Commodity trading activity bounced back in the second half of last year to raise optimism that better times are ahead for banks that stuck with the business while rivals ran for cover.

Commodities desks were hit hard by a regulation shake-out after the financial crisis, when a ban on proprietary trading and higher capital requirements made banks rethink what they did and even whether they stayed in the commodities business at all.

Deutsche Bank, Barclays, Credit Suisse, RBS and others exited or cut back. Others, including Citigroup, JP Morgan and Goldman Sachs, also shut prop desks, sold or closed physical trading businesses and reshaped and narrowed focus.

In recent years, some firms have stepped up activity, however, including Citigroup, Macquarie and Natixis, bankers said.

They benefited from a pick-up last year, which helped drive the resurgence in revenues reported by banks across fixed income, currency and commodities.

“Commodities increased significantly during the quarter as higher energy prices drove better market-making conditions and more client activity,” Harvey Schwartz, chief financial officer for Goldman Sachs, told analysts last week.

The big five US investment banks remain the dominant players in commodities and their FICC revenues jumped 44% in aggregate in the fourth quarter from a year before. For 2016, their FICC revenues hit US$50.3bn, up 16% from 2015.

Banks do not break out revenues from commodities and are secretive about their businesses.

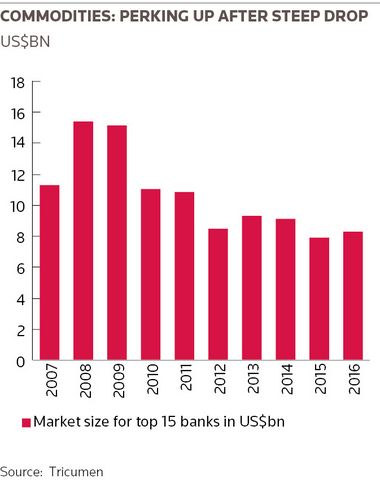

Analysis firm Tricumen estimated commodities revenues across the 15 major corporate and investment banks were US$8.28bn last year, up 5% from 2015.

That is well down from a peak of over US$15bn in 2008, but marks a modest recovery after years of decline (see chart).

“While most banks have withdrawn from extensive commodity trading, those that have remained, or even invested in the area, are now starting to see the rewards. Volatility has picked up and client hedging needs have risen,” said Tricumen partner Seb Walker.

The revival was helped by a recovery in oil prices to above US$50 per barrel and higher commodity prices in general.

“That led to renewed interest in the sector. We have seen investors putting money into commodities and assets under management devoted to the sector, which have been growing for the first time in a couple of years, and there also have been increased levels of hedging as producers locked in prices at higher levels,” said Stuart Staley, global head of commodities at Citigroup.

NARROWED FOCUS

While banks axed prop trading and cut back physical trading, commodity trading firms have also faced financial pressure, leaving both groups narrowing their commodities activities.

“Banks, in part because of regulatory pressure but also due to returns pressure, have really focused on their core client business, and the physical trading houses have focused on their physical intermediation business,” Staley told IFR.

“Everybody is much more narrowly focused on their core lines of business.”

Credit Suisse and UBS, for example, exited most commodities but stuck with precious metals, to provide services to wealthy private clients.

For banks keeping a wider platform, core areas are providing hedging for clients to reduce commodity price risk; giving exposure to the asset class for investors, including sovereign wealth and hedge funds; and providing capital for firms.

The latter can be complex. A commodity is often put up as collateral, such as for an intermediary who needs financing because commodities can tie up so much working capital. An oil refinery, for example, has to buy and ship crude, store it, refine it and store the refined product, so for part of that process a bank may own the oil to provide finance for the production stream.

A commodities arm can also help banks in other areas, such as trade finance or repos, where it can help them assess risk if they need to handle or value commodities.

Goldman ranked as the top firm for commodities in 2015, followed by JP Morgan and Citigroup, according to Coalition.

It said Bank of America Merrill Lynch, Morgan Stanley and BNP Paribas ranked 4th to 6th, and Societe Generale, HSBC and Barclays filled 7th to 9th spots.