include sovereigns, SOEs and corporates,” said Spencer Maclean, a syndicate official at Standard Chartered, who expects issuance to pick up before 2011.

“The window of opportunity is now wide open. We expect a number of repeat borrowers and debut names to access markets before Eid al-Adha in mid-November,” agreed Whichello.

In conclusion, Whichello noted that there was a wall of cash out there and fund flows into real money accounts were at record highs, much of which would be put to work in new issues over the next three months. “The technicals are extremely supportive for our issuer clients,” he said.

The Middle Eastern capital of all things glitzy and glamorous – Dubai – returned to the bond market on September 29 in grand style, sending a strong signal about the turnround in investor perception. It paid no charge for its curve extension, tapping red hot demand at the perfect time.

As the unrated city-state of Dubai continues to stun the world with its architectural and touristic masterpieces, the Emirate of less than 2m people amazed the market by paying next no new issue premium on its dual-tranche US$1.25bn Eurobond, in spite of its pariah status less than a year ago.

Dubai priced a US$500m 6.70% five-year issue at par for a spread of 542.7bp over US Treasuries and a US$750m 7.75% 10-year Reg S at par corresponding to 527bp over, through leads Deutsche Bank, HSBC and Standard Chartered Bank. Both 2015s and 2020s traded at 100.00–100.25 in the secondary market.

The Emirate’s first bonds after the Dubai World crisis came inside guidance of the 6.75% area for the five-year and 7.875% area for the 2020s, which in turn was well inside whispers in the region of 6.875% and 8%. Based on an adjusted curve, Dubai paid a maximum 5bp of new issue premium on the 2015s and up to 2bp on the longer tranche, given that, for example, another regional sovereign Abu Dhabi pays a pick-up of about 50bp between its 2014s and 2019s and Qatar pays about 30bp.

The Emirate’s Eurobonds garnered a US$5bn order book from high-quality investors, sending a bold statement that Dubai is back in demand.

Another repeat issuer was Qatar Telecom, which on October 6 topped its 2009 success with a two-part Reg S/144a bond issue that was 10 times covered, with orders totalling a staggering US$15.1bn versus last year’s US$13.5bn. Both tranches came well inside outstanding paper. The A2/A/A+ rated Qtel priced a US$500m 3.375% six-year deal at 99.243 to yield 3.516%, or 235bp over US Treasuries. The US$1bn 4.75% long 10-year came at 99.161, yielding 4.855%, or plus 245bp.

Joint leads Barclays Capital, Deutsche Bank, Mitsubishi UFJ, Qatar National Bank, RBS and Standard Chartered Bank brought the shorter tranche in line with guidance, or 15bp tighter than whispers, while the 2021s came at the tight end of 245bp–250bp guidance following a plus 262.5bp whisper. The 2016s traded at 99.875–100.125, or 228bp wide of Treasuries, on the break and the 2021s were seen at 100.625–100.875, or 237bp over.

The 2016s come 15bp inside the outstanding Qtel 6.5% 2014s on an adjusted curve, although some investors called it more like flat, having taken off a bit of fair value spread given the high 112-plus cash price on the existing 2014s.

The dollar price on the existing Qtel 7.875% 2019s was also very high, at over 121, but even by taking a full 20bp off for that premium, the Treasuries plus 245bp pricing level on the new deal was well inside the outstanding. Being the only telecoms issuer from the region also helped the deal to fly off the shelf.

Interestingly, the credit metrics actually put the company at Triple B, but the fact that it has 68% direct and indirect ownership by the Qatari Government (Aa2/AA) boosts the ratings as per Moody’s and S&P’s government rating methodology.

“If you believe the government ownership angle, and most people seemed to, then this pricing level was attractive for the rating,” said a banker away from the deal in New York.

Table