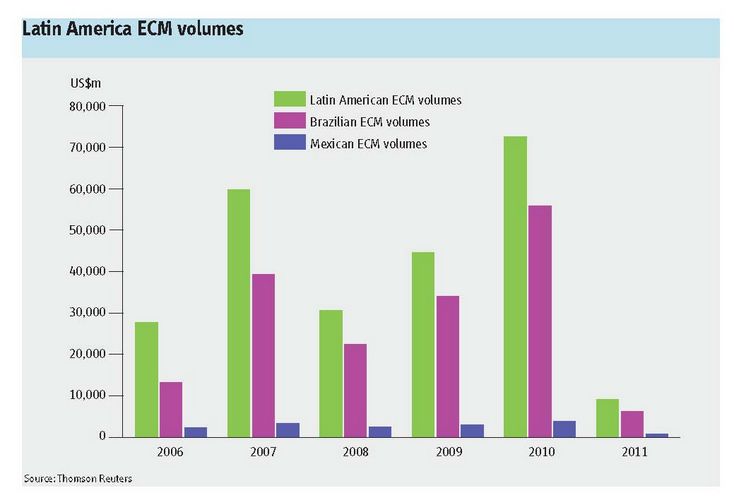

Brazil is set for a healthy year of equity capital market activity in 2011 but it is unlikely to achieve the record-breaking heights achieved in 2010. The country is the centre of ECM gravity in LatAm, but the picture is looking brighter for other countries in the region. Jason Mitchell reports.

To view the digital version of this report, please click here.

Brazil could have up to 40 IPOs and follow on deals this year, raising a total of up to US$30bn, but overall the market is likely to be a lot weaker than last year, when a total of 23 offerings in Brazil raised a record total of US$88.5bn, according to Itau BBA, the Brazilian investment bank.

Of those transactions, 11 were IPOs, which raised US$82bn. In 2009, there were 24 offerings raising a total of US$25bn. Six were IPOs, which raised US$13.1bn. In 2008, there were a total of 12 offerings, raising US$21.1bn. Four were IPOs, which raised US$4.6bn.

Last year’s numbers were scewed by one mega deal: the US$70bn IPO by Petrobras, Brazil’s giant semi-public, oil company.

As at February 28 there had been seven deals out of Brazil – a slight underachievement, with bankers having expected around ten during the window until Carnival starts on March 1.

“The Petrobras deal really drained attention away from other transactions last year,” said Fernando Iunes, director of investment banking at Itau BBA. “This year, there will be no equivalent deal. Until now, this year has been more volatile than expected. I think investors are being more cautious, more selective about the pricing of a deal.”

“We are bullish about Latin America and, in particular, Brazil, but I do not expect there to be as much ECM activity from a volume perspective in the region as last year,” added Pedro Leite da Costa, head of equity capital markets for Latin America at Goldman Sachs.

“A number of deals traded well at the end of last year, which led to a number of filings in December with the Bovespa,” he added. “However, those filings were based on third quarter financials, and the window for pricing those deals has passed. We expect filings based on fourth quarter numbers to file mid-March, and increased activity to follow, subject to market conditions. The outflow of funds from emerging markets, including Brazil, could affect overall IPO numbers for the start of this year.”

It all started in 2009

The market’s current vibrancy can be traced back to two deals that took place in Brazil in 2009 which reopened the market, following the international financial crisis: IPOs by VisaNet in June and Santander Brazil in October.

“These set the stage for a new wave of IPOs and follow-ons by established companies at the end of 2009 and into last year,” said Ana Cabral-Gardner, a Sao Paulo-based managing director in the investment banking division at Barclays Capital. “However, the market last year did not have the euphoric aspect that we saw in 2007, when investors were even absorbing companies that might not have been prepared or mature enough in their corporates trajectories for life as a publicly traded entity.”

Of the 11 IPOs in Brazil last year, the first four were priced below range. The US$392m IPO by Mills Estruturas e Servicos de Engenharia, the Brazilian construction company – which took place in April – was the first one to be priced within range, with some 37m shares sold at 11.50 reais each, within the 11.5 reais to 15.5 reais price range.

In October, Brasil Insurance Participacoes e Administracao, a group made up of 23 local insurance brokerages, realised an IPO that raised US$331m. The company sold a total of 420,200 shares, with each share priced at 1,350 reais, well within the range of 1,250 reais to 1,450 reais. This deal was particularly successful, because of the scarcity value attached to this type of business.

