The euro has gained some 7% against the USD while 10-year Bund yields are 60bp higher since mid-April but the DAX is only down some 3%.

Given the scale of the moves we have seen on the FX and FI markets, the ability of the DAX to not weaken sharply suggests that the real ECB QE trade is to look for upside on Eurozone equities.

This has been the favoured trade when it comes to BoJ QQE that has helped the Nikkei all the way to 20k. But it was also something that was seen after the Fed and BoE announced their respective QE programmes back in 2009.

Although it is probably better to compare ECB QE to the BoJ’s as opposed to the Fed and BoE as the latter delivered theirs in very adverse market conditions.

On a YTD basis the DAX is up 18% while the Nikkei is up 12% while the S&P500 and FTSE100 are up by 3% and 6% respectively. We would expect further gains on the DAX and Nikkei with the recent rise in bond market volatility providing support .

QE until inflation path adjusts substantially

Draghi’s latest speech makes it clear that it is too early for the central bank to be thinking about adjusting its QE program. The ECB in Draghi’s words “will implement in full our purchase program as announced” with the qualifier “until we see a sustained adjusment in the path of inflation”.

While much has been made about headline inflation moving away from negative territory, the core inflation rate in the Eurozone has been stuck at 0.6% for the past two months. Just to recap, this is still lower than the 2010 low during the GFC and highlights that beyond the swings in volatile items inflation remains low.

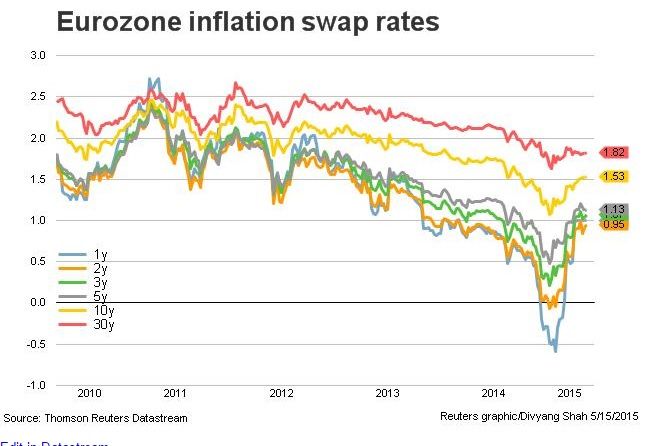

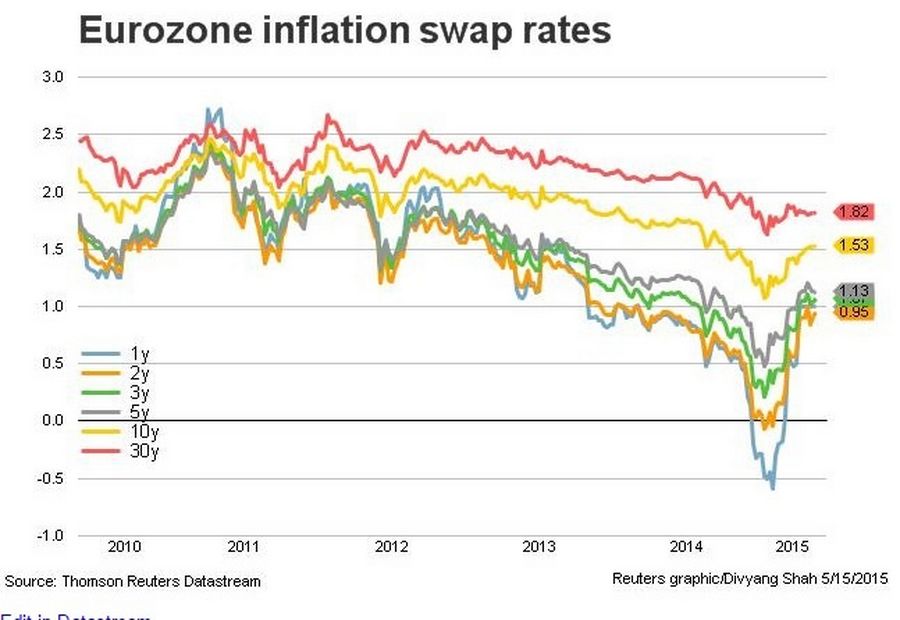

Inflation swaps have also shown a revival mirroring the move on headline inflation with 1-5y inflation swap rates all higher. While 10y and 30y inflation swaps have also moved away from their lows but at 1.54% and 1.83% respectively they are below 2%.

