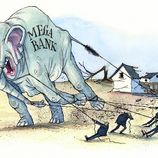

Argentina has imposed capital controls, seized assets, nationalised companies – and shows little sign of yielding in a bitter and long-running legal battle with its so-called holdout creditors. Antagonising the markets is no way to attract the long-term investment the country needs, which raises the question: how much longer can this go on?

There have been plenty of headlines out of Argentina in 2012, and few have spelt joy for investors. An Argentine court ordered the seizure of Chevron’s local assets. The country’s Chaco province defaulted when the central bank blocked it from accessing US dollars. And there was the small matter of the government expropriating Spain’s stake in domestic oil producer YPF, a surprise bit of nationalisation that unleashed shock waves in the markets and fractured an important relationship with Madrid. Spain’s foreign minister said Argentina had “shot itself in the foot”.

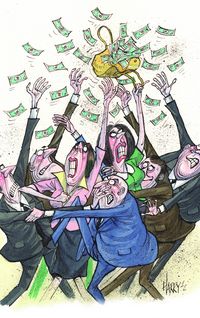

And then in late October, a US federal court ruled that Argentina must indeed pay “vulture funds” – creditors who rejected the restructuring that followed Argentina’s massive 2001 default – at the same time that it pays those who accepted it. The country vowed never to pay the funds, which want full value for their holdings as opposed to the 65% haircut suffered by those who accepted the restructuring terms.

“The court effectively commandeered immune Republic assets to pay plaintiffs, and ordered the Republic not to use equally immune assets to pay other legitimate debts unless it submitted to this commandeering,” Argentina said in a court filing. “A greater affront to sovereignty and sovereign immunity is hard to imagine.”

Locked out

Argentina has been locked out of the international capital markets since the default, and its apparent refusal to play by the rules continues to put the markets off.

From early October to mid-November – that is, from just before until just after the appeals ruling – the country’s Boden 2015s fell from around 92.00 to 79.00. Over the same period, five-year CDS on Argentina widened from 980bp to 2,400bp.

“There is no shortage of reasons to remain cautious on Argentina credit risk,” Siobhan Morden, head of Latin America strategy at Jefferies, wrote in a mid-November analysis. “Argentina seems more on a path of inward isolation … as opposed to the alternative strategy of normalising external creditor relations.”

“Argentina seems more on a path of inward isolation … as opposed to the alternative strategy of normalising external creditor relations”

Tensions escalated further on November 21 as the US courts ordered Argentina to deposit US$1.33bn in an escrow account for the benefit of the plaintiffs before a US$3bn payment of GDP warrants could be paid to bondholders that had accepted the country’s 2005 and 2010 exchange offers.

Further, the court order said that if Bank of New York Mellon and other US payment agents facilitated any payments to exchange bondholders, they would be breaching the order if the escrow monies had not been deposited. This heightened the risk of default even further.

District Court Judge Thomas Griesa was asking Argentina to break its word and pay in full the claims of the bondholders that had not accepted any restructuring, or else risk technical default if it ignored this, as US payment agents were unlikely to make payments to exchange bondholders.

He said: “Argentina must pay that US$1.33bn concurrently with or in advance of the payments on the exchange bonds. Argentina owes this and owes it now. After 10 years of litigation this is a just result.”

However, the threat of default receded on November 28, when Argentina succeeded in getting a stay on any payments to the vulture funds reinstated. The country was also allowed to appeal the ruling from Judge Griesa about how any payments might ultimately be made.

The move gives the sovereign some more breathing space, at least until February 27 2013, when Argentina and plaintiffs must present oral arguments. The final outcome of the court proceedings remains uncertain. But the recent developments have sparked talk that the exchange may be reopened to holdouts.

“They have the money to pay the restructured debt, and strictly speaking they have the money to pay the plaintiffs, which is about US$1.3bn,” Stuart Culverhouse, chief economist at Exotix, told IFR.

“But if the plaintiff wins, the expectations are that other holdouts will join them, and from that US$1.3bn you could see something over US$10bn, which becomes much more constraining for the sovereign.”

Runaway inflation

Meanwhile the country is facing other, more typical problems. Growth has slowed, and runaway inflation – estimated at an annual 25% by some private economists, as opposed to the official 0.8% rate the government announced for October – is crippling the middle class.

Hundreds of thousands of people took to the streets on November 9 to rally against Cristina Fernandez de Kirchner, banging pots and pans in a traditional Argentine protest.

Moreover, Argentina quite simply does not have the money for the big projects it needs – like the US$32.6bn capital expenditure plan for YPF, aimed at reducing Argentina’s reliance on foreign oil and gas.

“The economy is not generating enough to finance the investment necessary in the country to enable further growth,” said Felipe Hernandez, chief economist for Latin America at RBS in Connecticut.

Daniel Broby, chief investment officer at London-based boutique house Silk Invest, said Argentina was “gaining a reputation as the world’s largest submerging market”.

But while the capital markets are only a local affair for now, they are active enough. YPF has raised nearly US$900m-equivalent in the local market in the last few months alone – US$157m in November, US$423m in October, and US$300m in a multi-tranche bond issue the month before that.

And there are still extremely high yields available to tempt investors willing to stomach the significant risks involved – in the corporate and provincial sectors along with the sovereign. Argentina’s Cordoba province, for example, has 2017 bonds that are yielding north of 20%.

“So we feel we are comfortable with taking on the risk and are more than compensated for it. Either you understand what the situation is and you put the headlines into context, or you shouldn’t invest at all”

“Do I think Cordoba will default? No,” said Diego Ferro, partner and portfolio manager at Greylock Capital.

“Because after the 2001 experience, the political cost of default in Argentina is pretty high. So those who don’t have an easy excuse to default won’t,” Ferro said.

“The provinces of Cordoba and Buenos Aires are also run by governors who see themselves as potential presidential candidates, and they wouldn’t want to be tainted by default.”

More important, he said, these provinces have the resources to make good on their debt obligations.

“So we feel we are comfortable with taking on the risk and are more than compensated for it,” Ferro said. “Either you understand what the situation is and you put the headlines into context, or you shouldn’t invest at all.”

To see the full digital edition of the IFR Review of the Year, please click here.