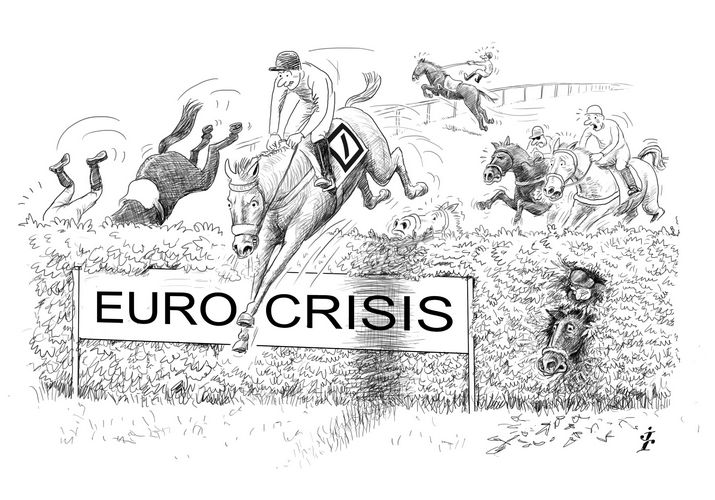

Staying the course: While many European banks struggled to stay the course in the face of the economic crisis, Deutsche Bank remained firmly in the saddle to ride out the financial storm. For consistently providing leadership across both investment-grade and leveraged loan markets, IFR’s EMEA Loan House of the Year is Deutsche Bank.

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

The European loan market in 2012 was characterised by low deal flow as the eurozone crisis continued to play out slowly. Investment-grade volumes were decimated by lack of M&A and the fact that most corporates had already completed refinancing in previous years, while leveraged loans were also hit by a scarcity of M&A trades.

As a result, this year’s winner would need to show strength across the entire loan franchise from corporate refinancing to leveraged buyouts. Despite the strong inroads made by some dollar-rich US and Japanese banks in Western European and emerging markets lending, Deutsche Bank continued to be ever-present right across the market and, indeed, managed to increase its footprint in the investment-grade space.

Deutsche Bank was one of the few European banks to rise in the league tables as the bank was seen as a stable and desired counterparty, reflecting Germany’s fiscal strength and leadership of the eurozone crisis.

Here, there and everywhere

“Who has stayed the course through the volatility and been at the forefront of the market? Deutsche Bank is the only bank that has been active in all aspects of the market at all times this year,” said Nick Jansa, head of European leveraged debt capital markets at Deutsche.

“We’ve been consistent. The market changed but we didn’t change our strategy. Providing underwriting and M&A for core clients is the same strategy as others have, but we had more opportunity to shine as others stepped back.”

The bank showed itself to be a leading European bank not only in investment-grade acquisition financing but also in general corporate refinancing, taking high-profile leadership roles in a number of deals, including bookrunner roles on seven of the 13 most prominent acquisition deals of 2012.

The lender did not shy away from providing big ticket underwriting as well as substantial take-and-hold positions on high-profile corporate M&A financings throughout the year.

In February, Deutsche Bank underwrote US$3bn of a US$6bn, two-year backstop facility for Xstrata, backing the mining company’s proposed merger with Glencore. The financing was ultimately cancelled without being syndicated, but with dollar funding at a premium in Europe, the underwriting was a bold statement of intent from a bank looking to commit precious balance sheet resources to its comprehensive loan offering.

Deutsche Bank displayed best advice backed with committed liquidity when it jointly underwrote German software company SAP’s €2.4bn loan backing its US$4.3bn acquisition of US-based Ariba in May 2012, complemented with a fast-track syndication that saw the loan sold to a select group of SAP’s relationship banks within two weeks of announcing the deal.

The bank continued to show that it could provide heavy lifting underwrites, even in dollars, when it jointly underwrote, with Morgan Stanley, German industrial gases group Linde’s US$4.5bn loan backing its acquisition of US-based Lincare in July.

The firm also demonstrated a commitment to support clients in Italy despite the difficulties thrown up by the eurozone crisis, as one of three underwriters on Italian drinks company Campari’s €450m bridge loan that backed the acquisition of Jamaican rum maker Lascelles de Mercado in September.

