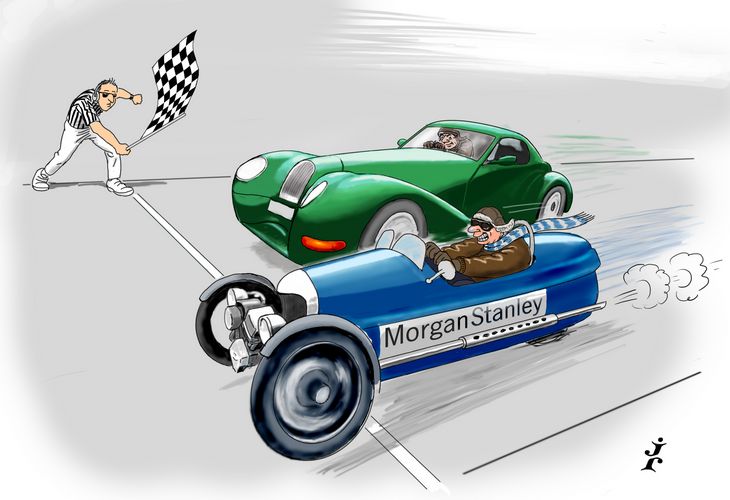

Edging in front

Morgan Stanley capitalised on the resurgence in ECM in 2017. It maintained its position as a leader of IPOs, built its presence in block trades and remained the bank adviser of choice, making it IFR’s Equity House and Asia-Pacific Equity House of the Year.

After two terrible years of low issuance, 2017 provided a much-needed rebound in ECM volumes. Yet some banks did better than others at capturing the rise in activity and, more importantly for bank revenues, the joint global coordinator or lead-left positions that earn outsized fees. Morgan Stanley is the best of the bulge bracket at ensuring it is in the driving seat.

“What is keeping us up there is the IPO franchise, which is something that we have been very strong at across the years. Our fully integrated syndicate on a global basis also allows us to react quickly on block trades and have a better read on pricing than anybody else,” said Alex Abagian, head of equity syndicate for Asia-Pacific at Morgan Stanley.

By early December Morgan Stanley sat at the top of the equity league tables in each region. The bank slips a little lower when factoring in structured equity, and looking at the IFR Awards period, but as these league tables are based on bookrunner roles they are not the best barometer of leadership.

The most reliable metric of performance is reported financials.

In the first three-quarters of 2017, Morgan Stanley collected fees of US$1.07bn from equity underwriting, up 61% year-on-year. It posted an astonishing 144% rise in first-quarter revenues to US$390m, above even what it earned in the first quarter of 2014, the last year of feast before two years of famine in ECM fees.

Its growth in the first quarter outpaced its global rivals – which at present amounts to other US banks – while it was one of only two US banks to increase equity underwriting fees in the third quarter (Citigroup being the other). After three quarters it was the top earning bank.

As Abagian said, the bank continues to be strong in IPOs, the highest fee-paying business in every region. Also increasing its revenues has been a leading position in activity by financials in the year, typically the largest deals of the year and as a result, the biggest fee events.

It is for that reason it is Asia-Pacific Equity House, and was a contender in the other two regions.

It is the bank’s leading position in financials that stands out. In Europe, Morgan Stanley was a top-line bank on the rights issues by UniCredit (€13bn) and Credit Suisse (SFr4.4bn), while picking up bookrunner roles on the fundraisings by Deutsche Bank (€8bn) and Santander (€7.1bn).

In the end, the bank played a part in 10 of the top 11 FIG transactions in EMEA, with five of those top-line mandates and including an advisory role on Allied Irish Bank’s re-IPO.

In Asia, the HK$11.9bn (US$1.5bn) Hong Kong IPO of ZhongAn Online P&C Insurance was the first offering for a pure online Asian insurer and the first major China fintech IPO. Morgan Stanley was joint bookrunner on the deal, after previously acting as sole private placement adviser on a pre-IPO fundraising in 2015.

It is a healthy roster considering mandates between banks are often handed out on the basis of reciprocity.

“Capital raising has been all about the banks,” said Martin Thorneycroft, head of cash ECM in EMEA. “We don’t have the cheapest balance sheet, we don’t have much to offer back. They trust what we have to say.”

Another significant financial trade was the disposal of the UK government’s 9.2% stake in Lloyds Banking Group for over £4bn. Morgan Stanley was re-employed for the dribble-out in October 2016 and sold the final share in May. Morgan Stanley offered a unique set-up where it has two traders in their own office outside the trading floor but with access to the bank’s trading flows, typically working on stake builds for clients and perfectly suited to a dribble-out.

GLOBAL REACH

Morgan Stanley showed its global reach by delivering major IPOs from Asia to hungry US investors, particularly in the financial technology and education sectors.

It worked on the US$1bn IPO of Chinese online microlender Qudian, the largest listing from China’s fintech sector and the biggest US listing from a Chinese company in 2017. It also arranged the US listings of online consumer lending company China Rapid Finance and wealth management platform Jianpu Technology.

Morgan Stanley also brought to market the US$181m IPO of Bright Scholar Education, the largest China ADR float in the education sector, plus the US listings of RYB Education, Rise Education and Four Seasons Education.

The bank handled the biggest US listing from South-East Asia in the US$880m New York IPO of Singapore online gaming and e-commerce firm Sea, as well as South Korea’s biggest IPO of the year, the W1.1trn (US$1bn) listing of ING Life Korea.

BLOCKBUSTERS

The bank also secured lead roles on the blockbuster transactions of the year. In Hong Kong, it was the lead-left joint sponsor of the hugely popular HK$9.57bn (US$1.23bn) IPO of Tencent-backed online reading platform China Literature, a rare mandate for a bank with a close relationship with Tencent’s rival Alibaba.

Morgan Stanley balanced its new issue expertise with a healthy appetite for risk and sound market judgment, winning several competitive block trades without getting caught long.

It leveraged a long-term relationship with ASM Pacific into a sole mandate for a HK$4.1bn (US$526m) block in ASM Pacific Technology, one of several sole-book trades during the year.

A steady flow of business throughout the year gave Morgan Stanley the confidence to bid aggressively when Royal Dutch Shell looked to sell a stake in Woodside Petroleum in November 2017. The bank responded within two hours for a fully underwritten A$2.2bn (US$1.68bn) sell-down and won the deal alongside one other bank. The block sold quickly, and Morgan Stanley helped Shell increase the trade to a hefty A$3.5bn, cleaning up its entire residual stake.

Prominence in Europe did not always require a generous bid for blocks. Morgan Stanley is the only bank to have been involved in every step of the Dutch government’s sales of ABN AMRO – including two ABBs this year – while its role in Barclays’ US$2.9bn sale of Barclays Africa stood out in a syndicate dominated by the automatic inclusion of the parent’s corporate brokers and Barclays Africa’s adviser.

A slot on FEMSA’s US$3bn sale of Heineken shares means the bank was on four of the top five ABBs in EMEA – without any backstops. “We’ve been a scalpel rather than a blunt instrument,” said Thorneycroft.

BIG IN THE AMERICAS

Bigger roles on blocks and more were supported by the expansion of the syndicate desk in the US.

“We’ve doubled the size of the equity syndicate desk in the Americas,” said Pawan Passi, head of Americas equity syndicate. “That has allowed better collaboration not only within the US and the Americas, but for cross-border transactions and across products.”

Cross-asset class fertilisation was evident in Crown Castle International’s US$7.1bn acquisition of small-cell tower operator Lightower Fiber Networks in July. Morgan Stanley advised on the M&A, backstopped the all-cash purchase, and acted as lead-left on the equity-linked and bond take-outs – all within a week.

“We were finally able to really attract real REIT investors,” said Passi of the US$5.5bn equity-linked raise, the largest in the US this year and the largest-ever by a US REIT.

Crown Castle sold shares at US$96, just 0.66% below pre-launch levels, with the exercise of the greenshoe taking total sizing to US$3.85bn from US$3.25bn at launch. The mandatory was priced at a 6.875% dividend and 20% conversion premium, through the aggressive ends of both 7%–7.5% and 10%–15% talk, with the overallotment taking the size to US$1.65bn.

Morgan Stanley was also lead-left on the US$3.9bn March IPO of social messaging portal Snap, the largest US IPO of the year and the largest tech company to go public in the US since 2014. Key to a positive outcome was the endorsement of anchor investors that agreed to purchase 25% of the deal and be locked up for one year.

A broader, 10-day roadshow across the US and Europe culminated in pricing 200m shares at US$17, above the US$14–$16 indicative range.

* Reference to stabilisation agent removed in penultimate paragraph.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.