To view the digital version, please click here.

IFR: Thank you all for attending IFR’s latest Covered Bond Roundtable. Our discussion today comes at a critical time in the evolution of the EU regulatory framework and a fascinating time for FIG capital markets generally as banks from the European periphery regain access to senior and covered bond markets and as banks in the EU core achieve pricing close to or at record tights. Before we discuss issues the covered bond market will likely face in 2013, Jens, could you give us some introductory comments from the VDP’s perspective around what you saw as the major issues, challenges and achievements of 2012?

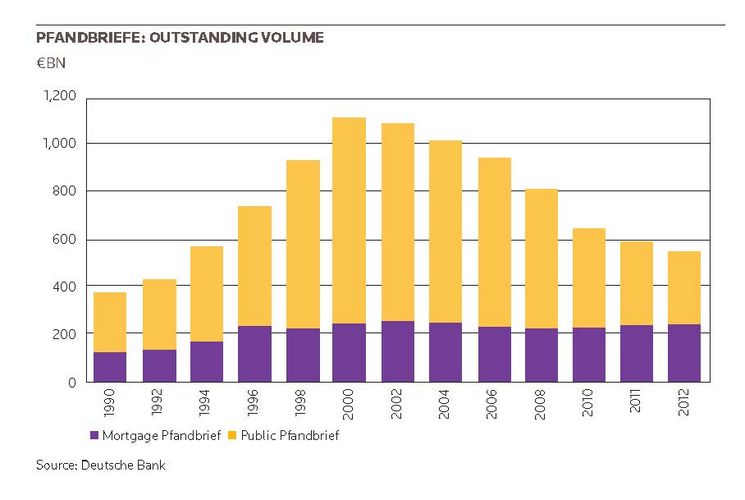

Jens Tolckmitt, CEO, Association of German Pfandbrief Banks (VDP): Starting with a market perspective first, a clear challenge - but at the same time a positive development - was that the ECB stepped in very early last year and provided liquidity to the market. This dampened new-issue volumes, not just for Pfandbriefe but for covered bonds overall. You can see that very clearly if you look at overall issuance volumes for 2012; the ECB had a substantial effect on the overall market.

That said, in the very challenging market environment we experienced at the very beginning of the year, covered bonds (and in our case more specifically Pfandbriefe) performed quite well and this underlined their strength as a source of long-term funding in difficult market conditions. This added to the image they’ve gained over the last few years.

From a regulatory point of view, what was dominant in 2012 was the fact that in most areas where we have had upcoming regulation and where covered bonds have received preferential treatment, this has proven to be stable so no second thoughts from regulators on how to treat covered bonds, contrary to other products. The special position of covered bonds in regulation will come into place over the next few years and now that regulation is starting to be implemented by banks and other financial services companies, the special role that covered bonds had during the crisis will be enshrined in regulation.

IFR: Are you comfortable in terms of where we’ve got to on labelling?

Jens Tolckmitt: Look it’s good that the industry has sat down and thought about ways of ringfencing the traditional covered bond product i.e. legally-based and primarily backed by mortgages and public sector loans. This is one of the basic elements for safeguarding the asset class in the future and retaining its preferential treatment. One of the main challenges going forward will be justify on a day-to-day basis the preferential treatment our asset class has received. The more diverse this asset class gets the more the new-found preferential treatment will be at-risk.

So we have a final label, which came into force in the second half of last year and a number of banks have signed up to it. It’s an ongoing development and there will be a constant process of review but it’s gathering pace.

IFR: Stephane, still focusing on 2012, how did the covered bond product evolve in the mindset of issuers vis-A-vis the alternatives?

Stephane Bataille, Head of FIG Origination, Commerzbank: Well for some issuers, there weren’t any alternatives to covered bonds. Strong issuers located in core markets of course had different funding avenues but for weaker issuers or issuers located in weaker markets, there was no other alternative. If we look at 2013 so far, [capital markets] access for peripherals is much easier than last year and most of it is in covered bond form.

Fifty per cent of covered bond activity this year has come from peripherals while if you look at senior financials, 30% is from peripherals. This will be a gradual process but it’s going into the right direction. But in general in 2012, there were a lot of issuers that had no alternative other than issuing covered bonds.

