EUR depreciation undoubtedly plays a key role in the ECB’s fight against lowflation.

EUR weakness is approaching the half-way mark towards the unstated US$1.20 target, but it is too early for the ECB to consider putting a brake on the trend.

However, when it becomes time for the ECB to say mission accomplished, preventing EUR from overshooting beyond US$1.20 is likely to prove difficult.

The EUR has consistently weakened since its peak close to 1.40 early in the year after the ECB’s May meeting.

The importance of the EUR to the inflation outlook was highlighted by Draghi at that meeting where he explained:

1) 80% of the 2 percentage point drop in inflation since 2012 was due to lower food and energy prices, and

2) it was the exchange rate that had helped to keep inflation low and depressed. As Draghi noted then, the “exchange rate, both nominal and effective, has appreciated by something like 10 percent since mid-2012 to today”.

Since the May meeting, the nominal exchange rate has depreciated a little less than 5%, so there is still some way to go before that 10% appreciation is fully reversed.

The fact that energy and food prices have fallen further since May suggests even more EUR weakness may be needed to offset the impact. A further 5% depreciation of the EUR would equate to a move down to US$1.20, and at that point ECB rhetoric will likely change to wanting stability and refocusing on the G7’s flexible exchange rate agreement. This does not mean that EUR/USD will stop there as the move is as much about the ECB as it is about the Fed policy outlook.

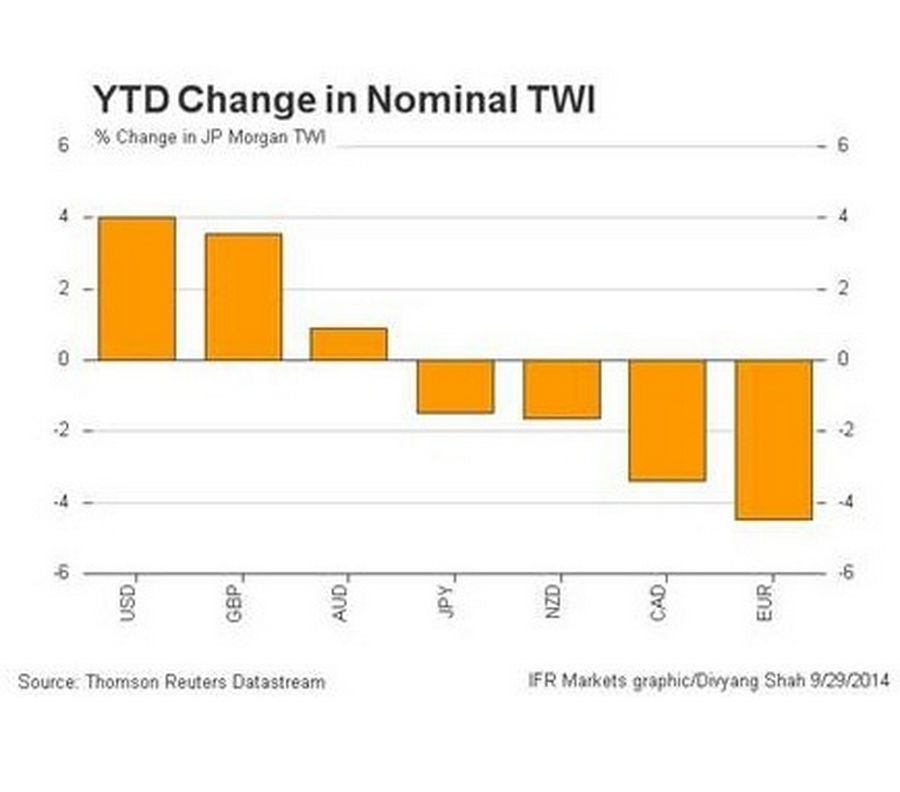

Beyond the usual maxim that FX markets are prone to overshooting, remember that EUR/USD’s decline has been as much about EUR weakness as it is about USD-strength. The numbers tell the story: over the past 3 months, EUR has dropped 7.4% against the USD while GBP has shed 5.1%.

With the Fed expected to hike rates around mid-2015, USD strength has begun a multi-month trend at a time when the ECB will be looking to expand its balance sheet. There is no ‘on’ or ‘off’ switch only the potential that the USD will strengthen against, not only EUR, but also the JPY as policy divergence dominates.

The ECB provided the initial spark for EUR/USD weakness back in May, but the Fed outlook has been key in its acceleration lower recently and will likely prove more influential ahead in an overshoot beyond US$1.20.

The Fed could lend a helping hand, but this is only if USD strength becomes an issue in terms of its impact on dampening already low inflation. This would then allow the doves to lean toward an even less aggressive tightening cycle, which would ultimately slow the pace at which the dollar appreciates.