![]()

Two years ago, Deutsche Bank decided to come clean about €60bn of legacy trades that were bleeding money for the bank. The positions, which included long-dated derivatives struck before the crisis, were losing hundreds of millions of euros a year. After a decade of silence, the time had come to be more open about problems lurking within its balance sheet.

Christian Sewing, the current boss of the bank who was then number two, announced that management would focus on cleaning up such loss-making legacy trades. “We just want to create the transparency that these are things that we are going to work out,” he said at the time. Echoing that sentiment, his then-boss John Cryan added: “The sooner these go, the better”.

It is now clear the clean-up was far from thorough. As part of Sewing’s latest overhaul of the bank, Deutsche has revealed another €79bn portfolio of fixed-income trades that are also largely loss-making. Some trades are almost identical to those revealed in 2017 - in that they are longer-dated rates positions - but were nonetheless omitted from that clean-up.

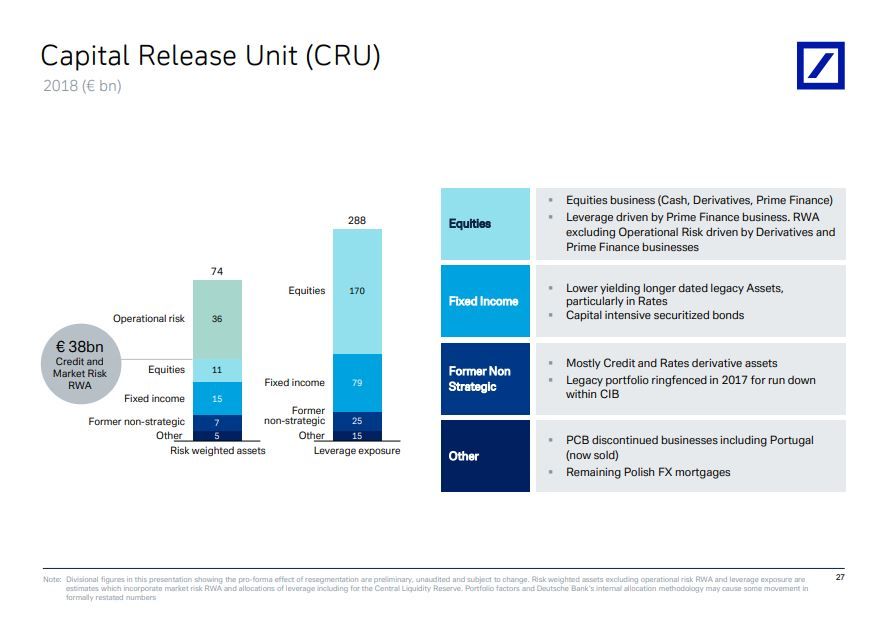

The newly revealed portfolio is just one part of a €288bn non-core unit at the heart of Sewing’s overhaul. Described as the “capital release unit”, it is expected to be anything but. While selling and running down assets will help Deutsche improve its capital ratios over time – by virtue of shrinking its balance sheet – doing so will likely involve deep writedowns.

LACK OF TRUST

For many, the latest revelation sums up why Deutsche’s shares are valued at such a deep discount – even after the latest clean-up, its shares trade at 0.2-times book. Investors have injected more than €30bn into the bank to fund several clean-ups since the crisis. Time and time again they were told it would be enough, only for further problems - and more loss-making legacy trades - to be revealed later.

“Another layer of sub-optimal assets on top of the old stuff!” said one bank analyst. “You are left scratching your head a bit: have they been writing this stuff all along the way, have they suddenly decided they don’t like it, or were previous managements lying to you because there were much bigger numbers but they couldn’t admit that? It feels like they are just fessing up as they can afford to along the way.”

Deutsche’s group treasurer Dixit Joshi told IFR the new positions had been identified after a complete reassessment of the bank’s businesses. “We are just being very disciplined around capital usage across our core businesses right now,” he said. “What we are doing is taking exposures with RWAs attached that we don’t feel are economic to run on a go-forward basis.”

“The components that we are moving in from fixed-income are low return,” he added. “So hence when you look at the forward revenues as well, you have to do that with the view that we have taken out what were the low-yielding revenues pieces. The CRU will include long-dated transactions but it’s not its main function. But the whole point of putting them in there is to unwind them and accelerate that unwind.”

