In a year when UK issuance of dollar-denominated securitisations ballooned to US$6.5bn, one bank towered above rivals in winning mandates from clients large and small. Lloyds Bank is IFR’s EMEA Structured Finance House of the Year.

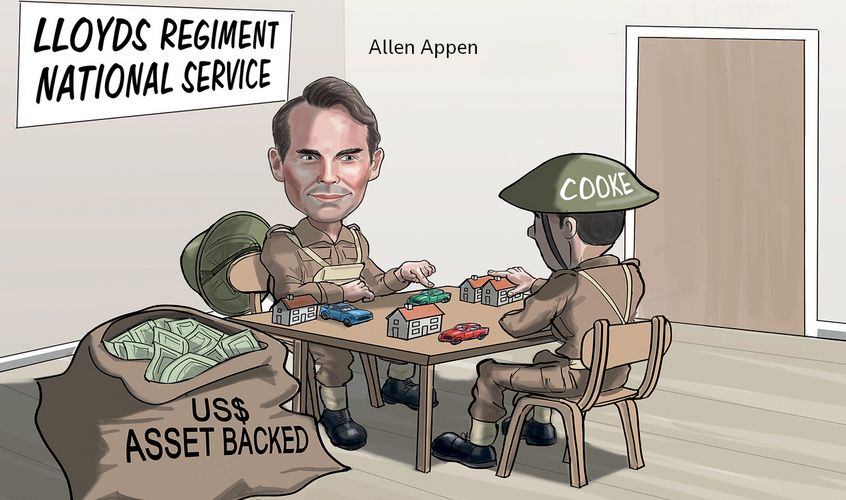

“National service” is how Allen Appen, head of bond financing at Lloyds, describes the bank’s UK-focused structured finance business. “This group is all about supporting the real economy.”

That real economy hadn’t seemed too desperate for support from securitisation in previous years. Even once the stigma of sub-prime receded, central bank liquidity schemes were providing many lenders with cheaper funding sources.

But Lloyds had faith that the market would be needed again and had been preparing for the end of central bank support.

“The securitisation market in Europe, however badly damaged it was, was not going to disappear,” said Appen. “Eventually, conditions would emerge that would enable full resurrection.”

With the Bank of England’s term funding scheme ceasing to lend from February UK banks would need ABS investors once again, but there were doubts the fickle sterling market could absorb a supply spike on its own.

In anticipation of this, Lloyds had started re-engaging US accounts in 2017, traditionally big buyers of UK paper but feeling neglected after UK supply in dollars dried up.

Just US$400m of dollar-denominated UK RMBS was sold in 2017, but that ballooned to US$4.7bn in 2018, with five credit card deals adding a further US$1.8bn.

“Our view was that 2018 would be about proving the market would be there for the big treasuries and the smaller players,” said Matthew Cooke, global head of the securitised products group at Lloyds.

Rival syndicate officials acknowledge the groundwork Lloyds carried out with US accounts, and those investors’ ready appetite for UK risk meant the sterling market was never completely overwhelmed in 2018.

Not that the sterling market felt congested at the start of the year, with January and February finding extremely strong demand in the currency.

But by July, sterling spreads gapped out and some issuers with multi-currency platforms dropped sterling altogether to sell only dollars.

Lloyds was involved in most of the US dollar securitisations, which kicked off with Clydesdale Bank’s Lanark 2018-1 RMBS in January, its first dollar tranche since 2013.

Lloyds led a second Lanark, a deal for Virgin Money and one off its own Permanent shelf, and two from Santander’s Holmes programme, all with dollar pieces.

“Our ability to take UK product to other credit markets is second to none,” said Appen.

The bank brought sterling RMBS from smaller UK lenders too, including West Bromwich Building Society’s first deal in five years, and Aldermore’s first in four. It arranged a debut for Atom Bank, which operates exclusively over mobile phone apps, and led deals from specialist lenders such as Paragon and Charter Court.

The Lloyds team credits its range of mandates to the planning work it carried out with smaller lenders to prepare them well in advance for the withdrawal of central bank liquidity schemes.

“You don’t get paid for that advisory work but when you look how clients rewarded us this year; it’s been deal after deal,” said Cooke.

More consumer mandates came from autos, where Lloyds was a lead on three UK deals and two German ones, and UK credit cards. And behind the scenes the bank has worked to build a private placement market for smaller UK and European asset-backed issuers.

If the end of the TFS marked a turning point for the market, and played to Lloyds’ focus on the UK consumer, two of the year’s other big developments completely passed the bank by.

Lloyds has no involvement in the leveraged loan CLO or CMBS markets, both of which grew strongly through 2018. But it is a sign of the bank’s strength in its core mandate that as well as topping the league tables for European deals excluding CDO and CLOs, it still is placed a respectable fourth when all deals are included.

That focus doesn’t mean the bank can’t push the innovative, pointy-headed product too. It has built expertise in synthetic risk transfer, selling three deals at the end of 2017.

One of those, Mespil Securities, was joint lead-managed with Mizuho for Bank of Ireland. The deal bought protection on a mezzanine slice of risk from a portfolio of leveraged acquisition finance loans and reduced Bank of Ireland’s CET1 ratio by around 45bp.

Lloyds also shed junior risk on a similar portfolio of its own, and on a commercial property portfolio.

“This group … is not focused on arbitrage or repacking product. We’re supporting the real economy,” said Cooke.

To see the digital version of IFR Awards 2018, please click here.

To purchase printed copies or a PDF of IFR Awards 2018, please email gloria.balbastro@refinitiv.com.