While attention now turns to the Lunar New Year to begin on January 31 the impact of the latest bout of tight liquidity conditions on the swap curve should not be lost. The swap curve has bear flattened as the market discounts a PBOC more tolerant of higher money market volatility and less willing to accommodate irresponsible lending.

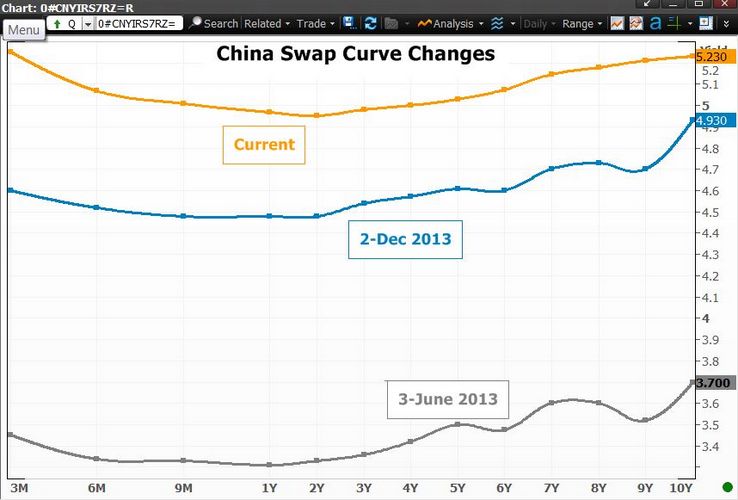

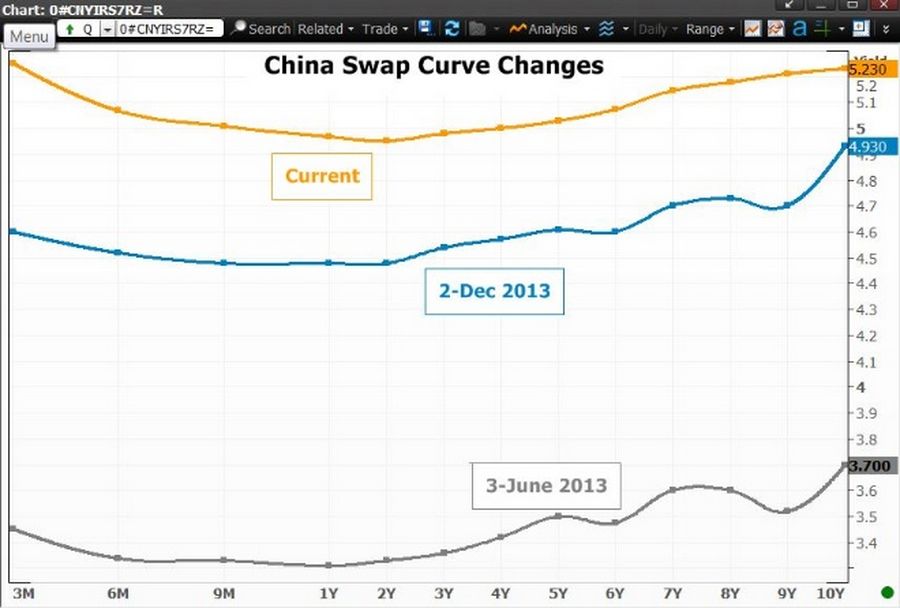

The swap curve shifts since the beginning of June, to the beginning of December and its current slope can be seen below.

The shift in the swap curve simply reflects the market’s view that the seven-day repo rate will be more volatile and elevated. The market has understood the deleveraging message but the question is whether banks have taken on board the PBOC’s desire to see a change in lending attitudes and deleveraging.

Disincentivising banks from irresponsible lending that is funded at the very shorter end of the curve via WMPs also requires incentivising them to price risk off a more appropriately priced yield curve. The other side of deleveraging is that China might have to accept a further slowdown in growth as the economy moves in the direction of a more sustainable growth model.

swap curves