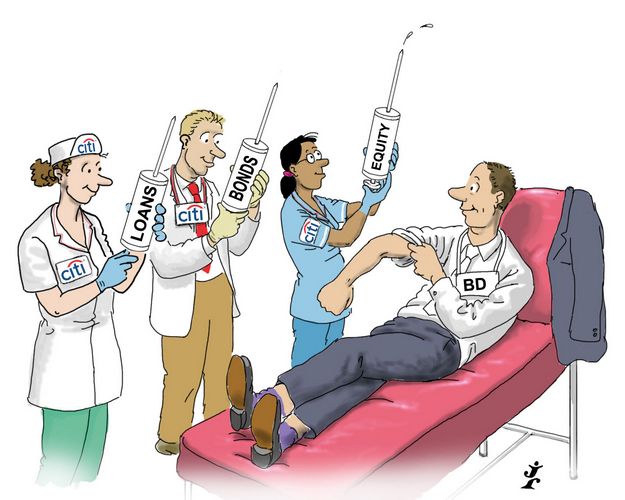

Debt injection

Becton Dickinson caught most market participants by surprise as it announced its multi-billion acquisition of CR Bard. For carefully managing investor expectations in the face of a downgrade to junk while successfully tapping the loan, bond and equity markets, Becton Dickinson is IFR’s Corporate Issuer of the Year.

The “predictable” and “incredibly conservative” medical devices maker Becton Dickinson had to counter a great deal of scepticism as it announced its largest acquisition ever: the US$24bn takeover of rival CR Bard.

The April announcement came only two years after BD had already surprised investors with its US$12bn purchase of CareFusion, a 2009 spin-off from Cardinal Health.

BD had just managed to bring leverage back down to under three times following the CareFusion deal, and there it was announcing plans to raise billions of dollars of new debt to pay for a deal twice as large as its previous record acquisition.

Investor unease aside, a very tangible threat was looming this time around: on the same day the Bard acquisition was announced, rating agency Moody’s warned it would downgrade BD into junk territory because of the US$10bn of new debt the company planned to take on to help finance the deal.

“Becton will raise its leverage significantly at a time when Moody’s expected the company to continue to deleverage from its CareFusion transaction,” Moody’s analyst Diana Lee wrote in a note at the time.

As a result of the acquisition, BD’s leverage was expected to soar back up to around 4.7 times – or 5.2 times, according to Moody’s calculations that exclude expected synergies.

The rating agency said it would downgrade BD’s Baa2 rating by two notches to Ba1, pushing the company into junk for the first since it began rating it in the 1990s.

“The acquisition of CareFusion was the first sign that Becton Dickinson is departing from its century-old strategy of bolt-on acquisitions only,” analysts at Morningstar wrote in a note in June.

“But the Bard deal moves the company even further away from its comfort zone.”

CARE PACKAGE

Financing the deal required careful manoeuvring across the equity, loan and bond markets.

In addition to US$8bn of its own common stock and US$1.7bn of available cash, Becton planned to raise US$10bn of debt and US$4.5bn of equity and equity-linked securities to pay for Bard.

It launched the equity offering, led by Citigroup, only two weeks after announcing the acquisition, ultimately raising a higher than expected US$4.95bn – the fourth largest M&A-related equity financing in the US market.

Three days of marketing with equity investors paid off, with some 80% of accounts that took one-on-one meetings putting in orders for an offering that was evenly split between common stock and a three-year mandatory convertible preferred tranche.

Investors piled in US$11.5bn of orders across the two tranches, with the common stock sale ending almost two times covered and the preferred tranche receiving orders around three times its size.

BD priced the stock at US$176.50 a share, which represented a 4.8% launch-to-offer discount, in line with other jumbo M&A financings seen recently with equity and equity-linked components.

The mandatory was priced at a dividend rate of 6.125%, towards the low end of the 6%–6.5% talk. The conversion premium ended up at 20%, which was the mid-point of the 17.5%–22.5% talk.

The stock rallied 2.8% the day after pricing, enabling underwriters to immediately exercise the overallotment option.

JP Morgan, Morgan Stanley, Wells Fargo, BNP Paribas, MUFG Securities and Barclays were also bookrunners on the equity sale.

RATINGS FIX

On the debt side, BD had to do a bit of nifty ratings manoeuvring to maintain its place in the high-grade universe – and assuage investor concerns.

It countered the expected downgrade to junk from Moody’s by securing a new investment-grade rating of BBB– from Fitch, which expressed confidence in the company’s ability to cut leverage to a level consistent with high-grade status.

Along with its existing investment-grade rating from S&P, BD therefore managed to keep two feet in high-grade.

Debt financing for the acquisition was backstopped by a US$15.7bn bridge loan underwritten by Citigroup, which was the largest split-rated bridge ever seen in the US dollar market.

Even more impressive, the bridge was more than six times as large as the previous record holder: a US$2.5bn deal dating back to 2014 to support aluminium group Alcoa’s acquisition of aerospace company Firth Rixson.

BD had an existing group of 16 lenders in its syndicate, which it wanted to work with to get the deal done, but not all of its banks could take part in the financing.

Goldman Sachs, for example, was advising Bard on the M&A process and was unable to participate.

Many of the banks in the existing syndicate also faced some obstacles, as they lacked the huge balance sheets typically required to shoulder such a large commitment for a crossover credit.

“While they had a strong bank group, not every bank had the same capability within the group in terms of what they could deliver for the company,” said Carolyn Kee, head of North American loans at Citigroup.

“We worked very hard with the syndication strategy to get the banks the right amount.”

In the end, the bank had a 100% hit rate among lenders invited to participate in the bridge and was also able to bring in a few new lenders for the term loan.

The bridge loan was eventually taken out with US$9.675bn of senior notes, as well as a US$2.25bn senior unsecured term loan and a US$2.25bn revolving credit facility, which was upsized from US$1.5bn.

SWEET TALKING

Bond investors, however, also needed some soothing. BD management spent two days on investor calls to reiterate the company’s commitment to remaining in high-grade territory.

The marketing effort allowed BD to go into its US$9.675bn seven-part bond sale bolstered by a shadow order book of around US$4bn.

The trade flew through the market on May 22. With ratings of Ba1/BBB–/BBB–, the bond was the largest crossover senior unsecured offering ever, according to Citigroup.

Investors piled into the trade, with books peaking at US$30bn. The demand allowed the company to tighten spreads by up to 25bp for the longer tranches, skimming new issue concessions down to 2.5bp–4bp.

The company priced fixed-rate maturities of two, three, five, seven, 10 and 30 years, as well as a US$500m five-year floater.

BNP Paribas, Barclays, MUFG and Wells Fargo were also active bookrunners on the bond sale.

But initial concerns aside, perhaps the clearest endorsement of the overall transaction came from the secondary market.

By the end of IFR’s awards period on November 15, BD’s stock price had risen 24% from its offering price on May 10, while spreads over US Treasuries of the company’s new bonds had compressed by 10bp–15bp.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.