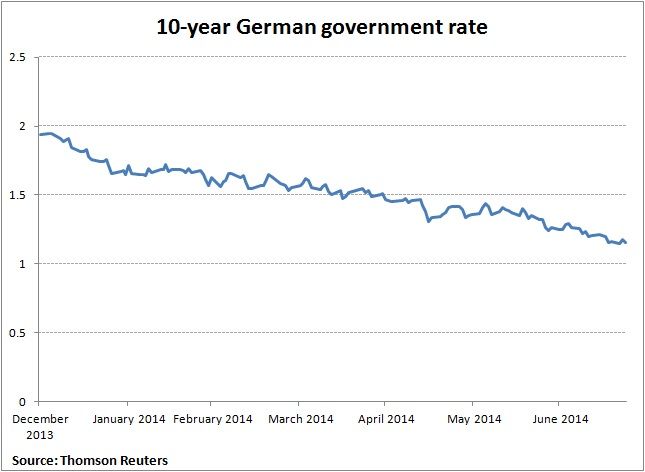

Ten-year German rates have hit a record low of 1.15% on the back of renewed uncertainty around Ukraine and the Middle East. Since the beginning of the year, Bund yields have relentlessly ground lower. Lacklustre growth and inflation, compounded by European Central Bank policy have driven the move down.

Reinforcing the lower for longer trend, last week’s 0.5% CPI print highlighted the lack of inflationary pressures in the region, despite a slight pick-up in Germany. This has prompted expectations of European inflation prints as low 0.3% over the summer months as the eurozone battles with low growth.

While volatility remains repressed by central banks, a combination of events has dented risk appetite recently, prompting investors to look for better entry points for risky assets and generating an additional bid for sovereigns. The VIX spiked over 15% last Thursday as geopolitical uncertainty picked up once again.

The US stepped up sanctions against Russia, hitting oil giant Rosneft and other large corporates following an intensification of military activity on the ground in Eastern Ukraine. Israel also just confirmed the launch of a ground attack in the Gaza strip to weaken Hamas. Much like earlier this year, a combination of localised events is leading to softness in spreads and equity markets as investors weigh the potential of sustained negative impact of the macro economy.

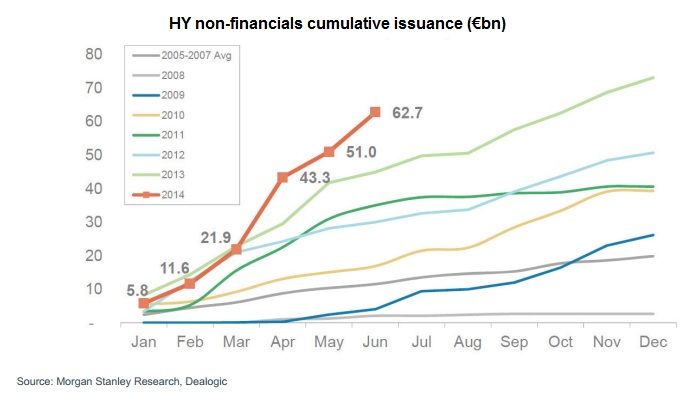

These geopolitical events come on the back of the Banco Espirito Santo debacle that initially dragged peripheral and banking spreads wider. It also follows a period of break neck high-yield issuance as bank disintermediation continues apace in Europe. The latest ECB data continue to highlight the rotation from bank loan funding into the bond space which has caused a degree of indigestion in the high-yield market at the beginning of the month that needs to clear.

Given liquidity has moved into summer gear as Europe switches into holiday mode after the World Cup and July 14 (spot the French writer here), the markets are showing great resilience despite the above-mentioned geopolitical events. The current search for yield in what remains a low rate environment is strong, particularly in Europe where spreads despite valuations provide a significant pick-up to sovereign yields. With equity markets looking fully valued, credit remains an interesting risk-reward proposition in Europe. But increasing selection is required as corporates become more active on M&A front and weaker bond structures get tested in the new issue market.