RUNNING COSTS

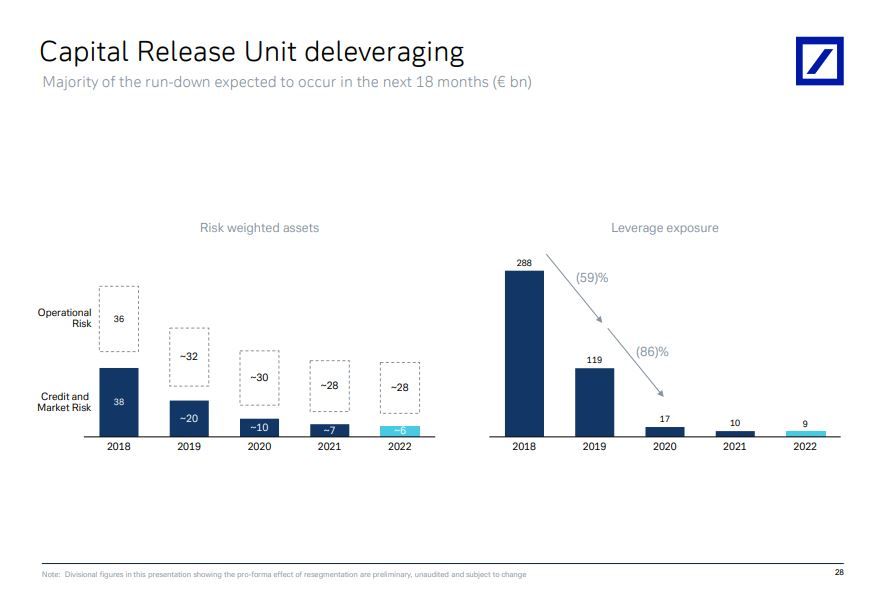

The bank has set itself aggressive targets for running down the portfolio, telling investors it intends to reduce the leverage exposure of the assets from €288bn at the end of last year to €119bn at the end of this year, and just €17bn at the end of next. Running costs are expected to remain elevated - the CRU will have hundreds of staff, at least to begin with, and the bank still projects costs of €1bn in 2022 - and that doesn’t include writedowns that might be needed to sell assets.

“We don’t need to do a fire sale of any sort,” Joshi said. “These assets have reserves and valuation adjustments attached to them, and to the extent that we want to accelerate a sale on any particular type of product or exposure, naturally we have a risk budget available for us to use should the need be. We won’t divulge how much that will be because we will seek to use as little of it as possible.”

It is unclear how much appetite from potential buyers there might be for such assets, some of which are uncollateralised bilateral transactions that are heavily penalised under new capital rules. Tellingly, the bank is still left with €25bn of the €60bn of similar assets it earmarked for run-off or disposal two years ago. The concern is that there just aren’t buyers at a price that is palatable.

“These positions are either with clients we are seeking to exit, or where we need some time to work through the position, or they are bilateral and uncleared, or we are ceasing activity as a result of the firm’s repositioning,” Joshi said. “They all have something that needs to be worked through, which is what the CRU then lets you do, with a dedicated focus and a risk budget.”

WINNING BACK TRUST

The bank hopes the clean-up will win back trust – and boost returns. Assets placed in the CRU, half of which relate to the equity business, parts of which are being sold to BNP Paribas, lost Deutsche €1.1bn last year and consumed 20% of its entire capital. “We will be able to allocate more capital to our growing business,” Sewing said at a meeting with bank analysts that was made available as a webcast. “This is a radical step-change for the bank.”

So why clean up now? For one, regulators appear to have cut Deutsche some slack, giving it the green light to operate with less capital because of its plans to shrink. The bank has cut its minimum target for common equity Tier 1 from 13% to 12.5%, which – based on the bank’s current size – will free up around €4bn of CET1 capital that the bank can burn through.

Some believe the bank has been unable to act until now: its low €14bn market capitalisation and long history of capital raises would have made a rights issue difficult, while concerns about being unable to pay coupons on its Additional Tier 1 bonds have prevented it from taking writedowns.

“They have known for a long time that restructuring was necessary, but basically they’ve been completely stuck,” said Jerome Legras, head of research at Axiom, an asset manager that focuses on banks. “It’s been impossible for them to take any meaningful charge without destroying any earnings they had, and this would have meant killing AT1 coupons, which was something they just couldn’t contemplate.”

At the same time, the European Union has given Deutsche another helping hand. Under the updated Capital Requirements Regulation – so-called CRR2 – passed a few weeks ago, available distributable items rules that dictate whether AT1 coupons can be paid have been eased.

“For me, the ADI changes are the main driver in all of this,” said Legras. “It is essentially why they are finally doing something. It’s not a coincidence that the law came into effect three weeks ago. Now they can do it. If they had done it before, it would have killed AT1 coupons, and that could have been a nightmare for them. The press would have gone wild. People would have worried about them being bust.”