The ECB gave Banco Popular the green light to proceed with its ill-fated capital raise in 2016 despite being in possession of evidence that indicated serious financial irregularities in the Spanish lender’s accounts, according to a confidential ECB report seen by IFR.

Investors eventually lost every cent of the €2.5bn raised by Popular in the rights issue as part of the resolution of the bank a year later. The capital call, which launched in May 2016 and closed the following month, is now the subject of a legal battle in Madrid, with disgruntled former shareholders claiming that they were misled into backing the deal by false numbers.

The report - dated September 14, 2016 - makes it clear that ECB investigators had identified “significant figures” of financial irregularities at the bank almost two months ahead of the rights issue. On April 8, the head of the team contacted superiors requesting that the scope of the inspection be changed to focus on the serious issues identified.

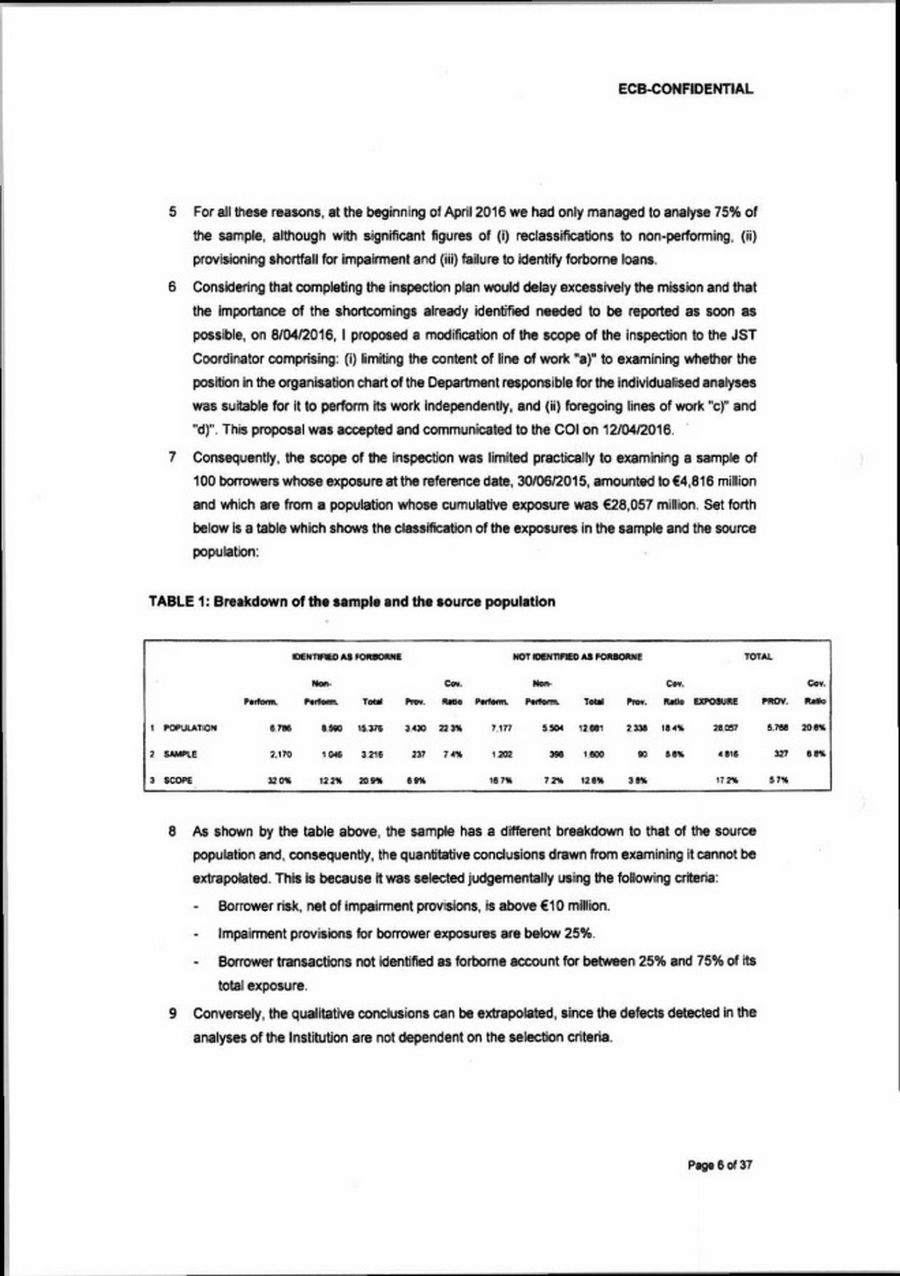

By the time the ECB investigation wrapped up in early June, the report says, the team had confirmed its earlier findings, identifying €2.4bn of bad loans wrongly classified as performing and a subsequent €1.8bn shortfall in provisions. That would have been enough to wipe 243bp off the bank’s core equity Tier 1 ratio and push its capital cushion below the minimum regulatory requirement.

