Moving forward

While most bank commodity businesses fell into disarray and retreated in the face of unprecedented regulatory scrutiny in 2013, one bank found itself in a position of strength having already opted for a more streamlined approach. For bucking the trend by expanding its capabilities through financial innovation and improved content Societe Generale is IFR’s Commodity Derivatives House of the Year.

It wasn’t just the regulatory environment that proved a headache for commodity businesses in 2013. Price performance was sluggish, volumes were low and a deluge of outflows left bankers scratching their heads over how to deliver profitability in a shrinking market.

“It’s been a pretty tough couple of years in commodity derivatives. We’ve all been hit by low volume and a tidal wave of regulation, but the important thing for us is that the current regulatory trends are all moving in the direction of our pre-existing business model,” said Jonathan Whitehead, Societe Generale’s global head of commodity markets.

That model was put in place in 2011, when widespread deleveraging across the French banking sector saw SG exit the physical gas business to create a more streamlined franchise, which flourished while the bank’s larger rivals came under intense pressure to hive off their physical assets. A regulatory onslaught put the final nail in the coffin of the full-service commodity house, opening the door for those banks that had already reoriented themselves towards a content and financing model.

The French bank’s commitment to research allowed it to make bold calls on price expectations – and remain relevant.

“We believe we have the best research on the Street, and our call on gold was well ahead of the others. Our research works hand-in-hand with clients in a way we’ve never seen before,” said Whitehead.

Assets under management across the sector slumped, primarily as a result of the exodus from gold-related exchange traded funds. But SG saw AUM in its investment products increase.

“We managed to grow AUM in our index business, mainly due to product development,” said Whitehead.

One such development was the Supply and Demand Commodity Index that addresses the crucial issue of timing commodity investments. SG’s analysis showed that, despite the macro-driven performance after the financial crisis, fundamental factors remained the key long-term drivers of commodity prices.

Launched in October, the index identifies more than 20 supply and demand factors that drive the prices of 12 commodities to time entry and exit. Soon after launch, it completed the first OTC transactions linked to the index with European private banks.

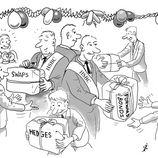

For institutional investors, SG became a pioneer of commodity variance swaps, bringing liquidity to a broad array of products linked to energy, metals and agricultural assets, as well as commodity benchmark indices and subsectors.

“People haven’t been talking so much about trading commodity volatility, but it makes a lot of sense. Hedge funds have been trading variance swaps for the last three years, but we’re bringing the products to an increasing number of pension funds,” said Alexandre Cosquer, global head of commodity investment solutions.

SG has also been at the forefront of technological developments to launch live index trading for commodity swaps over electronic platforms in early 2014. Around the same time, commodities will be added to the existing suite of assets for structured products.

“Investors can easily buy a reverse convertible on an equity, but soon they will be able to do it on crude oil – and the client will be able to design that product and receive pricing on request,” said Cosquer.

SG also successfully developed a solution for utility clients to sell surplus inventory with an option to repurchase at a future date, allowing the client to reflect a genuine sale of the gas inventory– and a corresponding cash effect on its balance sheet.

This solutions-driven approach saw the bank finalise a Sharia-compliant base metals hedging programme for Dubai Cable. Structured as a wa’ad agreement, the programme resulted in increased volumes with the client throughout 2013.

“We built a solution together with the client, and it took over a year,” said Franςois Combes, the bank’s global head of trading, commodities markets. “It will remain a non-standard product for some time, but our volumes with the client increased dramatically – and we’ve seen a wave of others queuing up for similar opportunities.”

SG’s expertise in base metals won roles on many of the year’s most significant trades, including a 10-year nickel hedge for a European corporate and a hedging and financing position on a US$150m pre-export facility for the Solway Group that included interest rate and commodities hedging structures.

“It’s a classic hedging and financing structure, with the added exoticism of being in Macedonia. It’s not a complex structure, but it requires integration of the financing and hedging businesses,” said Whitehead.

To see the full digital edition of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com