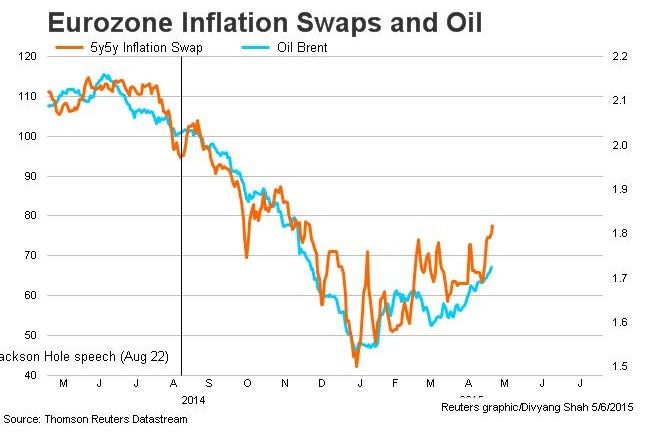

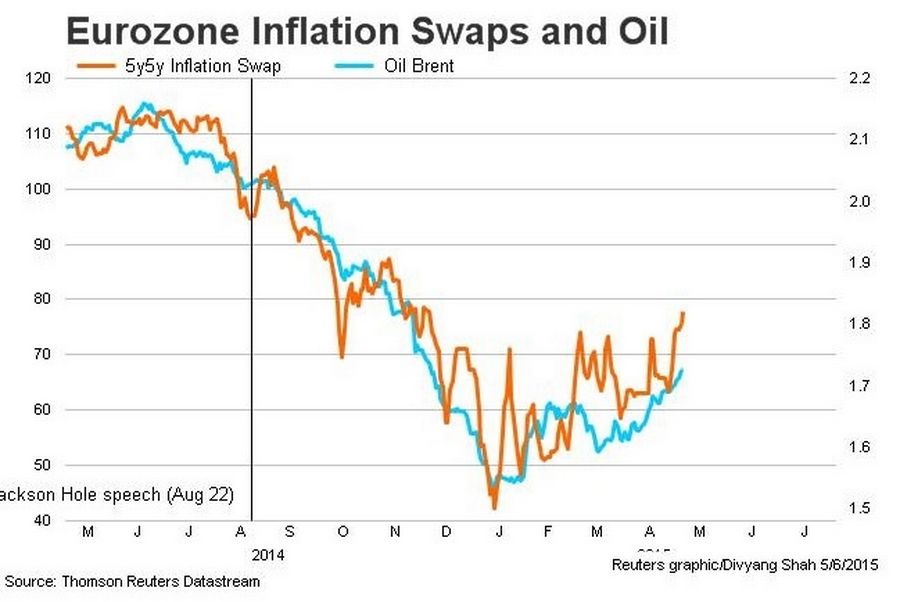

The 5y5y inflation swap rate mentioned by Draghi at the August 2014 Jackson Hole is at 1.81% and also below 2%.

Swaps and oil

Optimism over the economic outlook as well as credit growth does not equate to optimism that lowflation will also turnaround. The Fed and BoE, who have faced stronger than expected recoveries in the economy and labour markets, are still dealing with a lack of upside on inflation/wages. Given what is happening in the US and UK it is difficult to see how the Eurozone will fare any better given a wider output gap and higher levels of labour market slack.

With the recent bond market gyrations having reversed some of the market concerns over scarcity the central scenario has to be for the ECB to complete QE and potentially extend it beyond Sept-2016.