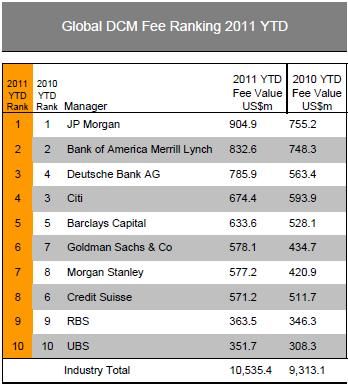

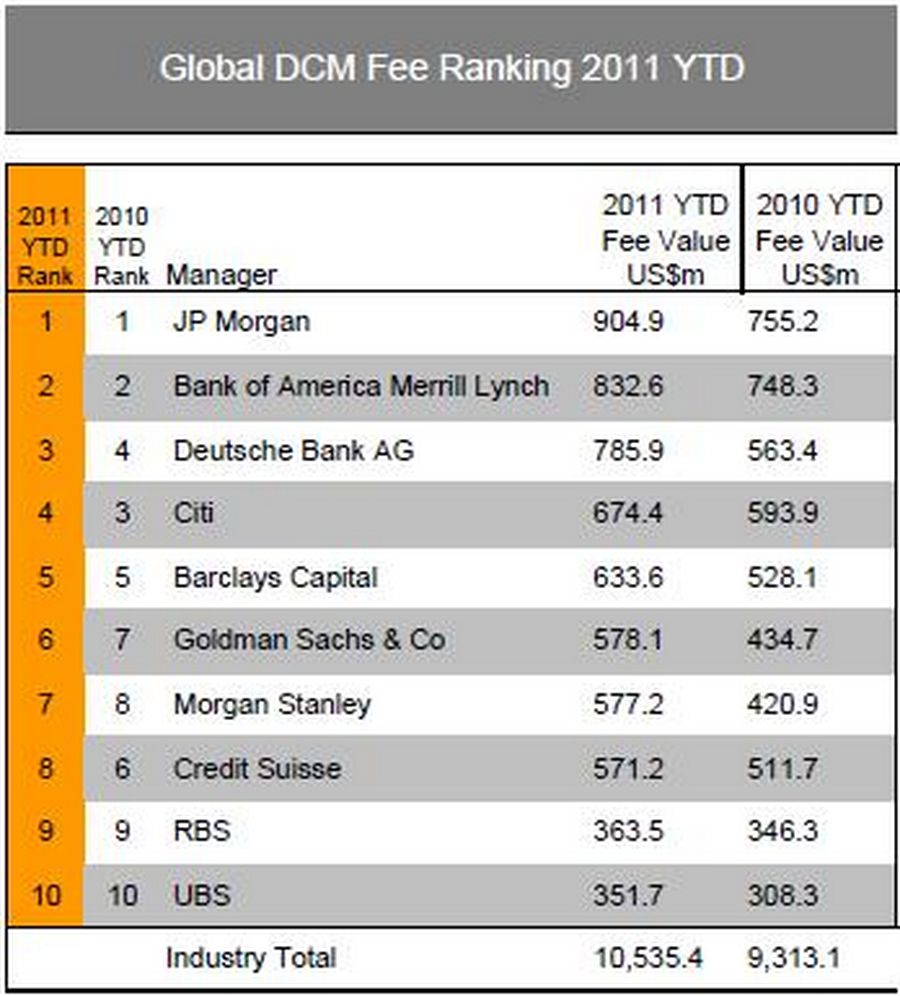

JP Morgan and Bank of America Merrill Lynch maintained their respective top-two position in global debt origination fees in the first half of the year, but Morgan Stanley and Deutsche Bank made major inroads – especially in the US. Fees paid by debt issuers in the period rose by 13%to US$10.5 billion from US$9.3 billion for the same period in 2010, according to calculations by Thomson Reuters/Freeman Consulting.

In contrast to fees, there was little movement in the deal volume rankings in the first half. JPM and BofA Merrill continued to be the undisputed leaders across debt markets. BofA Merrill was number one by deal volume in the booming US high-yield bond sector, with JPM second, while the positions were reversed for investment grade.

But underwriting bonds in bulk isn’t the only way to make a buck in the debt business, as Morgan Stanley demonstrated. Despite slipping in Thomson Reuters’ league tables for U.S. high-grade and high-yield bond volume, Morgan Stanley’s DCM business was the third largest revenue earner in the country in the first half of the year, according to Thomson Reuters’ fee rankings.

For U.S. high-grade bond underwriting, Morgan Stanley came in sixth place in the first half, down from fifth in the first half of 2010. JP Morgan was first, followed by BofA Merrill, Citigroup, Barclays and Goldman Sachs. Morgan Stanley’s ability to generate stronger revenue from lower underwriting volumes was largely due to its M&A prowess which resulted in a series of acquisition financing mandates.

Deutsche also won more bang for its underwriting buck, coming in fourth position in first half U.S. DCM fee rankings, compared with eighth a year ago. “In the US, we’ve maintained our focus on larger corporations, which have been increasingly active after a slow start to the year,” said Miles Millard, global head of capital markets and treasury solutions at Deutsche.

“We’ve also extended our footprint in financials, in partnership with our coverage bankers, and we’ve stayed very active in high-yield.”

Deutsche was the only firm that made any significant moves in underwriting volume league tables, leaping to third position in lead-left bookrunner rankings in high-yield bonds in the first half, compared with eighth position in the same period of 2010.

For the other top 10 banks, movements in rankings differed by only one or two notches.

The role primary markets play in investment banks’ overall fixed income franchises is not just about generating fees from issuers - it also drives secondary market flows. Consequently, most banks’ focus has been on generating as much flow as possible, something that has played to the strengths of those banks with the biggest balance sheets. Morgan Stanley’s efforts are therefore particularly notable, given that it is the only top five DCM fee earner without a large lending book.

“We have increased lending in the past year, but we tend to focus on particular clients, where we want to be a leader across a number of different products,” said Dan Toscano, co-head of global leverage and acquisition finance at Morgan Stanley in New York. The majority of Morgan Stanley’s leverage finance business is done in and around event financing so the fee potential is higher than on-the-run deals, he said.

Event financings, or acquisition-related business, has also been strong in the investment grade area. But M&A generated bond business has slowed in recent weeks as corporate confidence took a hit from the turmoil surrounding Greece and U.S. economic weakness.

Bryan Jennings, co-head of fixed income capital markets at Morgan Stanley, said he remains hopeful that the past month’s risk aversion is temporary and that M&A ball will start rolling again in coming months. In the meantime, he expects the capital return to shareholder theme - where companies are leveraging up their balance sheet to enhance returns - to continue as one of the big drivers of business in the high grade bond market.

Millard was also determinedly optimistic. “There have been some headwinds in the market over the past few weeks but overall the year to date has been very busy for us,” he said. “Assuming we get some stability, there is a lot more business to do by the end of the year. There is still plenty of potential supply from SSAs, financials and high-yield.”