This year, one of the most successful IPOs was by Arezzo Industria e Comercio, Brazil’s largest women’s shoe retailer, which raised US$339m. In January, it sold 10.3m new voting shares in a primary offering at 19 reais each, at the top end of the proposed range of 15 reais to 19 reais.

“The current market – 2010 to 2011 – is very discriminating but a transaction will be well received if it is priced properly and targeted to the right group of investors,” said Cabral-Gardner. “The market is discriminating at a company level as well as a sector level. One of the cornerstone themes for global investors seeking opportunities in the BRIC countries is the consumer discretionary sectors, including retail, healthcare, education, travel and leisure. Companies in these sectors are benefiting from a demand versus supply imbalance, as there are only so many publicly traded companies with enough float and liquidity for investors to gain exposure to the consumer discretionary themes in those countries.”

“Many Brazilian consumer companies are growing quickly, so they are trading at high multiples,” added Leite da Costa. “We expect there to be healthy activity in Brazil this year, with a sizable number of US$1bn deals.”

Today, valuations for small companies are at around five times Ebitda compared with three to four times Ebitda in 2006, according to IGC Partners, a Brazilian investment banking boutique. For medium sized companies, valuations are running at eight times Ebitda today, compared with five to six times five years ago. For larger firms the figure is nine to ten times Ebitda against seven times in 2006. Some sectors, especially healthcare, are seeing even higher valuations of 15 times Ebitda. It is an impressive picture – though some investors feel Brazilian companies are starting to become over-valued.

Investment bankers in Brazil expect a number of filings around March 10-15 for deals based on fourth quarter financials. These transactions have until 28 April to be priced. Local experts say large global investors would like to buy ten times the average daily trading volume of a stock, so around US$300m is the bottom line for a successful IPO. The bigger investors would prefer deals in the range of US$750m to US$1bn.

Meanwhile, outside Brazil

ECM activity should start to pick up in the rest of Latin America later this year, bankers predict. Last year, there were five IPOs in Mexico, raising US$1.4bn, while there was no IPO activity during 2009, according to data from ThomsonReuters. Last year, there were 13 follow ons in the country raising US$1.8bn, compared with 10 follows on the year before, which raised US$2.79bn.

“The ECM market is starting to open up in Mexico, although the recent Fibra real estate transaction there was pulled because of an overly aggressive valuation,” said Persio Dangot, a director in equity capital markets for Latin America at Citi. “We also expect activity out of Colombia, Chile and Peru. Valuations are doing well there, too, despite a recent pullback. Investors are increasingly focused on these markets as they proceed to consolidate their markets and exchanges and at the same time offer attractive growth rates.”

There could also be a return for Argentina. “We have already seen the Ternium deal, although that’s only listed in the US, and we are hearing more noise from companies there that want to undertake an IPO or follow on,” said Dangot. “Sentiment seems to be improving in that country, although there are presidential elections there in November, which will lead to some uncertainty.”

In the Andean region, ECM activity is also expected to gather momentum: in January, the Lima Stock Exchange (BVL by its initials in Spanish) and the Colombian stock exchange BVC signed a memorandum of understanding to combine the two companies that run the exchanges. This is expected to be approved by shareholders in March.

The two bourses are also getting together with the Santiago Stock Exchange to set up a new index, called Integrated Latin American Markets (Mila), made up of the main companies that trade on the three exchanges. Mila will have a total market capitalisation of US$614bn and, within Latin America, only Brazil’s Bovespa – with a total market cap of US$1.5trn – will be bigger. Its creation should generate much more dynamic capital markets in the Andean region, and could lead to many companies going public for the first time.

“I expect investment banking in general to perform very well in Peru and Colombia this year,” said Alberto Pandolfi, head of Latin America M&A at Citi. “Both countries have strong macroeconomic fundamentals. They are growing, their debt to GDP levels are low and are pursuing sound fiscal policies. Many countries in Latin America, Colombia and Peru among them, are also seeing a material rise in the size of their middle classes. Issuer activity in these countries needs to pick up in order to be able to sustain their pace of economic growth.”

This is excellent timing for financing. Rates overall are at historical lows in the region, with the baseline rate – the ten-year US Treasury rate – at a very low level and spreads very narrow. Given that the US economy seems to be gaining positive momentum, US treasury rates may not remain this low for long. If Treasury rates rise, spreads will likely widen given their historical correlation.

An explosion of M&A activity in 2010 is another important factor. “”I expect M&A volumes to continue to grow but at a more moderate pace,” said Pandolfi.

For countries outise Brazil, without the anomaly of the Petrobras deal, 2011 looks set to build on, and exceed, the achievements of 2010.