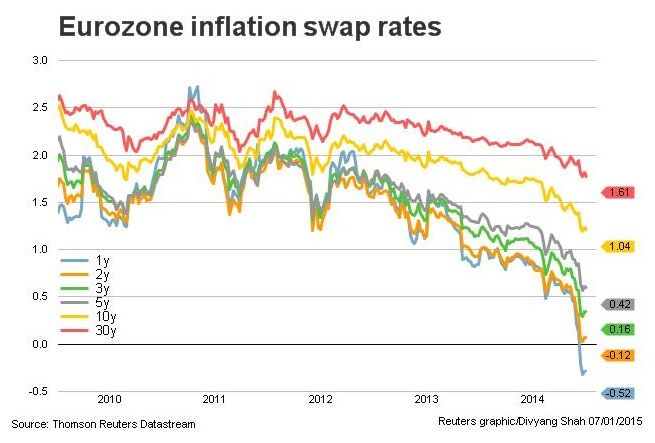

The market continues to focus on the eurozone 5y5y inflation swap rate which, despite new oil lows, has yet to break the mid-Dec trough. While Draghi has toned down the importance of the 5y5y rate since his Jackson Hole speech on August 22, the shape of the inflation swap curve has become important.

The problem with looking at the 5y5y rate is that it does not accurately reflect what is happening to inflation expectations when the whole curve shifts. The continued fall in oil prices has seen the front-end of the inflation swap curve move deeper into negative territory with 1y swap rate at -0.54% and 2y swap rate at -0.11%. For a chart of the inflation swap rates click:http://link.reuters.com/jeq63w.

Since August, 5y and 10y inflation swap rates have seen a decline of 53bp and 44bp respectively, highlighting that the whole curve has been shifting lower. While, over the same period, the 30y rate has gone from trading around 2% to 1.65%. This data supports Draghi’s view that the risk that the ECB will not fulfil its mandate is “higher than it was six months ago”.

The continued fall in oil prices will see low inflation persist and increase the risks of unanchoring inflation expectations. Eurozone headline inflation for December has already fallen into negative territory with a flash reading of -0.2%.

With the ECB close to pulling the QE trigger the question is whether it will work for the eurozone given:

1) already low bond yields

2) mixed QE results from Fed/BoE vs BoJ and

3) whether stimulus will be sufficiently aggressive.

We won’t be able to answer this question until the ECB unveils its policy, most likely on Jan 22.