IFR: Given the lack of alternatives how did issuers and investors go around pricing, Torsten? Was that an easy conversation to have?

Torsten Elling, Co-head, European Rates Syndicate, Barclays: Nothing’s easy but it’s clearly been an issuer’s market; at the end of the day there was much more demand than supply and everybody was keen to participate in transactions that came to market. One of the issues of 2012 that was quite phenomenal was the strong spread performance in more or less all countries. It meant for the first time you could actually price covered bonds through government bonds in certain domestic markets. That was striking.

There were two other things that struck me in 2012. One was diversification by currency: for the first time, we saw a very strong developing sterling market in covered bonds while last year was the lowest ever for euro issuance at around 65% only. And for the first time you had more non-eurozone members issuing covered bonds (55% of total) than eurozone members. All of a sudden Australia took up 15% of overall covered bond issuance. It tells you something about how strong the covered bond asset class is being perceived by international investors.

IFR: On the point about peripherals pricing through their sovereigns, was that a discussion that developed over time with investors that they were willing to accept that, for instance Banca Intesa, for example, is actually a stronger credit than the sovereign? Were investors thinking about that or was it more driven by technicals in such there was such little paper out there?

Torsten Elling: We were looking at this for a long time and thinking: if you have a very strong covered bond issuer which is de-linked from the domestic sovereign because it has more income coming from different countries and the product is better rated than the sovereign, why would it trade at the level of where the sovereign trades? It was a very theoretical discussion and always linked to the notion of the sovereign being the lender of last resort in each specific country.

But it started with technicals in the secondary market where suddenly you saw some of the transactions trading through the sovereign curve and it became clear that due to the demand and due to changing perceptions, investors were keen just to buy a safer asset class from that country even at a tighter spread. Nowadays it’s very common. Looking at Belgium, the initial covered bond transaction came 20bp through the OLO curve.

IFR: On Belgium, we were wondering at the time whether it made sense when you have issuers that aren’t considered to be particularly strong credits - and the sovereign isn’t core - but did it make sense to price through its sovereign?

Torsten Elling: To be honest I think it makes sense in terms of where clients will buy. It’s about supply and demand and the market at the end is always right. In this case the level through OLOs was definitely seen as fair value.

Ralf Burmeister, Senior Portfolio Manager, Covered Bonds, Deutsche Asset & Wealth Management: The issue of pricing through the sovereign is perhaps more of a phenomenon in DCM origination because as an investor you have to deal with the secondary market. We’ve been buying through sovereigns for some time. The big topic for us was whether peripheral issuers would be able to print new issues through the sovereign curve. We first saw this in September with Unicredit.

But [don’t forget that] sovereign ratings were deteriorating so fast throughout last year that we had covered bonds rated a couple of notches above the corresponding sovereigns so, spreads behaved accordingly. It was just a matter of time before the first new issues printed at those levels. But you had already been able to buy or to sell covereds some time before in the secondary market. It wasn’t a big issue for us.

IFR: So is your perspective that you’ll buy through the sovereign now because that’s how the market is trading from a technical standpoint but that over the medium term, all things being equal, at some point you’d want to see spread-tiering revert to the norm?

Ralf Burmeister: That’s a bit of a philosophical question. We have rating restrictions, for example, within our mandates. So if we can no longer buy a sovereign due to rating restrictions but you still have Single A rated covered bonds which qualify and you want exposure to the periphery you go for the covered bond. Is that the future going forward, for example in Germany or France? I don’t think so.

Stephane Bataille: I think you really have to divide the markets into core and periphery. I think in the core markets of Germany, France, Netherlands and the Nordics, I would be very surprised to see covered bonds trading inside the government market. Why? Because the sovereigns are strong, the budgetary situation is strong, the sovereign market is more liquid and the respective covered bond ratings are no better than the respective government markets.

But in Italy where you have some banks which are relatively strong, you have a solid housing market, no elements of speculation, small household debt and robust and strong legislation I think there are reasons why covered bonds can trade and price inside the sovereign.

IFR: But are investors thinking rationally about this i.e. do they think covered bonds are more creditworthy than sovereigns, or are they thinking: “I have all this cash to put to work and I have to make some money and if I hadn’t invested back in September I would have lost a huge amount of money”?

