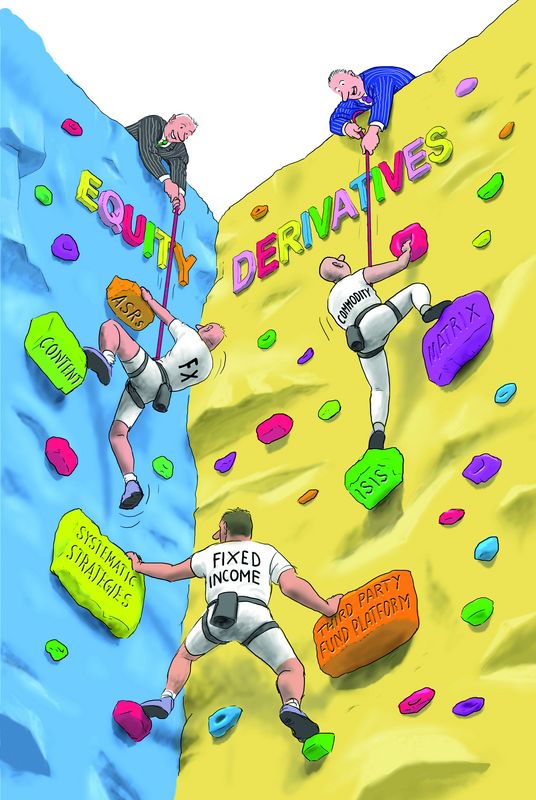

Game of two halves

In a year of stark contrasts, risk management and diversification were the difference between a strong half and a strong year. For one bank, better integration, cutting-edge technology and a content-driven model proved crucial in navigating extreme volatility to deliver double-digit growth. Morgan Stanley is IFR’s Equity Derivatives House of the Year.

Divergent central bank policies, a shift of money back into equities, and increased hedging activity around new stock market highs meant that almost all equity derivatives businesses could lay claim to a bumper first half.

Morgan Stanley delivered convincingly. First-half equity trading revenue topped US$4.6bn – the highest in the industry and more than 30% up on 2014.

But everything changed in the market in the third quarter as whipsawing volatility dynamics saw dealers struggle to manage exotics books associated with a glut of structured products issuance.

While others struggled, for Morgan Stanley it was business as usual. Third-quarter equity revenue was in line with a strong 2014 at US$1.8bn, as flow gains offset a cash slump.

“It was easy to feel that the only growth in derivatives came from structured products, but flow continues to be a huge area of growth for us,” said David Schlageter, head of institutional derivatives sales. “Clients who have never touched derivatives before came to us for derivatives.”

New clients were attracted by the bank’s content-driven approach and strong reputation for post-sales service.

“The way we think about things is to deliver the highest quality of interaction and assess the life-cycle of each trade,” said Matt Renirie, co-head of EMEA equity derivatives sales. “We help the client get in front of the pitfalls. It’s a massive hand-holding experience.”

One of the bank’s China-based wealth management clients highlighted Morgan Stanley’s quick response and competitive pricing. “They have a strong sense of market and always react quickly to suggest structures mitigating downside risk while capturing upside benefit,” the client said.

Analytics

The US bank’s Matrix platform was a crucial factor in the seven-year derivatives build-out, was further enhanced with IRIS implied volatility and options analytics. That enabled investors to identify the cheapest volatilities on a cross-asset basis.

“IRIS product is fantastic – nothing on the Street comes close,” said one large US multi-asset manager.

The cross-asset approach was a natural development in a highly diverse model that had already broken down many traditional barriers.

“Flow and structured is very integrated, we don’t have separate teams,” said Nikki Tippins, head of Americas equity derivatives sales. “That gives us the strength to push into new areas using flow as an access product.”

The third-party managers platform underscored the multi-asset approach, as assets under management surged to almost US$10bn. Investors can match a range of investment vehicles with more than 55 strategies across equity, FX, fixed income and commodities.

“The platform is run out of equities and into all asset classes, and we partner with other divisions in terms of risk,” said Aleksandar Ivanovic, co-head of EMEA derivatives sales.

Additions for 2015 included US-based Tremblant Capital and Stockholm-based IPM.

Changing market

The cross-asset theme also raged through systematic strategies, where the bank reviewed methodologies for a changing market environment.

“We’re looking at simpler, smarter structures to capture the regime change in a more effective way,” said Ivanovic. “We’re looking at strategies with more holistic triggers and we’re seeing a clear move to the multi-asset approach across credit, FX and equities.”

For example, the Dynamic Allocation strategy, launched in 2014, amassed multiple billions in AUM. It applies the “efficient frontier” concept on a multi-asset basis to maximise returns for a given risk level. The newest creation was the Dividend Seeker strategy, which captures positive price movement around dividend ex-dates.

Integration with capital markets helped drive key multi-billion corporate solutions. The firm was sole counterparty on US$5bn-plus accelerated share repurchases for Express Scripts and Abbvie, and joint counterparty on a US$5bn ASR for Qualcomm.

“Our approach has been to take the best derivatives people and put them in ECM. It’s a more effective way to achieve the goal,” said Kevin Woodruff, global COO of equity derivatives.

“We’re calling clients more proactively than in the past and we’ve made a big effort to get our bankers more fluent in the derivatives toolkit,” said Woodruff.

In Europe, the bank retained leadership in long-dated savings products, offering managed investment solutions on a partnership basis with asset managers, insurance companies and pension funds including Italy’s Banca Fiduram and the UK’s Praemium.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .