If the cap fits

The UK securitisation market was forced to cope with multiple shocks in 2016, including a sharp credit sell-off early in the year, broad volatility ahead of the Brexit vote and deep uncertainty around continuously shifting regulations.

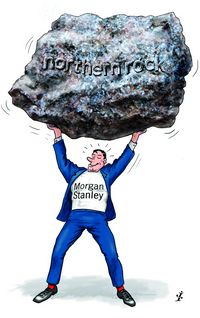

Early in the year, the jitters were amplified even further by an overhang of some £13bn in legacy Northern Rock mortgages, which Cerberus Capital Management bought from the UK government in November 2015.

From the start, most knew the US private equity giant planned to securitise the assets. But many worried that, if the massive chunk of supply was sold at once, it would flood the market and badly distort technicals.

When the trade emerged in April, much of it was already pre-sold, drawing a sigh of relief from the market.

Although some criticised the sponsor for leaving mere “scraps” for public syndication, most participants agreed that the UK sterling market simply did not have the depth to absorb over £6bn in senior and mezzanine mortgage bonds without significant efforts to pre-place bonds.

But Cerberus defied the odds – and market volatility – to successfully close the £6.2bn transaction, pulling off the largest public UK RMBS deal since the financial crisis.

“We know how the sterling market is and we know it can lack depth at times,” said Dimitri Kavour, head of structuring for Morgan Stanley’s deleveraging and lending group, including syndication of bespoke transactions. “If for any reason that transaction had failed, it would have had huge implications for the market.”

Notably, the involvement of deep-pocketed Japanese investors lifted hopes that demand for large chunks of UK paper could be found elsewhere, without disrupting the supply dynamics in the European market.

Structurally, Cerberus also found a workaround to a common issue plaguing sponsors looking to securitise legacy mortgages, which often carry thin margins over the base rate.

To make the economics work, the issuer introduced a weighted average coupon cap, a structure that essentially means what is paid to mezzanine bondholders cannot exceed the net WAC of the underlying mortgages.

The feature opens the door to potentially receiving less than the stated coupon as the mortgage pool amortises, which has ruffled feathers in the market. But the controversial feature has also provided a blueprint for other sponsors looking to make the economics of legacy portfolios work.

Ultimately, the trade’s structure and execution have eased nerves about the market’s capacity to absorb large chunks of supply, particularly as it braces itself for the sale of some £17bn in buy-to-let Bradford & Bingley mortgages.

Morgan Stanley was sole arranger and joint lead together with Bank of America Merrill Lynch, Credit Suisse, Lloyds and Natixis.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com

<object id="__symantecPKIClientMessenger" style="display: none;" data-install-updates-user-configuration="true" data-extension-version="0.4.0.129"></object>