Setting the benchmark

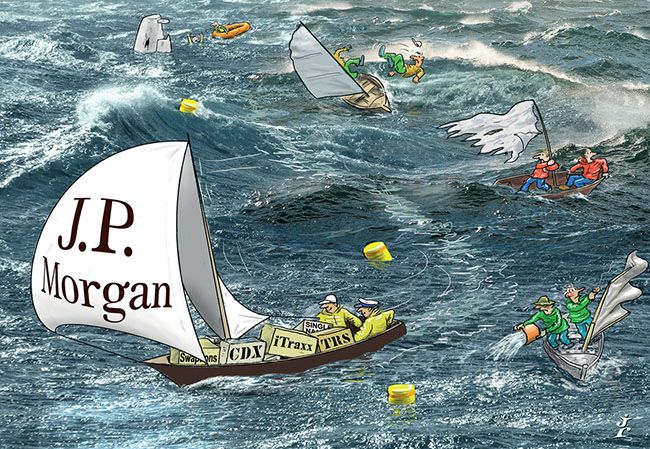

Credit markets whipsawed in 2016, driven by macro events and liquidity constraints, increasing demand for full-service provision. For its dominance of credit derivatives markets, its commitment to matching client risk appetite with investment opportunities and its ability to price and warehouse risk, JP Morgan is IFR’s Credit Derivatives House of the Year.

JP Morgan set the benchmark for performance and client service in credit derivatives markets in 2016, taking advantage of periods of intense trading activity to boost revenues and launch new products.

An exceptionally volatile first quarter, extreme market moves around the UK vote to leave the European Union, and a number of complex corporate defaults led to significant price swings in credit, interspersed with periods of relative inactivity.

The US investment grade CDX index traded in the first quarter as high as 123bp and as low as 78bp, while the European iTraxx Crossover index of high-yield names widened from 315bp to 485bp over the same period. The same index from the middle of July to the middle of September traded in a range of 30bp.

In a year in which dealers were required to operate in an exceptional range of conditions, JP Morgan’s ability to seek out relative value opportunities was appreciated by investors.

“They have really good coverage on the sales side, and are particularly good at understanding how the behaviour of credit indexes and their relationship with underlying names can be a source of opportunity,” said a credit analyst at one asset manager. “We look to buy bonds and hedge with CDS or buy credit and hedge with equities, and often those ideas come from them.”

Investors highlighted JP Morgan’s ability to pick out clients that were likely to have appetite for specific credits or risks, drawing on the bank’s global network to shift exposures across credit environments and currencies. The bank’s ability to make matches in European high-yield credit was particularly noted.

“Whether they have an axe, or are looking to get rid of something, or are warehousing positions for some idea, the traders are very good at taking those positions and working with us closely,” the credit analyst said. “They know our targets for specific names and they keep detailed lists so that if something pops up, they call. It’s a real help given that liquidity in CDS markets has declined significantly.”

JP Morgan’s ability to provide large chunks of liquidity in indexes helped it distribute products to passive managers looking for cross-asset exposure in credit, equities and rates in a rules-based format. The bank’s credit team coordinated with cross-asset specialists to roll out the investments, which attracted higher levels of interest in the insurance sector over the past year.

Several corporate events in 2016 tested the mettle of dealers and investors. In August, an ISDA Determinations Committee ruled that a court petition by Spain’s Grupo Isolux Corsan Finance for a moratorium on coupon payments on €850m in bonds constituted a bankruptcy event, entitling buyers of credit protection to a payout.

The decision was seen as a test case for bankruptcy credit events after ISDA in December confirmed that a one-word change in the 2014 credit derivative definitions had led to a surprise split decision that triggered payouts on credit default swap contracts relating to Spain’s Abengoa issued under the 2003 definitions but not those under the 2014 version.

In February, the DC ruled that a Portuguese central bank transfer of bonds out of Novo Banco did not constitute government intervention under the 2014 ISDA credit definitions. Another controversy in May saw the DC rule that a restructuring event had occurred in relation to a disputed Norske Skog bond exchange.

In light of the controversies around the CDS market investors were appreciative of JP Morgan’s credit research capability, which they said offered insight and trading perspectives on complex legal issues.

“They have a real technical appreciation and are able to view the market on a cross-asset basis,” said one credit hedge fund manager. “Their website contains all their research and analytics and in terms of research they are up there.”

The credit swaptions market continued its growth in 2016, with JP Morgan seeing rising investor participation as investors looked to speculate and hedge sharp moves in indexes. The bank’s technology platform was recognised for its functionality and ease of use.

“I think their platform is very good, especially for credit options,” the hedge fund manager said. “It’s very easy to price options and to see payoff profiles. We weren’t trading much over the most volatile periods but we know that if we had wanted to trade they would have been there.”

To see the digital version of this review, please click here .

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com