The report makes clear that the team was already aware in April of the significance of what it had discovered. “Considering … the importance of the shortcomings already identified needed to be reported as soon as possible … I proposed a modification of the scope of the inspection,” the head of the ECB team wrote in the report.

Superiors approved the request on April 12. But at a meeting in Frankfurt six days later between Popular bosses and regulators that was presided by Danielle Nouy, head of the central bank’s supervisory board, ECB officials did not step in to block the bank’s tentative plans to raise capital, according to one person who attended the meeting.

The person said bank bosses and ECB officials discussed the importance of raising capital quickly given the UK referendum on membership of the European Union two months later, which could have limited banks’ ability to raise capital. It was agreed that it was better to do the capital raise sooner rather than later, the person added.

Popular bosses returned to Madrid and began work on the deal. On May 18-19 they met Bank of Spain and ECB officials to outline their specific plans. Although formal approval was not required from either institution, the officials responded positively to the plans, said one person with knowledge of the meetings.

WIPED OUT

The €2.5bn rights issue was formally approved by the board on May 25 and announced to the market the following morning. At no point did the ECB seek to dissuade Popular from making the capital increase or raise the issue of inaccuracies in the accounts, according to sources. All of the money raised was later wiped out as part of the resolution of Popular in June 2017.

What the ECB knew before the capital raise could now be a key piece of evidence in the legal battle that has been launched by disgruntled shareholders, which is expected to be heard this year or next in Madrid. That case is also likely to seek to identify who - if anyone - at Popular or elsewhere knew of the irregularities.

The ECB took charge of supervising the eurozone’s significant banks in November 2014, superseding national regulators. Its main aims are to ensure the safety and soundness of the European banking system, increase financial integration and stability, and ensure consistent supervision.

“The ECB quite clearly knew that the bank was in a bad situation,” said Jordi Ruiz de Villa, a lawyer at Fieldfisher in Barcelona, who is representing Popular bond and shareholders who lost money. “The matter was very grave. They had identified systematic failures in accounting for the loans properly.”

“In my opinion, they should not have allowed the bank to raise capital in this situation. As the supervisor, they had a responsibility not just to monitor the solvency of the institution, but also of ensuring transparency to the market.”

The ECB declined to comment.

The Comision Nacional del Mercado de Valores, Spain’s securities market regulator, also signed off on the deal, although there is no suggestion that it knew about the irregularities at the time. It declined to respond to questions about its role, but said: “The CNMV is not the appropriate source for commenting on the ECB’s actions.”

“On the face of it, this doesn’t look good,” said one lawyer away from the case, who asked not to be identified because he was not familiar with all the facts surrounding the case. “The question is whether the inspectors told the right people at the ECB. As a regulator they have a duty of care to the wider market.”

Santander, which bought Popular for a token €1 after all shareholders and some bondholders were wiped out, also declined to comment. As part of the purchase, it assumed responsibility for all of Popular’s legal liabilities, meaning it could face a substantial bill if former shareholders win their case.

SIGNIFICANT FIGURES

The ECB investigation at Popular began on November 13, 2015 and formally ended on June 7, 2016 - right in the middle of the subscription period for the rights issue. The team of ECB officials spent just over five months doing on-site inspections at two of the bank’s sites in Madrid.

The ECB only formally notified Popular of its findings at a pre-close meeting with bank executives on June 22, the same day that the new shares issued as part of the rights issue began trading. The bank emailed its draft response to the ECB nine days later, indicating a final reply would follow. It never did.

The ECB report makes it clear that the ECB investigation was beset with difficulties, not least a shortage of staff members, with reinforcements needed at the beginning of February. Data provided by Popular was also riddled with “defects”, making analysis of the bank’s accounts difficult, the report says.

In the end, because of delays in performing its investigation, and because of the serious irregularities discovered, the team of investigators decided to limit the nature of their probe, and dropped two of the four initial objectives set at the outset of the investigation.

According to the report, the impact of remedying the failures would have reduced the bank’s core equity Tier 1 ratio from 12.48% to 10.05%. Its minimum requirement was 10.25%.