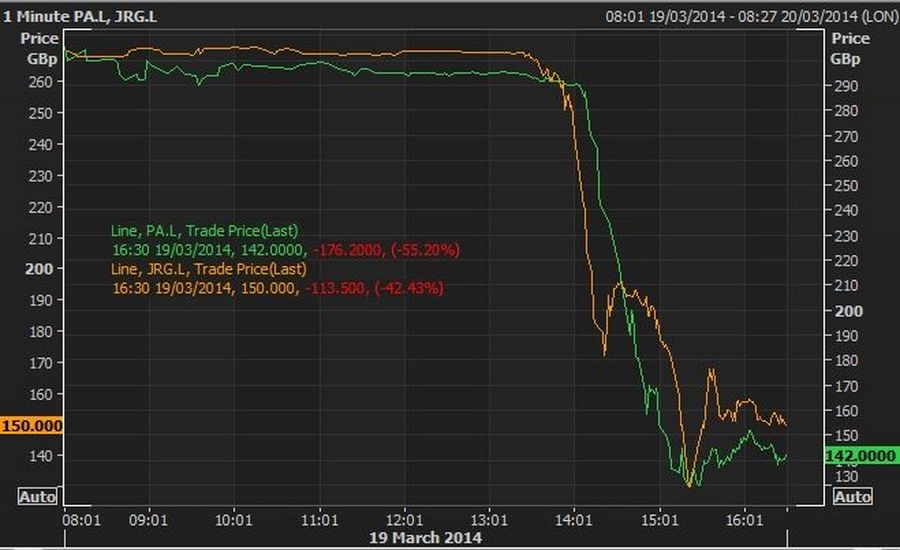

Buyers of two 2013 UK IPOs were today instead contemplating enormous losses after the chancellor’s significant changes to defined contribution pensions and the annuity market.

Partnership Assurance’s IPO totalled £557.8m in June 2013 and investors earned a quick return as the stock gained 16.9% from the 385p IPO price on debut. Just Retirement had a slightly harder time ending its debut down 5.7% from the 225p pricing level on the £343.2m IPO.

The two annuity providers have seen their share prices savaged this afternoon as a result of the pension changes.

Partnership and Just Retirement

Source: Thomson Reuters Eikon

“I am announcing today that we will legislate to remove all remaining tax restrictions on how pensioners have access to their pension pots. Pensioners will have complete freedom to draw down as much or as little of their pension pot as they want, any time they want,” the chancellor said in his Budget speech.

“No caps. No drawdown limits. Let me be clear. No one will have to buy an annuity.”

Just Retirement priced its IPO at 225p in November and closed last night at 267.5p, but today lost 42.4% to close at 154p.

Partnership’s IPO priced at 385p and the stock peaked at 530p in July, but had traded down and through the IPO price to last night’s close of 319.2p. Today the losses were extended with a closing price of 143p, down 55.2%.