The right medicine

A Swiss pharmacy chain isn’t the sexiest of equity stories, but investor appetite for safe, predictable yields is enormous – especially in a country with negative rates. As a result, Galenica Sante’s SFr1.9bn (US$1.9bn) IPO in April became an unlikely hot ticket, with investors rushing to place orders as soon as the books opened.

A plan to separate Galenica’s two units – Vifor pharmaceuticals and Sante pharmacies – into independent listed businesses was first outlined in 2014. The two had little in common and few synergies from being bundled together. The acquisition of Relypsa strengthened Vifor in late 2016 and added leverage to the group, so the sale of Sante became understandable.

The reality was that Vifor provided the glamour and Sante sat in the background as a reliable provider of cash but little excitement. Therefore, the leads could not rely on existing shareholders backing the deal.

The timing couldn’t have been better considering that the SFr1.9bn call on investors came as two major Swiss-listed companies were in the process of being bought – Actelion by Johnson & Johnson and Syngenta by ChemChina – so investors were looking for somewhere else to put their money.

Galenica also got the messaging just right. At launch, the plan was that a majority stake would be sold. By the start of bookbuilding, interest was sufficient to increase the base deal to 75%. During bookbuilding, the deal swelled – on the back of buyside demand – to 84.8% on the base deal or 97.5% with the greenshoe. As the stub would go to employees, a successful aftermarket meant the two companies could go their separate ways immediately upon the listing.

Publishing the price range on a Friday gave investors time to prepare orders for when books opened the following Monday. This move particularly suited private banking and as a result massive orders were delivered on day one.

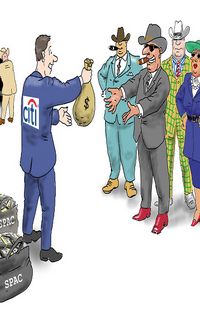

Credit Suisse delivered the largest order in the book through its private bank, while UBS’s wealth management arm corralled an impressive SFr3bn of demand. Gathered together with orders from institutions, the global coordinators – a trio completed by Citigroup – were in the enviable position of a book that was covered through guidance in a matter of hours. Aware of how demand would snowball if they told the market, the leads opted to just say the book was covered, and not mention this applied at the top of the range.

Inevitably, demand still got out of control and so bookbuilding was cut short by one day, pricing came at the top of the range and the allocation meeting ran for 11 hours. A book of 800 lines where 80% of the stock was given to 25 investors meant many investors were left unsated. That carried into the aftermarket, where the first-day close was up 10% and a buoyant stock price ensured the greenshoe was exercised after four days.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.