Away from underwriting, Deutsche Bank was also one of seven bookrunners that provided a chunky take-and-hold ticket on global brewer AB InBev’s US$14bn loan in June backing the acquisition of a 65% stake in Mexico’s Modelo. One of the largest loans of the year, the financing was eventually syndicated to a small group of relationship banks.

Deutsche Bank proved it was still there for core clients, taking a lead role in a number of jumbo refinancings for top European credits, including as a joint co-ordinator, alongside Commerzbank, on German industrial conglomerate Siemens’ €4bn, 5+1+1-year refinancing in April, which paid a tight 30bp margin, testing the market in terms of deal size, maturity and pricing. Despite the fine pricing, the financing raised more than €7.5bn from the market and was a blow-out success.

The lender maintained a strong franchise in Europe’s leveraged loan market in 2012 despite the drastic fall in M&A activity, which meant many banks took a hit on fees. Out of 14 leveraged buyouts this year that were widely syndicated to institutional investors, Deutsche Bank was a bookrunner on seven deals.

They included key buyout loans for German bandage maker BSN Medical and UK frozen food group Iceland, two of the most well received LBO loans of the year. Both were oversubscribed after attracting a high number of commitments from investors.

Storming ahead

While some banks started withdrawing from underwriting loans to riskier borrowers in 2012 and selling loan portfolios, Deutsche Bank continued to underwrite leveraged loans for new clients, including German automotive group Schaeffler, as well as existing clients.

“The leaders are the guys that are underwriting rather than those that are churning portfolios,” said Jansa.

On the M&A side, the bank jointly underwrote a €4.8bn-equivalent loan, together with four other bookrunners, for German healthcare group Fresenius – one of Deutsche Bank’s core leveraged clients. Although the loan was cancelled following the failure of Fresenius to win shareholder backing for its takeover of Rhoen-Klinikum, it was nevertheless successfully syndicated to a wide group of other bank lenders. The withdrawn loan would have been the largest M&A related leveraged loan since September 2008 – a clear sign of Deutsche Bank’s commitment to continue underwriting during volatile markets.

Deutsche Bank was also one of four lead underwriters on the €1.3bn financing package for EQT’s buyout of BSN Medical. The sponsor-backed financing was one of the most successful syndications of the year, with many institutional investors seeing their orders scaled back after a hefty oversubscription. The success of the deal was also emphasised by its subsequent repricing, just three months after closing syndication, cutting margins for the borrower.

Cross-border ties

BSN Medical also syndicated a US$280m term loan to investors in the US, a theme that became very prominent for European leveraged borrowers in 2012, not only because of the more liquid market in the US, but also for banks to create competitive tension between investors on both sides of the Atlantic.

Deutsche Bank built on this trend on a number of transactions throughout the year, thanks to the bank’s market-leading transatlantic sales and trading platforms and cross-border co-operation.

“This competitive advantage has allowed Deutsche Bank to underwrite the largest transactions in the market despite volatile market conditions, accessing the European and US leveraged investor base,” Jansa said.

Schaeffler’s €8bn financing – IFR’s EMEA Leveraged Loan of the Year – was successfully syndicated in the US, as well as Fresenius Medical Care’s US$3.8bn refinancing.

Both deals underline Deutsche Bank’s strength and ability to carry out complex refinancings and loan amend-and-extend processes. Together with Schaeffler and FMC, Deutsche Bank was bookrunner on seven of the 11 large refinancings, including Spanish cable company ONO, German utilities metering firm Techem and Spanish pharmaceutical and chemical company Grifols. Deutsche Bank also successfully completed the A&E for German cable company Kabel Deutschland and Irish packaging company Smurfit Kappa.

While M&A activity remained scarce in the third quarter of 2012, Deutsche Bank was at the forefront of banks actively pitching for more opportunistic deals, including dividend recapitalisations.

That initiative led to Deutsche Bank, together with BNP Paribas, successfully leading a £260m (US$419m) term loan used to back a dividend for Carlyle on UK roadside rescue business RAC – another new client for Deutsche Bank – which was the first pure European dividend recap of the year after Formula 1 completed a cross-border one in April. RAC’s new term loan was entirely sold within Europe and attracted strong demand from investors, leading to a reverse flex on the margin to 5.125% from 5.5%.