Still Number One

The consistency with which Goldman Sachs tops the global equity capital markets league tables every year would be tedious were it not so remarkable in one of the most cut-throat arenas of investment banking. The dominance of the US house whatever the weather is why it is feared and revered in equal measure. Goldman Sachs is IFR’s Equity House of the Year.

For the fourth year in succession, Goldman Sachs tops the tables as the number one in equity capital markets, dominating cash and structured equity deals for the IFR awards year.

That record is impressive in itself. But Goldman’s dominance is such that you can slice and dice the data in just about any way and the bank comes top.

Which firm executed the most jumbo deals of US$1bn or more? What about if that group is refined to just sponsor sales? How about when a client trusts just one firm, which sole led the most deals? Ignoring bookrunner league tables and the passive banks they include, which bank leads on active roles in, say, US IPOs or US follow-ons?

Of course, the answer every time is Goldman.

A Goldman pitch is a litany of statistics detailing the sectors, nations and structures in which it ranks number one, and the biggest deals in each and every category, where Goldman was almost certainly at least a bookrunner.

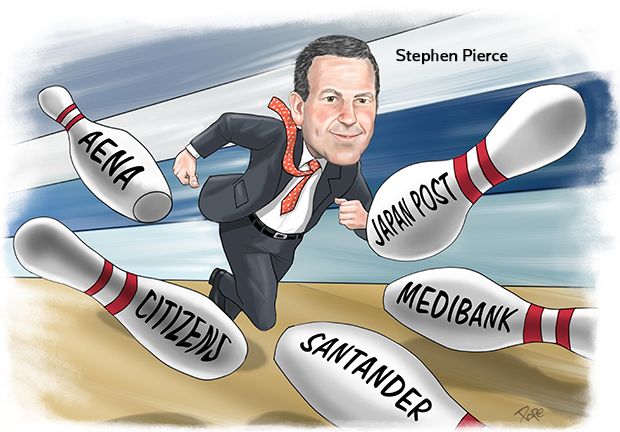

“We are a firm that prides itself on the equity product,” said global head of ECM Stephen Pierce. “We consistently operate at such a high level that there really is only one way for us to go in any given year. So if we can’t focus on momentum or be the most improved, then we have to focus on the fact that we are the most consistent.”

The €7.5bn capital increase by Santander at the beginning of the year was a deal without peer. The largest ECM transaction in the EMEA region in 2015, it is also the largest-ever underwritten overnight transaction globally and the largest accelerated deal ever executed in Europe.

The Spanish bank needed to raise capital and boldly launched on the evening of January 8, with the book closing less than four hours later. It is IFR’s EMEA Equity Issue of the Year.

It is easy to get lost in the superlatives, but deals as significant as this, where just two banks were employed (UBS was brought in alongside Goldman), only happen when a client implicitly trusts its advisers.

There were plenty of other illustrations of such trust. After being dragged over hot coals for so-called underpricing of the privatisation of Royal Mail in the UK, Goldman advised the Spanish government to price above guidance on the €4.4bn privatisation of airport operator Aena. It was a rare move and risky on the largest European IPO of the year, but turned out to be the right call.

The UK government’s £2.1bn sale of RBS in August was another bold call, considering investors were more interested in sunning themselves than purchasing a struggling bank, but one backed by the US firm in its new role as the UK’s privatisation adviser. The deal met a strong response and was lauded by Chancellor George Osborne as an important first step towards full privatisation.

“You need to do the standout trades,” said Richard Cormack, co-head of EMEA ECM. “No one else can say they have touched so many of the largest deals of their kind.”

His boss had no cause for complaints about the bank’s year in the region. “Our performance in EMEA was superb,” said Pierce. “We’ve done more deals and more size, including the largest IPO, follow-on and block trade.”

Their own competition

The one deal that could hold a candle to Santander for sheer ambition is Chevron’s sale of its entire 50% stake in Caltex Australia through an accelerated bookbuild. The ambitious sale was led and underwritten by Goldman Sachs alone and lacked any wall-crossing of investors.

The A$4.7bn (US$3.7bn) sale of the petrol station operator was the first sale by Chevron since Caltex’s IPO in 1980 and was accomplished at a discount of just 7.6%.

“The Caltex block points to our prowess in the Australian market, but I don’t think we would ever have done that one if we weren’t close to Chevron,” said US ECM head John Daly. “Chevron was very focused on keeping this block as tight as possible. It was a five-week process and we did a good job of keeping things confidential.”

Goldman was also on the top line of the largest Australian IPO of the year – a US$5bn deal for health insurer Medibank.

Caltex was another high-profile success in a strong year for block issuance at the bank. If proof were needed that Goldman runs this as a business – rather than a crutch to support its league table position – the sale of General Motors stock provides it. The US$2.6bn exit by the Canadian government is the largest unregistered block trade ever completed in the US – and, as it lacks an SEC offering document, earns zero league table credit.

According to Pierce, block revenues globally, net of losses, had reached US$300m in the first three quarters of 2015. “We are very smart about how we approach risk,” he said.

When a bank is as active as Goldman, it is easy to overlook the times when it isn’t involved. But the bank has shown its skill in those situations where it was conservative. As the largest sponsor trade globally, the US$2.7bn Hilton sale by Blackstone was a hard one to resist, but Goldman did just that.

The deal, which resulted in losses of US$100m (or more) for the banks involved, even got its own nickname thanks to the day it hit the market.

“We were not part of the Mother’s Day Massacre – our bid was not even close,” said Pierce, in reference to the trade.

Rough rides

Being the leader in IPOs was fun in the first half as stock markets around the world touched record highs, allowing Goldman to rack up more record-breaking deals. Those included the US$4bn Hong Kong IPOs of GF Securities – the largest-ever securities firm offering at the time – and Wanda – the largest-ever IPO of a real estate company.

But things were much more challenged as the year went on, particularly following the sharp correction in China over the summer months and the resulting volatility.

“Volatility doesn’t work well for IPOs,” said Daly. “Depending upon the month that you went public, it was very much what was happening in the macro market that determined success of an IPO.”

With a bulging pipeline, the bank worked to maximise the positive outcomes.

“We knew this post-summer window would be tough, so we put our strongest two horses first – Scout24 and Worldpay – so the others could follow,” said Christoph Stanger, co-head of EMEA ECM with Cormack.

It was a strategy that broadly worked, though the bank’s success in pricing deals did not always extend to positive initial aftermarkets and some deals were postponed. It is also fair to say that optimism occasionally overwhelmed bankers, with the cancelled float of German early-stage home delivery service HelloFresh the most predictable failure of the year.

Just half of the European IPOs that were launched post-summer were actually priced within original plans, but Goldman’s performance globally in those difficult months was strong – though time will tell on whether those stocks that struggled in the early days, such as Showroomprive in Paris and Mimecast on Nasdaq, can recover.

Structured equity is an arena in which Goldman has performed strongly, winning IFR’s global house award on the last two occasions it was awarded, but where issuance was limited in 2015.

Yet Goldman still managed to appear on some benchmark trades, including the US$2.9bn mandatory convertible issued alongside US$1.1bn of equity by Fiat Chrysler in an effort to build US representation on its shareholder register. A genuinely cross-border effort, the mandate had to be won from Italy but the structure was all about US distribution.

Rivals are snapping at Goldman’s heels, but can’t quite get ahead. Pierce and Co are proving hard to topple.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .