A closely watched barometer of Deutsche Bank’s financial health is set to improve markedly following the introduction of new derivatives contracts used to insure against German bank defaults, handing a considerable lift to Germany’s largest lender.

The cost of buying default protection on Deutsche could be around 40% lower from Monday when the new credit-default swap contracts begin to trade, analysts say, reducing the cost for clients and trading partners to transact with the bank.

That promises to be an important development for Deutsche, which has battled with soaring CDS spreads in recent years whenever concerns over the bank, or the broader system, have increased.

Investors track CDS levels as a crucial signal of a company’s financial strength, but the cost of CDS also has meaningful implications for banks’ trading units. Clients and trading partners buy CDS to manage exposure stemming from trading derivatives and other financial instruments with a bank. Lower CDS should make it cheaper for counterparties to trade with German banks.

That would be particularly significant for Deutsche given it boasts sizable trading operations and trillions of euros in derivatives exposure. It also has one of the most elevated bank CDS levels, trading at several times that of most of its European rivals.

“For clients, the cost of hedging their exposure when looking to do business with us should fall materially [so that] it becomes more cost-effective to trade with us,” Dixit Joshi, Deutsche’s group treasurer, told IFR.

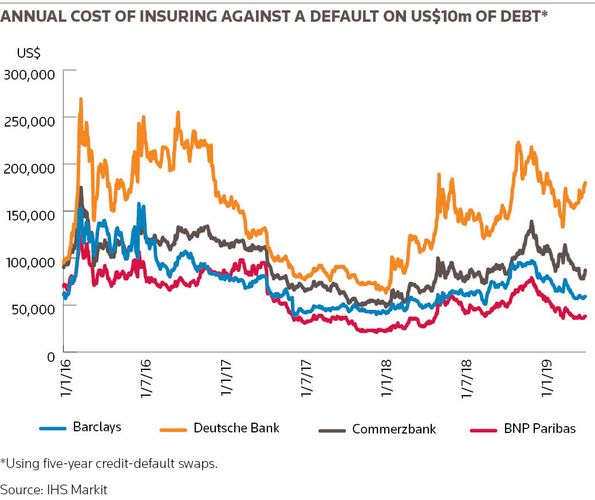

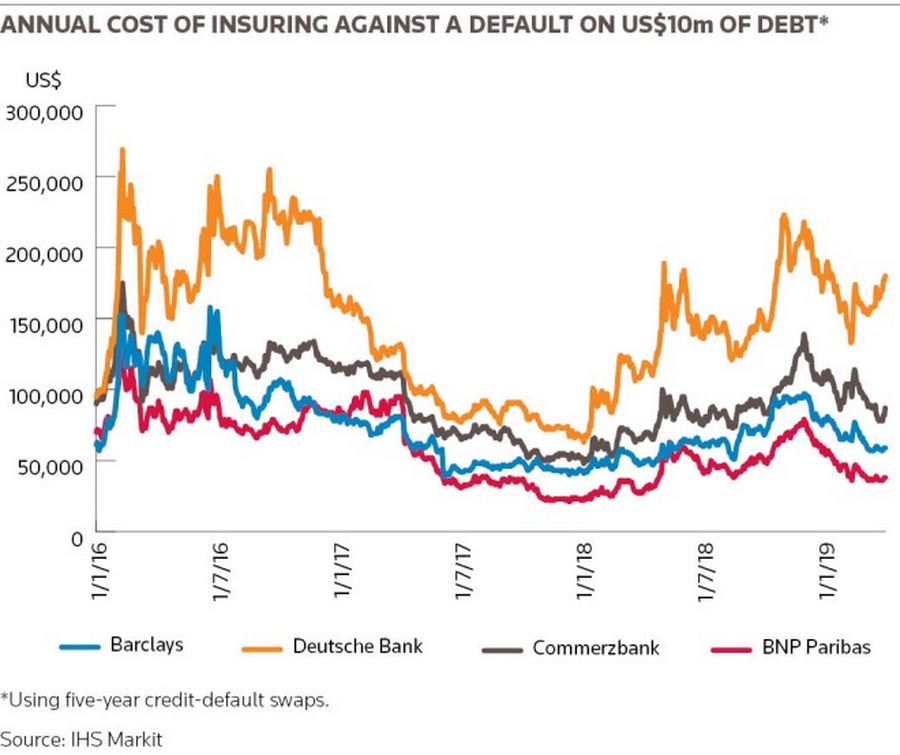

Deutsche’s CDS level has been a cause of concern in the past within the firm. Executives fretted over its elevated CDS three years ago when spreads ballooned to 269bp (meaning that in effect it cost around US$269,000 a year to insure against a default on US$10m of Deutsche’s debt for five years). That came amid concerns over Deutsche’s ability to make interest payments on some of its junior debt.

UNLEVEL PLAYING FIELD

Executives have been frustrated by what they see as an unlevel playing field between German lenders and other large European banks due to differences in national legislation on bank debt.

Those differences inflate German bank CDS levels compared with their European peers. On Thursday, CDS spreads on Deutsche were 180bp, compared with 38bp for BNP Paribas and 59bp for Barclays, according to IHS Markit. Only a portion of that difference is a result of the difference in perceived credit risk.

Annual cost of insuring against a default on US$10m of debt*

Annual cost of insuring against a default on US$10m of debt*

Last July, the German government aligned itself with other European countries such as France by passing legislation allowing local banks to issue so-called senior preferred debt. These bonds rank equal to some large deposits and derivatives and above other kinds of bonds that absorb losses if the bank runs into trouble.

Banks can raise cheaper funding by issuing these securities as investors view them as safer. Since the law change, six of Germany’s largest banks have sold €7.8bn in senior preferred euro-denominated debt between them, according to Scope Ratings.

Next week’s changes will allow German CDS to be linked to the safer, preferred securities, rather than just the riskier, loss-absorbing debt they have been priced against up until now. Both options will be available, but the new contract referencing the safer debt should become the market standard for CDS on German banks.

Up until now traders “haven’t been comparing apples with apples”, said Gavan Nolan, director, fixed income pricing and research at IHS Markit.

“We will now be able to compare Deutsche and Commerzbank CDS with French bank CDS,” he said.

Analysts at Scope Ratings expect CDS linked to the preferred debt to be around 40% lower than the current contracts. Nolan said the drop in CDS prices will vary bank to bank depending on the structure of their balance sheets and how much loss-absorbing debt they have.

BIGGEST BENEFICIARY

The cost of default protection on Commerzbank, the country’s second biggest lender, is currently 87bp, down from 114bp in March shortly after the announcement of a proposed merger with Deutsche. The merger talks collapsed last month.

“CDS spreads are less of a concern for us,” said Michael Reuther, head of corporate clients at Commerzbank.

For Deutsche, the new CDS contracts are one of several developments that Joshi said “could be quite positive for the firm” when taken together.

Those include a decline last year at Deutsche in indicators that regulators use to determine capital and leverage requirements for the world’s largest banks, and forthcoming accounting changes that should remove uncertainty over the amount of money available to German banks to pay interest on their junior (or Additional Tier 1) bonds. Deutsche also cut its 2019 funding plan by €5bn earlier this month following continued “balance sheet optimisation” efforts.

“We don’t think our CDS spreads are reflective of the strong liquidity, solvency and funding actions we’ve taken,” said Joshi.

Additional reporting by Christopher Spink