Matthias Melms, Senior Covered Bond Analyst and Deputy Head of Fixed-Income Research, NordLB: There are different reasons why covered bonds trade inside the underlying government curve. I think Belgium is a good example for more technical reasons where we saw good demand for KBC and Belfius from German investors for portfolio diversification. In Italy and especially in Spain, you have strong banks relative to the government, such as Banco Santander or BBVA which is why they trade inside the government.

IFR: Joerg these are perfect market conditions for an issuer so you could have taken advantage of them through more issuance?

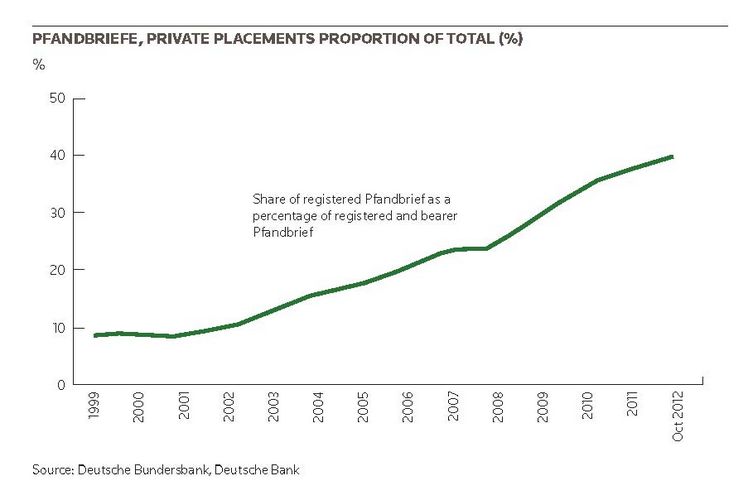

Joerg Huber, Head of Funding & Investor Relations, LBBW: We could have taken advantage of it but first of all we didn’t need so much. Like a lot of German borrowers, we do much more in the domestic private placement market so we don’t need to tap the market constantly with benchmark transactions. Secondly when investors start to push the risk-on button, you’re never sure if you can get the levels you should get. Investors just don’t like buying around Libor-flat or in the Libor-minus area especially when they have fewer restrictions when it comes to credits so it’s a difficult path to go down. And I’m not prepared to pay up just to get my transaction placed. When you’re in comfortable position of being able to wait, you just, well, wait.

IFR: In terms of investor distribution, have you seen new names in your deals?

Joerg Huber: We certainly haven’t seen hedge funds; it’s a bit too expensive for them. But we have certainly seen investors from other regions open up lines for covered bonds for the first time who went for the safest instruments first. This is certainly a trend. They need a lot of time to do their homework and to make investment decisions. But this is what we’re seeing. There are always new investors looking at this instrument, who before were only able to buy government debt but who are now trying to diversify.

IFR: And how has the differential between your private placements and your public issuance evolved?

Joerg Huber: There is no difference. We don’t have a lot of room to pay up in the public market. What we have certainly seen is situations where we could have done public transactions cheaper than private placements.

IFR: OK. Let’s look at the year ahead. Jens: when you came into your office on the first day of 2013, what were the top two or three things on your agenda?

Jens Tolckmitt: If you look more broadly at the year ahead, getting the regulatory framework right and looking not only at the overall framework in terms of Basle and bail-in but thinking (as we always do at the VDP) about how to make our product safer. Another amendment of our Act is coming up, which has been discussed in parliament but what we have been doing over the last three to four years is focusing on how to further enhance the quality of the instrument.

At the beginning of the year our credit quality differentiation model was put into place for the first time, marking a differentiation between different credits in the public sector cover pool. These were some of the things that I’ve looked at.

IFR: When you talk about improving the quality of the instrument, what specific areas are you looking at?

Jens Tolckmitt: Well, one is clearly transparency. That is something that not only we are working on within our Law; it’s also in a number of the initiatives that are going around internationally. Secondly, a very technical issue but we’re also looking at how to make the insolvency situation even more robust. It seems technical but in the end if you try to explain it to investors I would say it’s one of the key elements of the overall product perception and also one of the key elements that is differentiating products today. Beyond that, initiatives like looking at sovereign credits differently whilst politics or the regulator or the legislator can’t do it for political reasons. I think things like that enhance investor perception.

Covered Bonds Roundtable 2013: Part 2